I’ve been writing about Forex trading for the past 9 years, and I truly enjoy the responses I get from the people who’ve read, applied and benefited from the material I put out.

However, every now and then I’d get a (personally disturbing) email along the lines of:

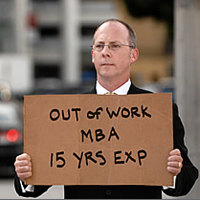

“Chris, I’ve lost my job and need to learn to trade to make money ASAP. Can you help me?”

This post is dedicated to answering this question.

First Of All, I Understand Your Pain

Let’s be straight here –

Losing your job (when you don’t intend to), sucks.

Our modern lives are so filled with bills that we simply can’t operate without an income.

The insecurity and anxiety that follows being unemployed is no laughing matter.

And I want you to know that unemployment is not something I take lightly.

I get where you’re coming from. I understand that feeling all too well.

Which Is Why I’m Gonna Be Straight With You

You can bet your bottom dollar that there will always be someone out there who’d tell you, “Yes! I can teach you to make money right away – just buy my product.”

To be blunt, that’s just bullshit.

My opinion is that you’d be better off buying a lottery ticket.

With no disrespect, I’d suggest looking for a new job.

“But Can’t You Just Show Me How To Trade Like You?”

Trading isn’t like flipping burgers at MacDonalds. It’s not something you just “get” over the course of a few days or weeks. It requires months and years of practice and experience.

And – very importantly – you’ll need time to build up your trading capital to a level where you can get a significant-enough income from your trading. Making a 50% capital gain per month is pointless if you only have a $300 account – it still isn’t enough to pay the bills.

So unless you have both savings and time to spare, I’d actually recommend that you don’t look at trading for your income needs. In this business, it takes money to make money.

What many people look for in trading after they’ve lost their jobs is (unfortunately) a magic pill to solve their problems.

And it just isn’t going to happen.

It’s Too Little, Too Late. Sorry.

If you’re looking to make a significant income trading, don’t wait until you have no other option before you start.

It’s like eating unhealthily for decades with no exercise, then getting a stroke and looking for a miracle cure.

Statistically, the odds of a full recovery are very poor. It’s pretty straight-forward: You reap what you sow.

Maybe you had an opportunity to learn how to trade years ago, but didn’t take it. Or maybe you started, but gave up on it.

Whatever the case may be, trading isn’t my recommended course of action for you now – it’s a risk you shouldn’t be taking on at this stage in your life.

My suggestion is:

- Get a new job, work at it and save up. In the meantime, start a demo account and practice trading.

- Once you have some savings, and you’re comfortable with your demo account, begin live trading on a small account.

- Once you’re comfortable trading on a small live account, deposit a larger amount to grow your account further.

It’s not exciting advice, but it’s the most effective one I know.

Profitable trading operates in a similar way – it’s unexciting, but effective.

Don’t Wait Until A War Starts Before You Build A Bomb Shelter

These days, sudden unemployment has become commonplace.

I have a friend working in a well-known British bank (as an investment banker) who tells me that 70% of his department got fired in the past 8 months. He has no illusions about the precarious position he’s in, and is mentally (and emotionally) prepared to leave his job if and when his turn comes, because he has prepared financially for it.

Now that’s smart.

How prepared are you to lose your job when the world is in recession and no one is hiring?

When the shit hits the fan, have you built the skills and capital to be financially independent, or will you be looking for a magic pill to solve your financial liabilities?

Hi Chris,

Actually all of your advises in your last posts are inspiring me to carry on with my intention to be a successful trader, i’ve been trading with my live account since 2008 under micro account with only about USD200.00 left now… anyway trading must go on… never give up though more than USD2000.00 wiped out. I just need your sincere advise what should i do with this my last bullet.. I used to trade using technical indicators available on the MT4 platform.. recently i read about your pip planting… could u pls explain further.. tq

Hi Muhamad,

My suggestion would be to just leave your Live account aside and get started with demo trading again.

To put things bluntly, your past results indicate that you’re not doing something (or a few things) in an appropriate manner.

It could be anything from your trading philosophy to money management – the point here is not to risk any more of your money until you’re reasonably sure of what you’re doing (in your trading), and why.

Regarding Planting Pips, we are closed at the moment but we’ll drop you an email with more details about about it when it re-opens (if you’re a subscriber here to the blog).

Cheers.

Hi Chris

Thanks for the frank comments. You are true to yr heart feeliing. My reason why I choose to be a forex trader is that i can make some money out of it when i don’t have a job or i have been told “U are FIRED”. So when I am fired at older age I don’t need to rely looking for a job. I have honestly gone thru this phase of life and I pray that my forex trading will give me good profit in time to come. I have a stable job at hand at the moment but u know at anytime u will be out of job. Its so unpredictable out there. Meanwhile I look forward to planting my PIPs.

Have a wonderful day.

Regards. Raj

Excellent article. Straight to the point. Just like a marriage. It takes time to conceive a baby !

Hi Chris

Very wise words!

People never make wise decisions when negatively charged ie. after a divorce, loosing a job/deal etc. That applies to communication, buying forex products, getting married, doing trades etc.

ALL ACTIONS in life starts with crawling, then walking and finally running.

When you want to run without doing the crawling and walking stages, you will definitely fall on your face and then loose your beauty as well.

Rather take the time to plan properly and then pursue that plan, also the goal, step by step to achieve your goal.

Well done Chris.

You deserve a pat on the back.

Thanks, I appreciate it my friend.

Hi Chris

The unembellished truth. How refreshing to hear in the forex world of hype.

John

Hi Chris, I have begun my journey with you with Icarus Project and have been following your blog updates. I am at a stage of my life where i need to plan for retirement and also the possibilities of ‘YOU ARE FIRED’ after 12 years of services to my current employer. There is no such things as “Security” in our time and the only security in our life with 100% certainties is Death.Thank you for the all the interesting articles and in a certain a motivation for that trading forex is a possibilities. I have burn my one live account…and this is my second journey…..*sigh**. Cheers

Edmund

Hi Edmund,

Don’t worry! It’s perfectly normal for any serious trader to have blown up a few accounts in the beginning – what really matters is to learn from the mistakes and not to repeat them.

Very, very wise informantion

I read the book Rich Dad, Poor Dad many years ago, and one of the most important things I got coming away from the book was that there was a huge difference between earning money and making money. Most people spend all their working lives earning money (thinking they are making money), all the while there are a few people in the world like the Donald Trumps, and Warren Buffets who know how to make money. The main difference between them and most people is they learned the difference between the two.

Learning to make money is the reason I determined to learn to trade Forex over seven years ago. Its been a slow process taking two steps forward and one step back but at the end of each trading week I’m able to take money out of the market and add to my trading account. At the end of the month I’m now able either take money out of my account, or increase the number of mini’s that I trade (I only trade mini’s, its more flexible).

Thanks Chris for your pearls of wisdom.

I have been retired for the last 12 years. So I agree with the truth of what you said. And they do not apply to me.

I did a course on spread betting and then on stocks. This cost about £6,000 just on education and then I lost £1000 on stocks. Since then I only listen to online courses and paper trade forex.

It will be a while before I spend money again but I believe that if I consider paper trading with 1% as though it is really my own money and if I can start to make a profit then I will gradually commit to real trading in 6 months time.

Great advice.

I am one of those in this situation. I wanted to learn to trade but never got to it. When I lost my job I had no choice but to learn. Desperation is what got me to start learning and I do get some income now. Been trading for 18 months.

Hey Tressie,

I think the important thing is that you got started as soon as you could.

Hopefully, you’ll also get a job to satisfy your income needs in the meantime.

Chris – you appear to be wise beyond your years. No matter what bulls***t you see coming through the inbox, promising instant miracles, the only way to make money in this game is hard work and persistance – it also helps if you can dispassionately look at past loosing trades and attempt to learn from your mistakes (and that’s not easy when it’s real money going down the drain)

Keep up the honest and refreshing work.

Trevor

Hey Trevor,

I appreciate the kind words, thank you.

Could not agree more.

When people are in desperate situation, ie no pay check coming in and bills to pay, they will do irrational trades which will compound their financial situation leading them to take more risk and more irrational trades…

Ofcourse the end result is Tragedy with a capital T (and no capital remaining).

You are quite correct, prepare now and then when mastered, move to trading as a career when it suits the individual and not the individuals circumstances.

John