(This is Part 2 of a post series. Read Part 1 here)

So… how else do experienced traders think differently?

Let’s take a look.

#2 Experienced Traders Don’t Trade For Income

Many people get into Forex trading for some extra spending money. Some even look to it to fully pay for their monthly expenses.

The idea is to make $3,000 per month (or whatever amount) trading, so they can fund their lifestyles with that money. This is the Forex Dream that motivates a majority of retail traders today.

Unfortunately, for most of them, the Forex Dream will remain exactly that — a dream.

You see, the way trading works is such that the people who are most inclined to chase the Forex Dream are those who are least likely to achieve it.

I see far too many people with $200 accounts looking to turn it into $400 (or more) in a month. That’s not impossible, but it certainly won’t be repeatable. What’s far more likely to happen is that for every account they double, they’ll blow up three.

The hard truth about Forex trading is that once you start aiming for monthly gains of 10% or more, you’re venturing into dangerous territory. The amount of risk you’d have to take will be exceptionally large.

Of course, I don’t doubt that there are genius-level traders out there who can pull ridiculous amounts of returns each month… but let’s be realistic: you’re probably not one of them (and neither am I).

So let’s be generous and say you can achieve an average 10% monthly profit. In order for you to make $2,000 a month you’ll need at least a $20,000 account. This is a far cry from from the $200 accounts that I see people trading with.

The fact is that the smaller your capital base, the more difficult it will be to achieve a meaningful income target.

Put another way, the more capital you have, the easier it will be for you to make $2,000 a month trading.

This said, experienced traders don’t typically trade for income because that’s not an efficient way to grow capital.

The 8th Wonder Of The World

Here’s a question for you:

Imagine that you are offered a job which lasts for 7 weeks, and you get to choose your salary.

You can either get paid:

- (Option 1) $100 for the first day, $200 for the second day, $300 for the third day, etc. Each day you are paid $100 more than the day before; Or

- (Option 2) 1 cent for the first day, 2 cents for the second day, 4 cents for the third day, etc. Each day you are paid double what you were paid the day before.

Which option would you choose?

Most people who come across this question for the first time will pick the first option.

But here’s how the math works out across the 7 weeks:

Option 1

Week 1: $2,800

Week 2: $7,700

Week 3: $12,600

Week 4: $17,500

Week 5: $22,400

Week 6: $27,300

Week 7: $32,200

Total: $122,500

Option 2

Week 1: $1.27

Week 2: $163

Week 3: $20,808

Week 4: $2,663,383

Week 5: $340,913,029

Week 6: $43,636,867,727

Week 7: $5,585,519,069,102

Total: $5,629,499,534,213

Yes, you read that correctly. That’s a total of $5.6 trillion.

Here’s the thing: You might have suspected that option 2 is the better option… but you’ve probably underestimated how much better it is.

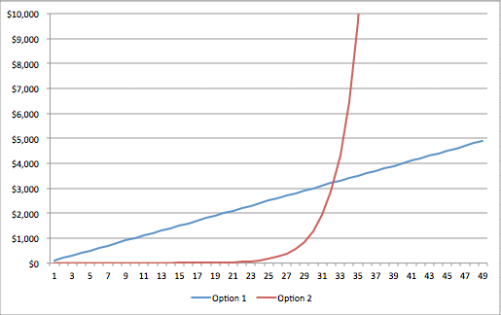

Here’s a chart showing the outcomes of the two options:

Short-sighted traders focus on the blue line (Option 1) since they get to make more money at first.

However, experienced traders know that the power of compounding will yield a much larger payoff later on.

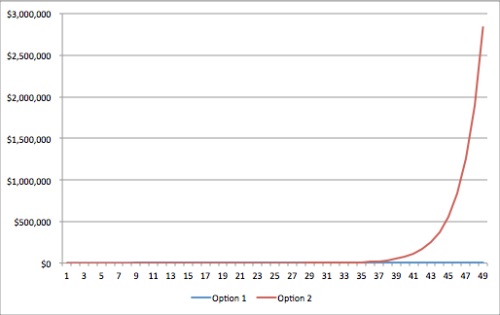

This graph shows the difference between the two options:

Of course, this is an exaggerated example… but it sufficiently highlights the reason why experienced traders prefer to keep compounding their profits instead of spending it.

Compound[ing] is the eighth wonder of the world.” – Albert Einstein

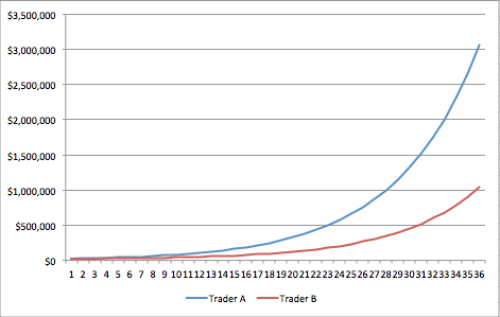

Now here’s a chart showing two traders who make 15% a month on a $20,000 account. Trader A chooses to keep rolling his profits while Trader B withdraws and spends $2,000 of his profits every month:

Just 3 years later, Trader A ends up with 200% more capital than Trader B.

Trader B withdrew (and spent) a total of $72,000, while Trader A grew that same amount to over $2,000,000. Both traders had exactly the same performance, but one made 3 times more profit .

This is why smart traders don’t trade for income. They know that by delaying gratification (of getting an income now), they’ll get a much larger payoff down the road.

This is also why experienced traders seldom live lavish lifestyles. They know that every dollar spent is a dollar that could be used to compound into a much larger amount later on.

How To Get Large Profits

In trading, there are only 2 ways of making large profits:

- Have a high monthly return

- Have a large capital base

Most retail traders start with a small capital base and pray for a 100% monthly return. They hope to double their money every month, and plan to use the profits to buy things.

Experienced traders however, know that high monthly returns come at the cost of high risk, which is unsustainable in the long run. Thus, they make large profits by (1) trading with a large capital base, and (2) rolling their profits.

Think about it this way: would you rather get $2,000 per month over 3 years, or get $2,000,000 at the end of the 3 years?

Logically, the answer is obvious.

But, unfortunately, most people don’t have the patience, foresight, or conviction to sacrifice small short term gains for a large long term payoff.

Hi Pip,

This was one of the arguments put forward by Learn to Trade when I first started and it looks absolutely wonderful – just keep the money there and watch it roll on up.

What I think it fails to take into account is that for every doubling of the account, your risk is doubling as well so starting off making 100 for a 25 bet (1:4) means that making 1000 risks 250 or 10,000 risk 2500.

Takes some balls to put 2500 on the line, or 100 per pip!

Hi Phil, 100 per pip is a good target to work towards. 🙂

I am a true believer in rolling your profits. However, I am not sure if you should risk 25% of your account on a trade. 4 times wrong you blow up your account. I usually risk 1/2% to 1% per trade(20 pips) and as the account grows this risk lets me trade tomorrow if I am wrong and also allows me to grow my account consistently. It is slow but if you have a trading system that is consistent it will eventually show nice returns.

Hi Michael, I am reminded of a wonderful phrase by Felix Dennis: “How much money can you make, and how long will it take? More than you deserve, and longer than you’d like.”