I’m sure you’ve heard of the saying, “Cut your losses and let your profits run”.

This is probably the most commonly quoted piece of trading advice on the internet.

For years, I tried to abide by it as I struggled – just like everyone – at the beginning of my trading career.

But it wasn’t until I started to think for myself, that I realized it’s probably one the worst pieces of advice anyone can give a trader.

Yes, I said it.

For the most part, I believe trading advice should only be given and taken with respect to a specific trading method.

There’s no such thing as useful generic trading advice.

Generalist or Specialist?

In many areas of life, general advice can be useful. For example, “don’t spend more than you earn” is general advice that’s useful for most people.

But successful trading isn’t like most other areas of life. In fact, it’s one of the most radical things a person can do.

After all, it requires one to think and behave differently from everyone else – that’s the only way to make money over the long term.

You see… to be a successful trader you need to be a specialist.

Regardless of the currency pair you trade, regardless of the charting time frame, doing well in trading requires you to specialize in a narrowly-defined trading method.

And a specialist has no use for general advice.

Cut Losses & Let Profits Run

To me, this is bad advice because it is generic, contradictory and impractical.

The worst part is, it sounds like it isn’t.

It sounds legitimately useful.

Generic

If I’m a short-term scalper, for example, I shouldn’t be letting my profits run – I should be taking profits at a predetermined level.

Any intraday trader worth his salt will tell you that short-term trading often involves taking counter-trend trades, called fading.

And allowing your profits to run instead of booking it quickly can very well turn that winning trade into a losing one.

The problem is that too many traders believe that “letting profits run” is good advice, when it is fatal in many situations.

Contradictory

If you really think about it, the spirit of the message behind “cutting losses” contradicts that of “letting profits run”.

“Cutting losses” means to close a trade soon after seeing a paper loss.

“Letting profits run” means to refrain from closing a trade when there is a paper gain.

To illustrate why this is contradictory advice, allow me to provide an example:

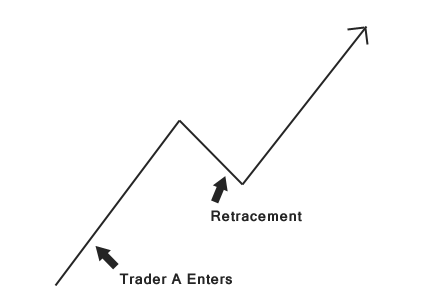

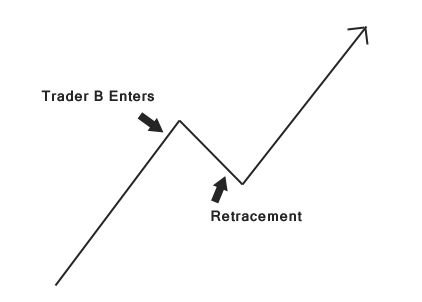

Traders A and B are trend traders. They are both looking to long the market, and the only difference is where they got into the trend.

Trader A got in early on the trend. When the retracement occurs, he follows the advice and allows his profits to keep running.

As you can tell, he’ll do very well on this trade.

Now, Trader B got in late into the trend.

Almost immediately after entering the trade, the market price starts to retrace and the trade suffers a paper loss.

According to the advice, Trader B should close the trade and “cut the loss”.

Later on though, the trend resumes and it becomes clear that Trader B should have held on to the trade.

Notice how, by following the same advice, one trader enjoys a larger profit while the other suffers an unnecessary loss.

How can two traders get such different results trading with same advice?

This happens when there’s a contradiction in it.

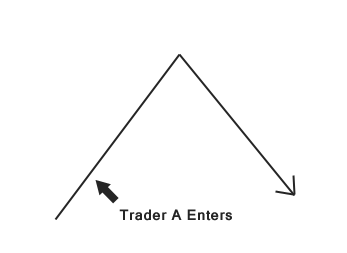

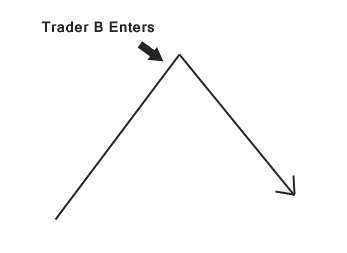

Now let’s take a look at the same Traders A and B, in a different (reversing) market situation:

If Trader A followed the advice and held on to the trade to “let profits run”, he would end up giving back all his profits, or more.

What about Trader B?

By following the advice, Trader B would have cut losses early and avoided a much larger loss.

This time, Trader B is the one that made the winning decision, while Trader A did not.

Again, we see two very different outcomes with the two traders following the same advice.

Notice that in either scenario (trending or reversing), there is one trader who made the right decision, and one who made the wrong decision.

Again, this can only happen when the advice is contradictory.

You see… the trader who makes the “right” decision is ultimately determined by how the market moves. It has nothing to do with how useful or effective the advice actually is.

If anything, it will likely cause endless confusion among the traders who follow it.

I suspect the reason why this piece of “advice” keeps popping up – despite its inherent contradiction – is that there is no situation in which it can be proven to be wrong. After all, one of the traders will always be seen to make the right decision, regardless of how the market subsequently moves.

Impractical

This is why I consider all trading advice to be impractical unless it is given with respect to a specific trading method.

Instead of just saying “cut your losses”, it would be more appropriate to examine a specific trading method and say, “close your trades when your indicators tell you the trend has changed”.

Now this advice is specific, clear and actionable.

Telling a trader to “cut losses and let profits run” is like telling someone “don’t buy losing lottery tickets and buy more winning lottery tickets”.

It’s not something that can be done on a practical level.

The Solution

So if you must give (or take) trading advice, make sure it is targeted towards a specific trading method.

Make sure it is specific, consistent with the trading philosophy, and practical enough to be implemented.

So share with me our opinion… What’s the worst trading advice you’ve heard?

“You’ll never go broke taking a profit”.

Totally depends on your hit rate combined with the size of those winners compared to the size of the losers.

That’s a good one!

agreed, Mr Lee!

well said ! A clear dissertation .

But it actually comes back to the first principal of ‘ follow the trend ”

And the difficulties have always been ‘how many ? and which one ? of the indicators .

Exactly. That’s a practical question to which practical answers should be expected.

Hi Chris,

What do you think of accepting an ATR baserd fixed risk, say 1% in the direction of the trend and running a sliding ATR based stop?

Hi Bliz,

It really depends on your trading method and philosophy.

For some methods, this approach would not be appropriate, while to others it would be.

The point is that all aspects of your method (entry/exit rules, lot size, trade management etc) should be consistent with your trading philosophy.

If it makes sense, by all means use it. If it doesn’t, discard it.

Hi Chris, great advice and also logical. I like your way of thinking.

Thanks Frank! I’ve learned that trading easily triggers emotional impulses so I believe logic is the best way to approach trading.

I totally disagree with your statement on losses and profits!

I successfully run my own Forex trading account. I concentrate on minimizing losses and let the profits run “with a controlling trailing stop loss”. My trailing Stop loss allows me to concentrate on selecting suitable trades and keep a careful eye on potential losses.

I’ve tried and rejected Scalping, I found it to be a poor return on the time required. Many of my trades run for a week or so and some for much longer periods; the longest was 18 months.

I will stick to “cutting my losses and letting my profits run”.

you are a trend follower, you best compare to trader A first scenario so really I don’t see why you dispute what Lee is saying but still you got the freedom to do it. Personally, I just love the logic Lee is illustrating here.. well-done bro.

Hi Chris,

As a long term trend trader in retail spot forex market myself, allow me to correct a little statement of yours under “Contradictory”. For real trend trader, there will be a specific amount of pips for the retracement, let’s say 250pips from the “high”. With this, both trade A and trader B will exit at the same time.

Besides, if trader A and trader B use the same trend trading system, they will enter almost at the same time and this will scenario will not happen.

Cheers,

Agrio

Hi Sannymac and Agrio,

Thanks for the input.

If “cutting losses and letting profits run” works for your trading method, then by all means follow it.

In this case it looks like you have specific parameters to cut losses and let profits run… and that’s the point I was trying to make — it can only work if it is consistent (and specific) to your trading method, but not as general advice.

There are many intraday and counter-trend traders who are struggling unnecessarily because they are trying to follow this advice when they shouldn’t be doing so.

I have heard lots of bad advices but i will tell you the best advice that i have ever heard…

“Always consider daily, weekly and monthly charts. Smaller time frames causes bigger risks…”

Hourly charts will give you todays info.

Hi Chris…Bang on advice,,,Anything and everything to do with trading successfully / consistently profitably must be tailored to suit the individuals method/system/budget/time available to trade and of course the individual traders psychological makeup etc…as you rightly point out if you are a somewhat aggressive scalper only shooting for a few pips profit target on most trades for example then the general advice to let profits run and cut losses short is not applicable except the cut losses short part

Hi Kevin,

Thank you for the comment. It’s good to know we are of the same opinion on this.

I thoroughly agree with the writer. That is what makes trading so difficult especially in the initial stages when we might for example be taking advice based on a different time frame or a contrarian trader , instead of a trend follower

The problem is that usually when you are just learning to trade you don’t know the difference and there-are many trading scammers who are anxious to take advantage of you. Yes, I say “take advantage of you very” very advisedcly because they do, some of them knowing that you don’t stand a chance of success at what you are doing, but anxious to sell you something, will push down your throat. “You must take advantage of this today or time will run out” they will tell you. Vantage Point sold me something they know I was not ready for at the time, but they promised that the winning trades would be phenomenal. Little did I know at the time that learning to trade was just part of it, or getting into the market early, might in fact be the cause of your demise.

As I get more trader savvy I weep for the young traders when I see the garbage they send out promising to make people millionaires overnight.

this doesn’t seem legit in any sense

I don’t agree. Why? cause your case do not had any statistical support and you had already drawn the future in your illustration where a trader should not predict the future. How A or B traders know the future price movement? If you don’t know the future, how you going to know where to take profit? Every good traders know that indicators, price pattern or classic trend/support/resistance did not work all the time. Relying on it will bring more confuse to the traders and eventually they will losing the edge by taking profit too early and missed the big move which can cover multiple time of small losses. I would suggest you to read Market Wizard book and learn from the best of the best. You can try to find successful scalpers like Dennis Richard in early of his trading days but he gets rich because of simple ‘cut losses short, let the profit run’ trend following system.

Hi Jeff, thanks for the comment. It seems you’ve missed the point of the post.

1) Yes, traders don’t know future price movement. That’s why I used 2 opposite scenarios.

2) I’m not saying that no one should ‘cut losses and let profits run’. I’m saying that trading advice should only be be given and taken with respect to a specific trading method. For Richard Dennis’ case, that was helpful. For others? Not necessarily.

Intesting thoughts Chris – enjoyed reading your post.

At the end of the day no one is going to pick the top or the bottom – as they say top pickers and bottom pickers become cotton pickers!

I think it is better to let profits run only because it is the hardest thing to do – and in trading, the things that are hard to do usually are the ones that we as traders *have* to do to have that edge – such as going Short at the bottom of the market or going Long at the top.

Regards

Shelton

Great post and points! If you can get a copy of the infamous Paul Tudor Jones documentary “Trader” there is a revealing moment at the end about taking profits:

– it is the easiest trade to do yet the hardest at the same time particularly at new highs

– even Paul Tudor Jones can never be sure of where the market will go so he sets a conditional sell / offer order

Watch it and you get a wonderful insight!

Thanks for the share, Dave.

All the while I learnt was cut the loss short and let profit run, the illustrations you gave is an eye opener for me, nevertheless, I do feel that in order to allow the “let profit run” we have to see ‘how strong the trend will last’, if the trend can last only for M30, then we should take profit at the end of M30 or at least book part of the profit, whether we should allow the profit to continue will be to see what is the candlestick continuation pattern, if there is a main anchor candlestick appearing at M30, then I shall allow some of the trade to carry on, if there is rejection then no point to let the profit run for it might turn into loss due to the weakening of the trend.

Yup, this is an example of applying advice to a specific trading method.

Hi Chris,

Thanks for throwing some light on the other side of things.

I got interested in this article cause it fits my perspective of forex trading as compared to any other business. I started making any profits considered ‘consistent’ after I took a critical assessment of the concept of ‘stop loss’ in forex. All businesses in life will have ups and downs. Should I close shop and quit my retail business just because customers have not taken my goods within a ‘short period’ of time? NO. Customers take goods on credit that might run into weeks, months etc yet the business keeps running. If the business owner does NOT ‘OVER TRADE’ he will ride the credit periods while carrying on with business in other areas – until his customer pays up. That is how I have come to view forex trading.

1) I stay with the trend until it bends.

2) I try NEVER to OVER TRADE, so my equity remains manageable as I ride any wrong entry.

3) Because my equity remains manageable I DON’T CARE ABOUT ANY STOP LOSS. When the trade goes against my initial direction it returns ultimately and I take whatever profit at that stage.

For me, therefore, there are no losses to cut, only profits to take no matter how long it might take.

Appreciate the comment, Edmund 🙂

Hi Chris, I have stumbled across your article after coming to my very own actualizations. Crazy how it took me years to stop being stubborn and question all that I have learned. Bless up to you and continue to help others who find this post.

I think the only way a trader can be successful is to use a system that incorporates a signal/s that tell the trader to close their position. This way you can allow a trade to run but be on high alert to see those signals. I do, however, agree that novice traders often mix “letting winners run” and greed and thus ultimately fail at trading. Brilliant Article.

Glad you liked the article, and thanks for dropping a comment!

Great article Chris. I totally agree. Stop losses are a sure way for a trader to lose money, that’s why mine are so far away from the current market price it happens very rarely. In the meantime I can make money from the markets without worrying about them. When a stop does get hit I consider it an overhead rather than a bad trade. My profitable trades far outweigh the odd loss overall. As long as your account has liquidity you can trade successfully this way especially in volatile markets.

Hi Jason, thanks for your thoughts. Not many people can make a wide stop loss work for them, and it’s good to hear that you’ve managed to get it working for you. Cheers.

You don’t understand how “cut losses and let profits run” works. 98% of all traders don’t understand it as well. It is good idea to cut losses as soon as you can by based on your trade rules such as EMA, HH/LL or other methods because retreacement can be unpredictable. Traders are confused with “run let profits” because they may think they should let profits run forever until it is against their trade to cut losses. They are supposed to have reasonable profit target at least 1:1 or higher but not set unrealistic profit target level. That’s how “cut losses and let profit run” works.

Worst advice was “ If you are a profitable trader you should trade more because the odds are in your favor.”