As individuals living in society, most of us have similar instincts and desires.

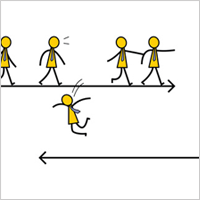

Thus, in any given situation, we tend to act and react like most other people. Our behavior typically mirrors that of everyone else.

And for the average person who wants to be a successful retail trader, this is bad news.

Why Successful Traders Are A Minority

A lot has been said about how difficult it is to do well in trading, but what most people don’t realize is that it is not because trading is difficult that winning traders are a minority, but rather that winning traders must be a minority, therefore trading is difficult.

You see, doing well at trading is not like doing well on a math exam.

In an exam, if the students answered all the questions correctly, they would ALL get an ‘A’. If only a few students get an ‘A’, it would be because the exam was difficult.

But this isn’t how it works in trading.

In trading, there aren’t enough “A’s” to go around. Trading profits are strictly limited.

Think about it this way:

Imagine there are only 3 traders in the world, and they each start with a $1,000 account.

In the end, (assuming no break even traders) there can be only 2 possible outcomes:

1. One trader wins (ex. $400), Two traders lose (ex. -$200 and -$200)

2. Two traders win (ex. $400 and $400), One trader loses (ex. -$800)

In the first scenario, the winning trader is already in the minority.

In the second scenario however, the winning traders are in the majority… at first.

But what happens after the losing trader loses all his money?

Then, the two remaining traders will be left to trade against each other until there is ultimately only one winning trader. The losing trader here would then join the previous losing traders to form a new majority.

And so you see, a natural and logical outcome of trading is that the winners will always tend towards a minority.

This will happen regardless of how “easy” or “difficult” trading is.

It’s an inevitable outcome based on how the game is structured.

How To Join The Minority Of Winning Traders

So far, we’ve established that:

- Most people have similar instincts and behaviors

- The trading game is set in a way that ensures successful traders will always tend towards the minority

The implication of this is that to be a successful trader, you’ll have to train yourself to think and act differently from your peers.

Are You Trading Like Everyone Else?

If successful trading was naturally intuitive, most people would be profitable traders.

But as you now know, this can never happen since winning traders will tend towards the minority.

The blunt truth is that trading profits can only be made at the expense of other traders. There’s no other way to make money is this business. It’s not technically possible for everyone to make money.

And this brings me to the point of this post…

How Did You Learn To Trade?

If you’re like most retail traders, you were probably taught to rely on technical indicators for your trade entry and exit decisions.

And if you’ve been a reader here for any length of time you’d know that I’m very critical about their validity and effectiveness.

To me, believing that an arbitrary set of indicators can describe (or even predict) market price moves is naive.

There’s a lot more to understanding markets than simply, “it did this before in the past, so it will do it again in the future”.

Too many retail traders believe that there’s a simplistic, straight-forward solution to successful trading. They think that trading is a two-step process:

- Do this thing (ex. apply this technical indicator)

- Make money

Unfortunately for them, financial markets are driven by factors more subtle and complex than that.

Perhaps then, accepting that we can never precisely understand or describe financial markets is a good first step to thinking differently from everyone else.

Some people jump into forex and after trying and losing, conclude that the market is rigged. They believe the forex market is being controlled by a mafia, and that If you’re not privileged to be in that mafia then you’re just wasting time and money trading forex.

I wish I was Professor X of the X-Men. Then I would read the minds of all forex traders and know what they were thinking. Even your own mind Chris. LOL!

I’ve stopped surfing the internet in search of indicators. Now I stick to only one indicator that comes with the MT4 and it’s been peaceful trading for me so far. I feel liberated. I hope one day not to have any indicator on the charts and just predict price movement using only the candlesticks.

Excellent, Okeke! Very nice!

bollinger band, some moving averages and candlesticks on daily and weekly time frames are all what you need to be successful in trading..

Interesting assertion. Personally, I disagree that it’s all one needs.

Forex is like life, as there are so participants and systems and views arise. And everyone has the right, but few succeed. What a paradox. Any system is only one view of the market and do not necessarily reflect the truth. So I came to the enlightenment of a system without system. No indicators are needed. Eye itself very accurately can see bias of the trend and areas of support and resistance. Therefore I support Chris as an apologist of pure Price action plus correct interpretation of the fundamental analysis

Hi Ivan, that’s a good point. Different strokes for different folks!

Have to strongly agree with you on this Chris ..

We have to think / act different from most traders .. go where they go but put yourself in front of most of them ,most of the time

Trading is business, operates like business, most traders are like shoppers, the successful trader is the businessman, buying and selling at the right price to the shoppers, but he is also a con man trying to out wit the shoppers by wrong footing the shopper to get the best price in order to take the maximum profit, you have to put yourself in the business mans shoes to become a successful trader….

Over the years, the market has come to the conclusion that the best analysis – an analysis without indicators. I consider it possible and efficient use of Gann angles, even better if they are used in conjunction with candlestick analysis and has already established patterns.

Hi Nikolay, thanks for sharing your views!

Hey, I found you from a recent youtube interview, you got a nice blog and it was a nice read, keep doing what you are doing !

Hi Jay, appreciate the kind words! Hope you found the interview to be useful.