POSITIVE EXPECTANCY

HOW TO DESIGN WINNING TRADING STRATEGIES

BACKED BY REAL-WORLD RESULTS

Hello, my name is Chris Lee.

I'm an independent Forex trader,

and author of the Amazon bestseller 'Forex Dreaming'.

It's embarrassing to say this, but I've always been a slow learner.

It took me many years to figure out what trading is really about, and to be able to articulate that knowledge in a coherent manner.

In the 10 years that I've been writing at the Pip Mavens blog, people have often asked me if there are any real secrets in trading...

And the truth is that yes,

There's one BIG secret to trading

Let me explain in this video:

You see, the main difference between winning and losing strategies is expectancy -- it's the single most important thing that determines whether a strategy is going to win or lose over time.

A series of winning trades means nothing without positive expectancy because sooner or later, the losses catch up with you.

Here's what I mean:

Take a look at the performance of this trading strategy after 2 weeks:

The return over the past 2 weeks is approximately +7.4%. It's looking good!

Now let's see what happens when we continue applying the same strategy over a period of 3 months:

Uh oh. The strategy made an all-time high profit of +21% but its net performance has since dropped to lower than -5.7%.

If we stick to the strategy, maybe it can recover from the losses?

Let's see what happens if we continue applying the strategy over a period of 6 months:

Argh! The strategy turns out to be a losing one, with a net loss of -23%!

This, ladies and gentlemen, is what happens to all trading strategies without positive expectancy.

Without it, you are guaranteed to lose capital over time. You may not lose today. You may not lose tomorrow. But eventually, sooner or later, you will lose.

Wow thanks for the morale boost, Chris.

Hey, don't shoot the messenger. I just think it's better that you're told the harsh truth right from the start.

Expectancy is THE most important aspect of trading, and as far as I can tell, aspiring traders don't pay nearly enough attention to it.

So what is expectancy, exactly?

In mathematical terms, expectancy is represented by the formula:

(Win Rate x Average Profit) - (Loss rate x Average Loss)

Put simply, it asks the question:

"On average, how much does the strategy win or lose per trade?"

This point seems easy enough to understand... but very few people have grasped the true implications of what this means.

For example, did you know that a world-class trader can have an expectancy of just +2.5 pips?

If you can achieve an average result of +2.5 pips on each of your trades, you can quite easily reach a six-figure income within two years, even if you started an account from scratch.

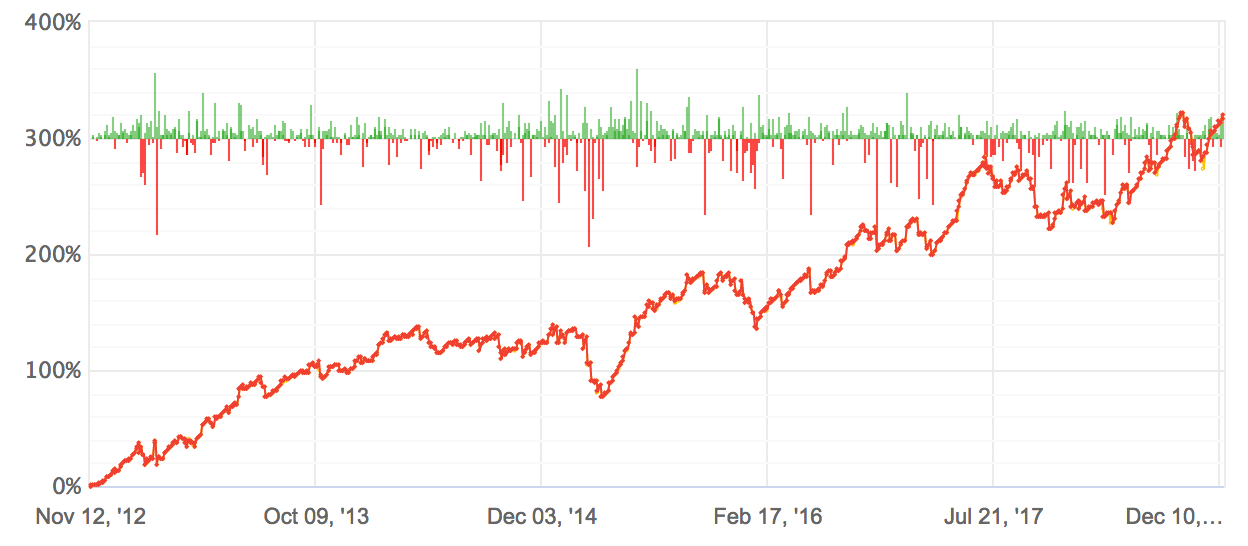

Check out the expectancy of REAL traders:

Can you see how even with multiple losing trades, these equity curves still move up over time?

That's what positive expectancy is about -- the ability of a trading strategy to overcome losses and win over the long term.

Unfortunately, positive expectancy is rare. It's the exception rather than the norm.

The vast majority of traders have negative expectancy

... and they don't know it!

Back in 2005, I read all the "must read" trading books and paid over $20,000 to attend seminars taught by "certified professional" traders. I spent years listening to, and following the platitudes: cut losses quickly, let profits run, don't risk more than 2% per trade, focus on psychology and money management, etc...

Yet somehow, I still kept losing.

I was taught all the theory of how to trade with chart patterns and technical indicators, but something always felt wrong -- no one could tell me why those methods would be profitable in the first place!

Think about it. Most retail traders are more or less taught the same technical analysis concepts. But if everyone is trading in those same few ways, who would we be making money off of?

It was only many years later (I'm a slow learner, remember) that I finally realized why I kept losing... there was something I had been missing all along: a trading edge.

You need an edge in the market

An edge is some form of advantage that gives you a better chance of winning compared to others.

If you're a professional boxer who can punch a split second faster than your opponent, you have an edge.

If you're an Olympic swimmer with a larger lung capacity than your competitors, you have an edge.

Few retail traders ever come to realize that the biggest determinant of trading performance is NOT psychology, discipline or money management...

It's whether or not they have an edge in the market.

You can trade with:

Good risk-reward ratios

Great money management

Solid psychology

Perfect discipline

... but without an edge you will STILL lose.

Everywhere you look online, people are focused on the small details: technical indicators, risk-reward ratios, trend lines, chart patterns, etc.

What they don't realize is,

- Technical indicators are NOT an edge

- Chart patterns are NOT an edge

- Good risk-reward ratios are NOT an edge

- Good money management is NOT an edge

While helpful, these aspects make only a minor difference to the overall result -- the vast majority of retail traders still end up losing because the default expectancy of retail trading is negative.

Every time we take a trade, our default chance of winning is worse than a coin flip.

It's unfair, but that's the reality.

If you don't know what your edge is, you don't have one

So the question you need to ask is: "Why would I win while most others lose?"

If you answered, "Because I'm using a 5-EMA and 10-EMA crossover system", or something like that... I have bad news for you.

You see, any trading strategy that can be easily and immediately applied has no edge to it. You can't make money over the long run unless your strategy is difficult to find, difficult to learn, or difficult to apply. This is the first secret of positive expectancy.

How to achieve positive expectancy

Over the past 15+ years, I've traded all kinds of strategies.

Each of these strategies taught me a lot. Every time I tested something new, I gained a new perspective, a new tactic, a new insight.

Over 30+ strategies later, the breakthroughs began to add up.

Slowly but surely, I began to see the big picture of how the game of trading is really played.

As you can see, expectancy is a deep topic that spans across all aspects of trading -- industry structure, market purpose, liquidity mechanics, competitor analysis, complexity, behavioral economics, game theory, just to name a few.

Viewed separately, it's not easy to see how each of these aspects can contribute to gaining an edge in the market -- it took me almost a full decade to understand how all the pieces fit together.

As I slowly began to connect the dots, I started to understand what the trading game is really about. And once I began to apply this knowledge, my trading performance immediately improved.

Real results on a live trading account

Now if you'd like the full details of how to achieve positive expectancy in your trading, please keep reading.

I've spent the last two years putting everything I know about this topic into a brand new course that will show you how to find a trading edge, and how to build a trading strategy around it.

Introducing...

This new course is the culmination of everything I know about how to get from the default negative trading expectancy, to positive expectancy.

Here's a summary of what you'll learn in the course:

Content Overview

You will learn:

- The true nature of the trading game and how 99.9% of retail traders misunderstand it

- A new paradigm to understand and navigate the chaos that drives market prices

- The key principles and perspectives to trade well amidst the market chaos

- The characteristics of trading systems with positive expectancy

- How to look for, identify and develop a trading edge

- The full step-by-step process of how to to develop a strategy with positive expectancy

Other topics covered:

- A completely new perspective of what trading is about

- Why conventional approaches to trading have a high failure rate

- How winning retail traders really make money

- How to understand the complex nature of the market

- How liquidity mechanics affect the expectancy of trading strategies

- Why pattern trading is for suckers

- How to tell if a trader's performance is sustainable (hint: most aren't)

- How to understand the market "hive mind"

- The 8 Iron Rules of positive expectancy

- How your losses contain one of the secrets to finding your edge

- The amount of effective leverage (lot size) you should be using

- Whether it's more important to fix weaknesses or to improve strengths

- The most underrated piece of advice from Mr Miyagi (of The Karate Kid) to traders

- Why following the BabyPips school is a recipe for disaster

- The 6 basic types of market edge, and how they work

- How billionaires make tens of millions each year with "just" a 5% edge

- The 4 best areas in trading where retail traders can find an edge

- What successful trading looks like

- What to do if you have low trading capital

- The exact steps to identify a trading edge and how build a strategy around it

- How the big money traders operate, what their edge is, and what to do about them

- What algorithms and artificial intelligence struggle to do, that humans can do easily

(this is a good place to start developing your trading edge) - Why you must specialize in a trading niche, and how to look for one

- A step-by-step process of how to look past your psychological blind spots and see the 'reality' of the market

- What it means to carry out your trading like a business operation

- The 6 unique roles of profitable traders - each role focuses on a separate activity and fulfills a specific purpose

- How to systematically design and develop strategies with positive expectancy

- The single best way to improve the expectancy of existing trading strategies

- The proper way to run a strategy back-test, and the most important statistics to watch for

- How to tweak a strategy for better results without curve fitting

- The proper way to run a strategy forward-test

- The best capital allocation approach to yield the best practical (not theoretical) results

- And much more

This course contains over 24,000 words, which is approximately 130+ pages.

Positive Expectancy contains the core principles, mental models and strategic insights I've accumulated over the past 10+ years as a full-time retail trader.

It contains meta-level trading concepts and perspectives that are not found anywhere else.

This is not just a how-to course. It's a paradigm shifting course.

If you're struggling in trading, it's likely because you've been asking the wrong questions. This course teaches you what the right questions are, and how to find the answers.

Here's a quick summary of the Introduction alone:

Introduction

- The nature of the trading game, and how it's different from the other games we play in life

How we normally achieve success in life cannot be successfully applied to trading. A totally different approach is needed. - What the true goal of trading is (hint: it's not "following your system")

Most retail traders get this wrong. They chase the wrong goals that inevitably lead to failure. - The difference between knowing how to trade, and understanding how the trading game is played

You can know a lot about trading and not really understand it. - Why trading losses can be guaranteed, but trading profits cannot

Once you discover the answer to this question, you'll understand what trading is about. - How the vast majority of people are learning to trade the wrong way

If you're focusing on "trade setups", chart patterns and/or technical indicators, you're never going to become profitable. - Why trading is not a job, and the right way to approach it

Traders don't get paid for effort. They get paid to approach the market in a way that most people can't. - "Can I make $20 per day with a $500 account?"

"Is trading a guessing game or do people actually know where the price is going?"

"How do some traders make great execution on trades?"

The answers to questions like these.

This is the first time I've ever discussed such high-level trading concepts, and to prevent too many people from learning about them, I reserve the right to remove this course at any time.

Positive Expectancy is RARE

Here's the thing. Few traders ever achieve positive expectancy because the vast majority of trading "educators" out there are really charlatans who teach concepts that sound good in theory but don't work in practice.

Just think: why don't they show their live trading results?

The reality is that there are only a very small number of people who (1) have achieved positive expectancy, (2) can demonstrate it, and (3) are willing to share that knowledge.

Right now, I am one of those people.

I don't mean to sound arrogant - and I apologize if I do - but that's the blunt truth. My live trading results are tracked by a neutral third party (Myfxbook) and verified by reputable brokers located in well regulated financial jurisdictions such as Australia.

Does your favorite trading mentor or guru show his ongoing live performance results?

If he doesn't, you need to seriously think about why.

Get full knowledge for a fraction of the cost

Since 2005, I've spent over $20,000 in trading courses, and lost over $300,000 of my own money in order to learn the valuable lessons covered in this course.

Instead of showing you how much money I've made, let me give you a snapshot of how much I've lost.

(These are REAL losses on a live account)

Everyone likes to talk about winning, of course. But real traders have losses.

To be fair, the losses shown here are significantly larger than my usual ones. However, they give a sense of the trials I had to go through to uncover the concepts you'll find in the course.

Everything you'll learn is backed by real-world trading experience on a 7-figure account, not theory.

Frequently Asked Questions:

1. "What exactly is this course about?"

Positive Expectancy is an online course that teaches you how to design, test and verify trading strategies that are profitable over the long run. It shows you how to develop a trading edge, and how to specialize in a trading niche.

2. "How is this course different from other trading courses?"

Positive Expectancy is the only trading course that's backed by verified live performance results. Live results are the ONLY way to tell whether a trader knows what he's talking about.

Additionally, this course is completely unique and its contents are not taught anywhere else.

3. "How long will this course take?"

There is no time limit. You can take as much time to cover the course materials as you like. Positive Expectancy covers 24,000+ words not including the pictures, diagrams and charts.

4. "How will I receive the course?"

As soon as you join, you will receive instructions to log in to the online course area.

5. "Will I get any support after joining?"

Yes. If you have any questions about the course content, send me an email and I will personally answer them for you. Also, new content will be added to the course over time, and you will get all of it at no extra cost, even after the course fee goes up. Once you get in, you get all future updates for free.

6. "Is the course suitable for everyone?"

This course is suitable for anyone who is serious about trading.

But I must WARN you, it's not for everyone.

Positive Expectancy is NOT for you if...

You're just 'playing around' and have no intention of getting serious with trading

You think trading is a magic bullet that can solve all your money problems overnight

You're not willing to work hard

Positive Expectancy IS for you if...

You understand that when taken seriously, trading can change your life

You want to stop blindly listening to "mentors" who can't prove they can actually trade

You're stuck in your trading, and you're not progressing

You're open to changing your whole perspective of trading

You prefer to learn how to think, rather than what to think

You're not afraid to work hard for your dreams

You're focused on the long term

BONUS VIDEO SERIES: Join Now and watch me

develop a profitable strategy from scratch

'Look over my shoulder' as I show you how, starting from scratch, I develop a full fledged trading strategy with positive expectancy.

Using the principles and processes covered in the course, I'll show you, in full HD video, how I come up with a basic trading idea and develop it to achieve positive expectancy.

You will learn all the strategy rules, and, more importantly, the process that came up with them.

Imagine being able to come up with multiple strategies like this, each with positive expectancy.

How would that change your experience of trading?

Imagine diversifying your trading capital across three, four, five or even more profitable trading strategies, simultaneously!

With these bonus videos, you will at the very least learn the full details of a winning strategy so you can get started immediately, if that what you want.

But only if you Join Now.

5 Reasons To Join Now

1. Fully verified, REAL performance results

Everything you'll learn in Positive Expectancy is backed by live performance results:

No other educator has openly shown his live performance results like this.

2. Learn from an ACTUAL 6-figure retail Forex trader

Trading on a $1,000 account is not the same as trading a $100,000 account. If you're serious about this business and want to grow your capital to 6-figures and beyond, this is the course you need to take. Positive Expectancy teaches practical lessons based on real-world experience from a retail Forex trader who has done it.

3. Proprietary concepts not taught anywhere else

Positive Expectancy contains highly unconventional concepts and perspectives.

This is material that REAL traders use, and it's vastly different from the ineffective platitudes that are blindly regurgitated all over the internet.

4. Bonus "look over my shoulder" videos (Limited)

Join now, and get the bonus video series where I show you how, starting from scratch, I come up with an initial trading idea, research it, test it, and fully develop it into a complete strategy with positive expectancy. This video series is exclusive to this course and is not available anywhere else.

5. This offer will be removed at any time

I reserve the right to remove this offer, or to raise the course fee at any time. The course fee you see today is the lowest it will ever get. Long time followers of mine know that the prices of my products never go down - they only go up.

When the timer runs out, the course will be closed for the next few months.

When next open again, the course fee may be raised.

Positive Expectancy

(online course)

$197

Secure Payment

If you have any questions, please contact me at chris@pipmavens.com.