Among the traders that I’ve communicated with over the years, the ones that struggle the most tend to be intermediate-level traders.

You see, although they are well-acquainted with the trading basics, their account typically hovers between a small loss and break even.

In private, they often admit that they feel like stuck and unable to progress.

If you fit this description, this post is for you.

Stages of Profit

Now the first thing you should understand is this:

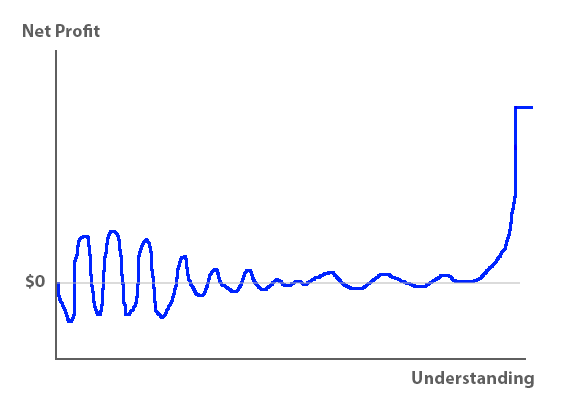

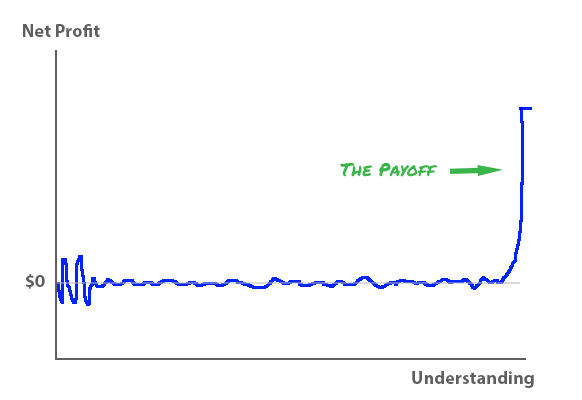

This chart describes the approximate path of profit for most retail traders.

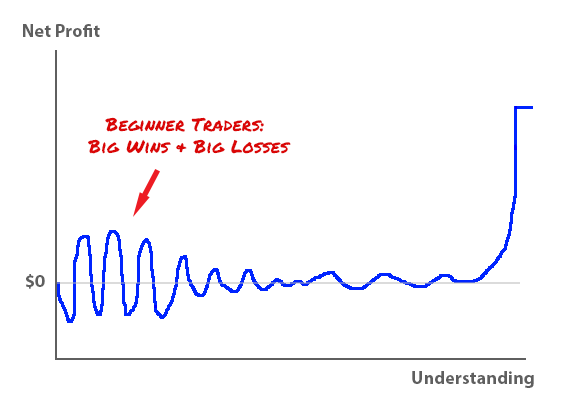

As beginners (starting from the left of the chart), people tend to be ignorant about the risks involved with trading.

Maybe they came into it with a gambler’s mentality. Maybe they try to get rich quickly. Or maybe they don’t bother to learn about how margin and leverage work.

Regardless, beginner traders have very little understanding of what it takes to succeed, and often take trades that are too large for their account.

Thus, they tend to experience large profits or large losses (often both).

Assuming they don’t quit trading at this stage, these traders will move on to gain more experience in the market. Eventually, they come to realize that their trading results have up until this point, been largely based on luck.

They discover that they’ve been gambling, and quickly wise up to the real dangers of the market. This tends to also be the point where they realize how little they know about what it takes to succeed in trading.

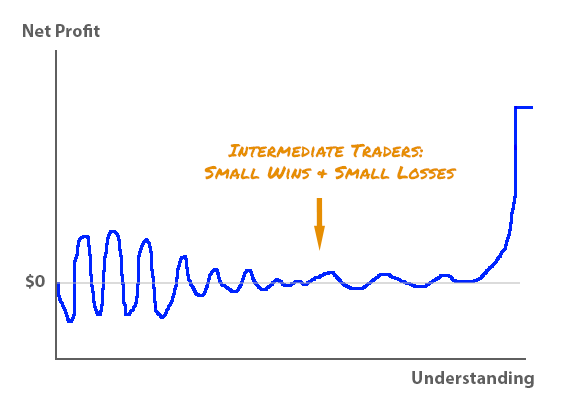

Thus, they decide to cut down on risk by reducing their trading lot size.

They think, “once I find a trading method that works, I’ll increase my lot size and start making some real money”.

This is actually the smart thing to do. By cutting down their trading lot size, these traders continue to gain valuable market experience without risking a lot of money in the process.

The problem with this stage though, is that it’s by far the longest.

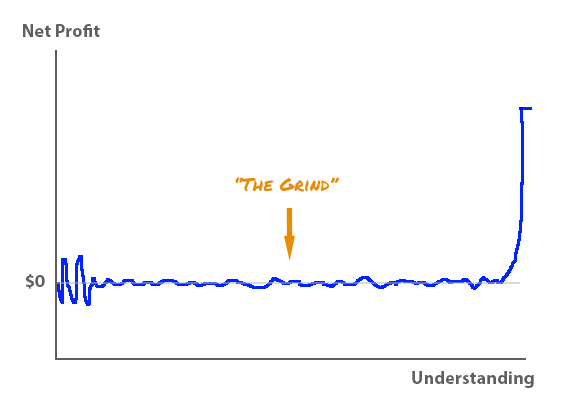

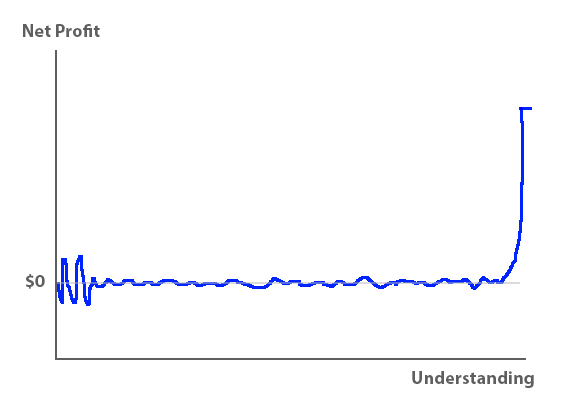

It’s actually something more like this:

This is the stage of the process I call The Grind.

What’s The Grind?

The Grind is the metaphorical brick wall that separates the wannabes from the committed.

It’s also the period when the trader begins to realize that conventional trading wisdom doesn’t work.

He slowly unlearns what he had been taught about trading, and starts seeing the market with new eyes. For the first time, he starts thinking for himself.

Instead of following the generic advice he reads about online, he goes through an arduous process of discovery and carves out a niche for himself in the market.

But, unfortunately, not everyone comes to this realization. For many intermediate-level traders, the feeling of being stuck leads them to think they are at a dead end.

This is why many will quit at this stage. These traders equate progress with the amount of money they’re making (i.e. very little), so they talk themselves into believing that successful trading is either not possible, or that it’s just not possible for them.

But the truth of the matter is, they just don’t want it badly enough.

You have to be passionate… because it’s so hard, that if you’re not passionate, any rational person would give up. It’s really hard. And you have to do it over a sustained period of time. So if you don’t love it… you’re gonna give up. And that’s what happens to most people actually.” – Steve Jobs

Thus, The Grind really refers to two things. First, it refers to the tedious, everyday grind that traders have to go through to eventually become consistent performers. And second, it refers to a grinding machine that sucks in the opportunity seekers and spits them out as minced meat.

The Payoff

If the trader hangs in there and continues to learn from mistakes, he eventually arrives at the promised land. This is the payoff period that he’d been working so hard for.

After defining his edge in the market (during The Grind), he is now confident of his ability to keep his losses smaller than his profits. From now on, it’s only a matter of how fast he wants to grow, and how capable he is of handling increasing levels of pressure.

During the last stages of The Grind, he might be growing a $10,000 account at 2 – 3% a month. But now, he faces the challenge maintaining this performance on a $20,000, $50,000, $100,000 account or larger.

This is more difficult than it sounds, because as the stakes get higher, the fear of losing gets disproportionately more intense.

After all, the feeling of losing $10 in 15 minutes is very different from the feeling of losing $1,000 in the same amount of time.

So in truth, the promised land isn’t filled with rainbows and marshmallows. It’s filled with bigger traps and pitfalls that are by degrees-of-magnitude more painful than anything the trader has experienced so far. So in a way, it’s more challenging than The Grind.

But this is also when the financial rewards start to surface. This is when the trader starts being able to afford the nicer things in life.

But make no mistake, this is not a gift from the gods. To get to this stage, the trader had toiled for years with zero financial reward, and without knowing if he’d ever make it.

The Growth Cap

Eventually, the trader grows his capital to a level beyond which he cannot emotionally handle.

For one of my early mentors, that level was $5 million. He found that whenever his trading fund grew larger than that, the emotional toll becomes too much. So he just sticks to $5 million and withdraws his profits periodically.

So… is there another level beyond this “growth cap”? Is it possible to train oneself to trade a $5,000,000 account as unemotionally as a $5,000 account?

I don’t know, I’m still figuring that one out.

Anyway.

Back To The Point

The purpose of this post is tell you that you’re feeling stuck because you’re equating “progress” with “a growing account”.

But that’s the wrong way to look at it because the relationship between “profits” and “understanding” isn’t linear.

Look again at the chart:

Notice that as your understanding of trading grows (along the horizontal axis), your trading profits (the blue line) remains flat and doesn’t grow by much, if at all.

It is only after you’ve reached a “critical mass” in your understanding that leads to an explosion in your trading profits (the payoff). Before this point, the only thing that grows is the intangible knowledge and experience that you’re accumulating in your head.

So rest assured… as long as you are continuously learning from mistakes, you ARE heading in the right direction, even if it isn’t obvious from your immediate trading results.

Just keep at it, don’t make stupid mistakes (like blow up), and you’ll get there.

Or, if you’re rational about it, you could just quit trading altogether.

Thanks Chris,

A timely and insightful piece which is so precise and encouraging.

You have a clear mind and create clarity in a complicated process.

This is a hard road for sure, but a worthy pursuit.

Thanks again Harvey O

Thanks for the comment Harvey. Glad you like the post. 🙂

Big thanks Chris,

These ideas you are sharing is worth far more than what one can learn in trading courses.Most people will generally quit before they get to the level of making money.it takes perseverance and passion to stick for forex when no money is coming in. My thought is how to shorten the journey and get to the profitable trading within two years.

I think the length of the journey depends on how fast you learn from mistakes. The faster one learns, the shorter The Grind is.

Thanks a lot Chris for this Masterpiece. This is absolutely TRUE & INSPIRATIONAL. Your are one in a million.Keep up the good works.

Thanks Paul!

Wow…What a relief to know that, Now i’m more committed than ever.Thanks Chris

Keep the good fight going Charles. 🙂

Hi Chris,

Thank you so very much for sharing your thoughts, and you are so Right in every aspects!

It feels, as you must have been there, and experienced it yourself… I only wish you could quantify this arduous journey. Like when the trader starts questioning his own sanity! and begins to wonder if he is really cut out to be a consistently, profitable trader! Or when would this so called learning curve, comes to an end. Every week, every day, you tend to learn something else, when does it end? Would you be able to one day look back and see that you have done all your learnings, and now you can sit back and relax?

I have asked this question of other Gurus, and they tell me ” Well the system has been working for the past 30 years, why change it!!!”. Is it right, that you can reach a stage that you don´t see the need for tweaking, or fine tuning your strategy? I don´t understand that? I appreciate it if you could share your views on this.

Thanks once again for the the lovely article.

Hi, Les. If you’re questioning your sanity, it’s a good sign. Crazy people don’t ask themselves if they’re crazy.

I haven’t been trading for 30 years so I don’t know the answer to your question, but I haven’t come across a system that doesn’t require some tweaking or adjustment depending on the situation. As far as I know, the learning and adapting never stops.

Hi Chris, I have been learning to trade for 8 years now and still have hope, hope is very powerful when it is focused. I still trade a demo account because the 2 live accounts I started the balances went to $1700 and $3200 respectively; I still have both of the live accounts.

I recently found out about and purchased ForexTester, this allows anyone to BACKTEST on real market historical data and take trades to refine your trading method. I have been using ForexTester one week and have learned so much faster than trading only a demo account.

I will reap the rewards if I continue to look ahead and not faint.

Now I’d say that’s being committed. Hope is crucial but don’t forget the other key ingredient: learning from mistakes. Otherwise, one could go on for a lifetime and never get there.

“Is it possible to train oneself to trade a $1,000 account as unemotionally as a $1,000,000 account?” I suspect you meant to reverse the figures.

That was a superb article. I have never seen anyone else say that. It is an enormously valuable insight. I love your posts.

Yes Ken, sorry about the typo (fixed it). Glad you like the post my friend.

Very true Chris, this article gives some good hopes, after all this years of struggling!

Thanks for the comment!

Thanks a lot .I will keep my faith to continue to learn how to walk on the tight rope.We,ll meet at the top

wow!!! I needed to read this. Thank you so much for writing your honest and genuine thoughts on this journey of trading!

Glad you liked the post Javier 🙂

Hello Chris,

Great Article. I am a beginner at forex and just finished reading your book “Forex Dreaming”.

How would I start trading now? I signed up to your web and facebook.

Thank you in advance for your help.

Hi Alex,

Glad you liked the article. If you’re completely new, Babypips school is a place to get started.

Thank you Chris. Signed up for that site. Will study and let you know my progress. Thank you again.

🙂

Hi Chris, am following your posts from long time and their are always so focused and clear, you are giving to traders the path way to follow for reaching their goals.

But…. after all the process of learning when you know how to avoid false entry or exit signals, how to protect your capital, how to fight emotions etc.. etc.. still every day when you sit in front your charts you have a simple? questions rising: what the dollar or the yen or the euro will do to day? we open buy or sell?? this kind of information you can not have just watching the trend in a bigger time frame or the list of the economical news of the day because the information’s influencing he market to day are so many.

There I feel you need the help of some one who analyze the market for you because most of us do not have the time and the means to do it and last but not less important how to avoid the traps of the SL hunters.

antonio

Hi Antonio, you’ve brought up some good points.

The problem with analysis-type articles is that the market situation can change very quickly in real-time, which would then render the “analysis” useless and counter-productive. I’ve written a short blog post about an example of this here.

Most trading websites/blogs that produce analysis articles do so solely to increase readership. It doesn’t matter to them whether their “analysis” is accurate (profitable) or not. Many of these people aren’t even profitable traders themselves and only make money via advertising revenue (which increases with readership numbers). Check out Forex Dreaming for more details on this subject.

If you truly want to learn how to trade, my suggestion for you is not to focus on tactics and analysis, but on principles. Taught correctly, the right principles will enable you to select the appropriate tactics that suit the market situation which often changes.

This is why I rarely talk about technical analysis. I’d rather spend my time writing about timeless principles that will be relevant for a long time. The aim of this blog isn’t to get eyeballs and more advertising revenue. If it was, then I’d be putting out analysis articles every day/week.

Hi Chris.like your post a lot. In fact, this is an eye opener.I have been trading for years without any success as my method was basically technical indicators.

Looking forward to registering your trading course. From Arin Collins

Hey Arin,

Thank you for the kind words. I am going to close the course to new members soon, so please join as soon as you can.

Cheers.

Thanks bro you have knocked me out with this artitle I.really like it and it came at a right time because i am sad and frustrated about blowing my 15th 100Dollar Demo Account..Thanks. Again from now on i ll take it easy and learn from my mistakes.

My pleasure. Glad to hear this post was helpful to you.

Great article Chris. Really like what you’re preaching on your blog. Please keep doing what you’re doing.

Thanks TJ 🙂

Hey Chris!

I started following your messages since few days ago but to be honest you’re the Messenger in this industry of trading. Every message you post finds me. For this one I’m in GRIND phase and I was asking myself in I can quit or move forward. But you’re helping me discovering myself. Thank you for choosing to be honest in this business. You’re doing what others hide.

Hi Gerard, thank you I appreciate the kind words.

Hi Chris,

Another great post. I’m amazed at how much truth, wisdom and hope you bring. What we new traders want and need is truth. Thank you for saying it’s hard and takes a long time.

Keep up the great work.

Thank you!

Hey Mitsu, thanks for the kind words. Glad you like the post. 🙂

Hi Chris , i really enjoyed this post, im in third year of my forex trading, im on breakeven , i take care of risk management i want to keep Draw down very low, but struggle with concept of retail trading , i just found that if i want to be profitable i must use bigger leverage, i dont know how it works in future but now i want to make demo account two times bigger in three times try.

im in doubt that really your chart will happen ? really ? this much big return for retail trader ? really ?? i wish to this

Hi Ali, I would say that at this stage, don’t focus on the amount of return and instead focus on staying profitable.

Hi Chris,

Thanks for this gem of information. I am in a stage where I feel that I have psychological edge because I don’t feel any emotions while trading and believe in probability. I have a strategy that gives me decent average monthly return. The problem I am facing currently is I keep reading books on different strategies because I always feel like I can improve the probability and my mind always thinks about different technical setups that would help in improve the edge. Sometimes I consider the new strategy and try for sometime. How can get rid of this situation? I know that there’s no holy grail in trading but many times after experiments only I reduced drawdown and improved on returns. So I always feel like I can improve more on this. How can I come to stage where I should stop experimenting the things and just follow a strategy?

Hi Tejas,

Drop me an email! 🙂