Forex Backtest Friday – Ichimoku Kinko Hyo (part 2)

Welcome to Forex Backtest Friday.

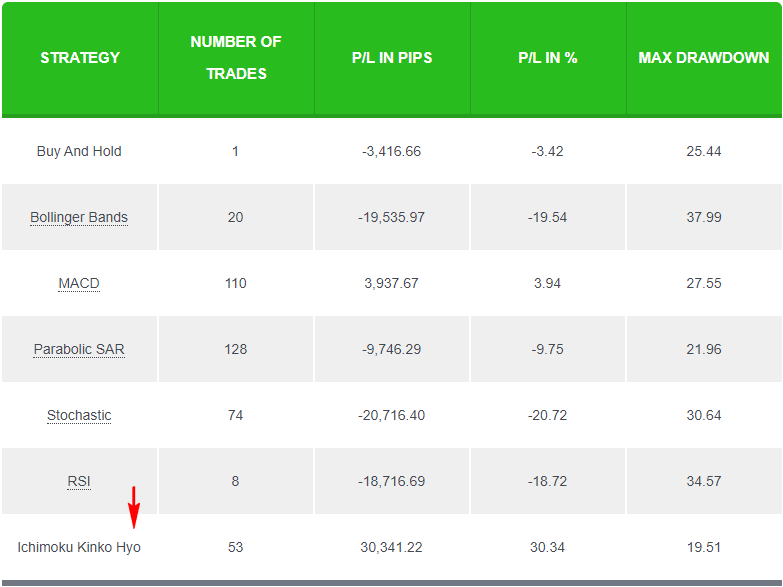

In the previous post, I tested the Ichimoku Kinko Hyo indicator and found it to be reasonably effective on a few currency pairs.

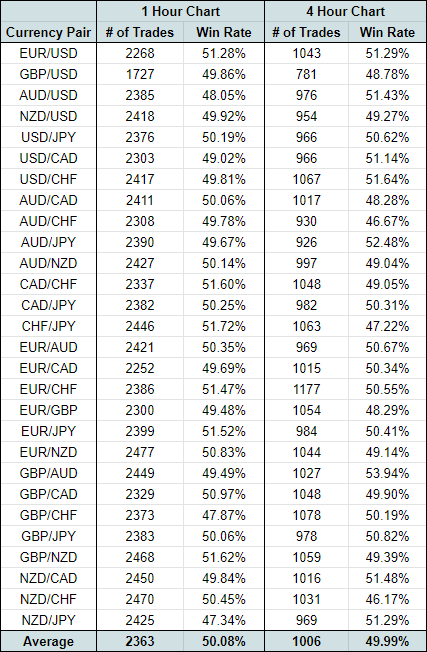

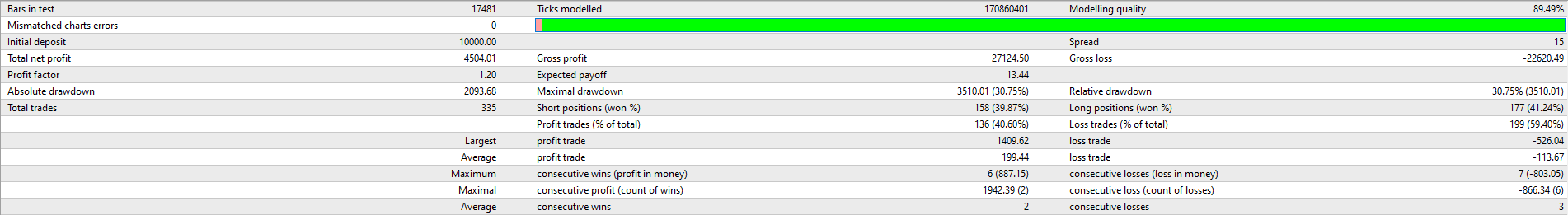

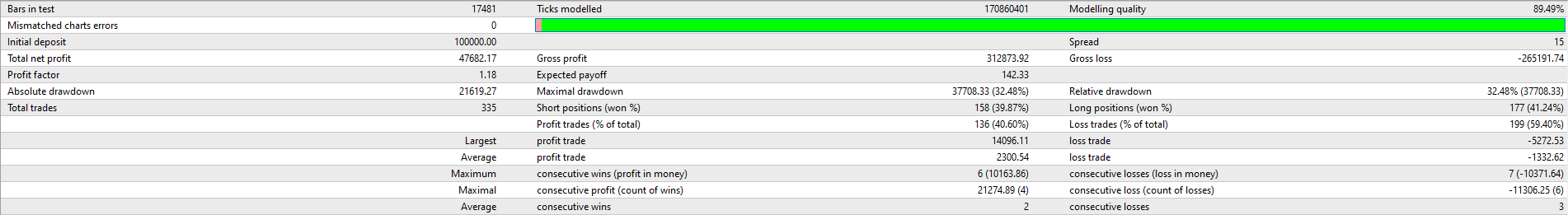

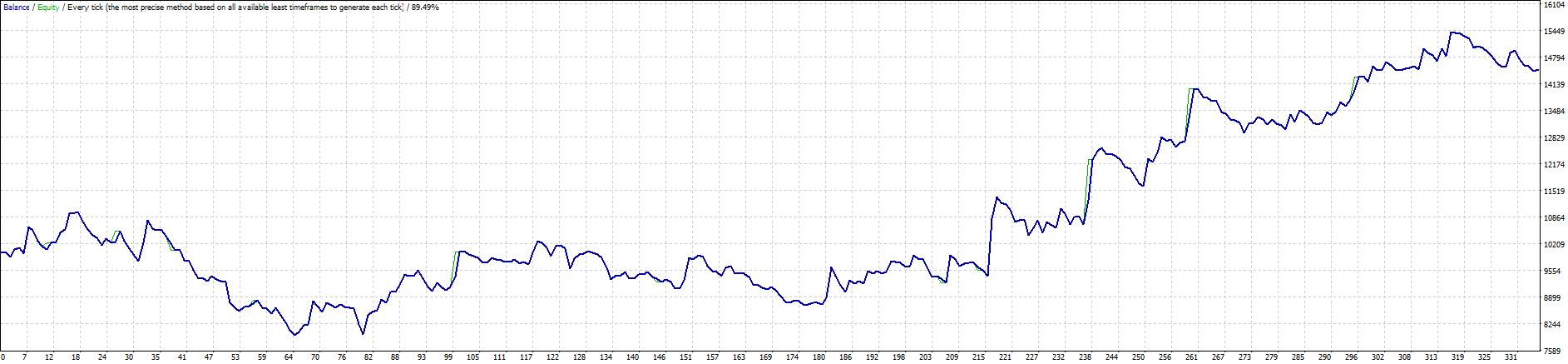

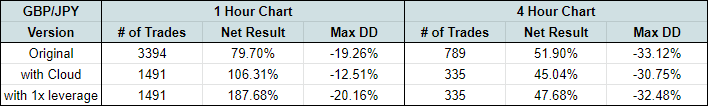

To recap, here are the results for the GBP/JPY (including spread costs) over the past 11 years:

- 1 hour chart: 79.7% gain

- 4 hour chart: 51.9% gain

Having established a base level of profitability, the next step is to be a little more discerning about the trades being taken.

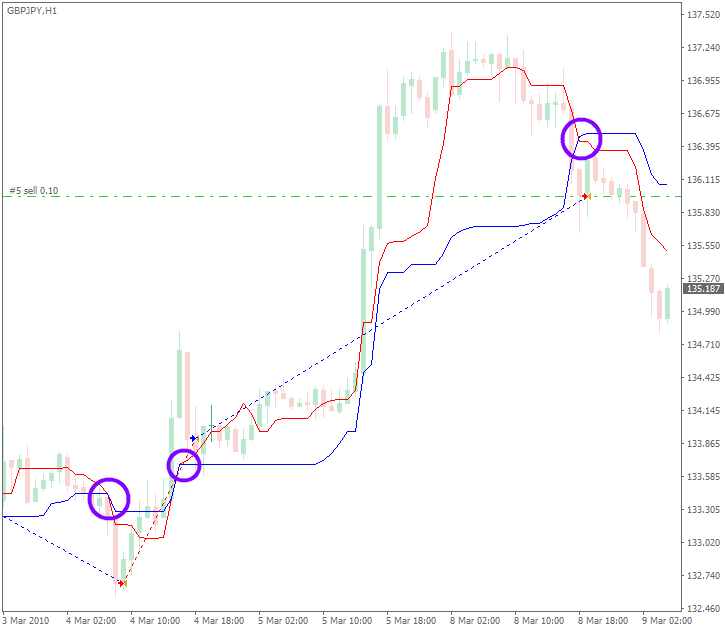

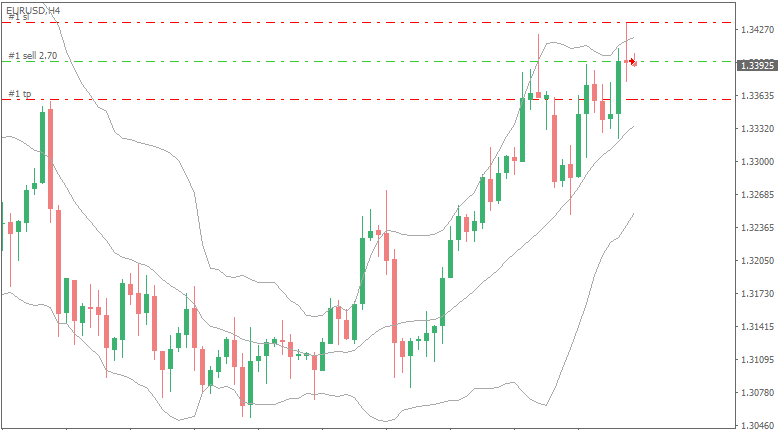

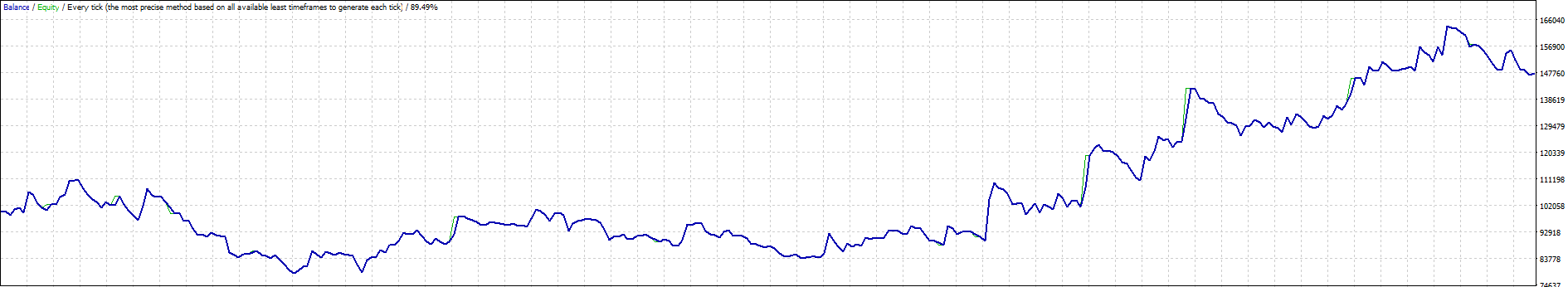

One of the suggestions in the comments section was to add a Kumo qualifier, where a buy trade is only taken above the Ichimoku cloud, and a sell trade is only taken below (thanks Zippy Bronstein!).

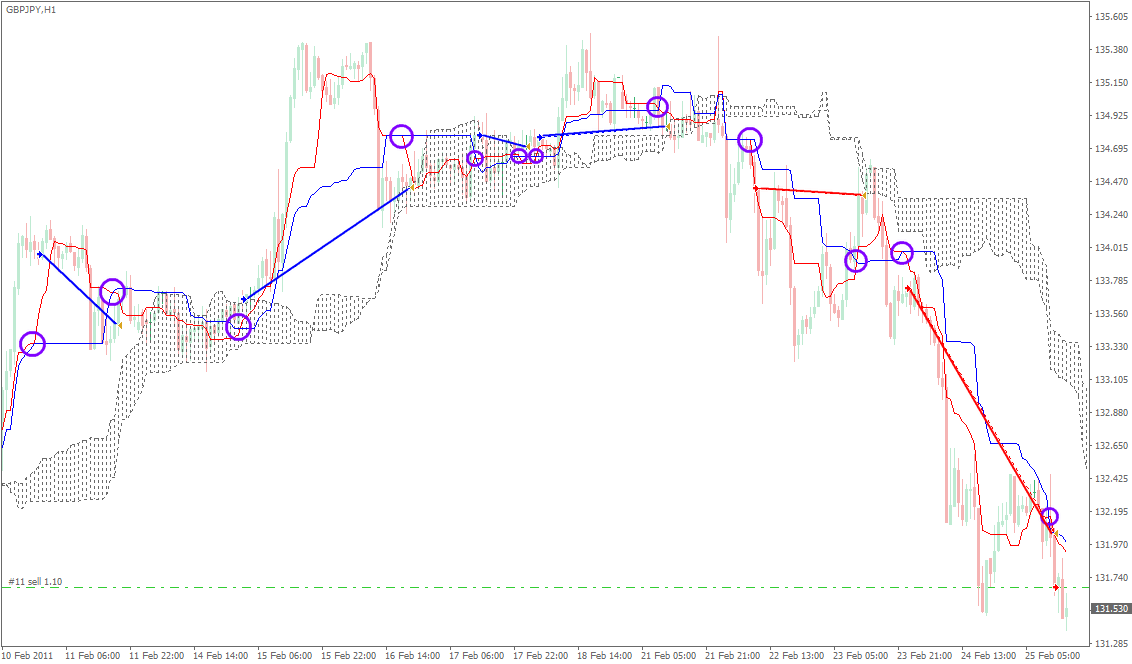

Click image to enlarge

- Purple circle: Tenkan Sen crosses Kijun Sen

- Blue straight line: Buy trade open-to-close

- Red straight line: Sell trade open-to-close

So I put this to the test, and the result was... well, I'll let you see for yourself!

The Results

Here are the results of the backtest (click to view):

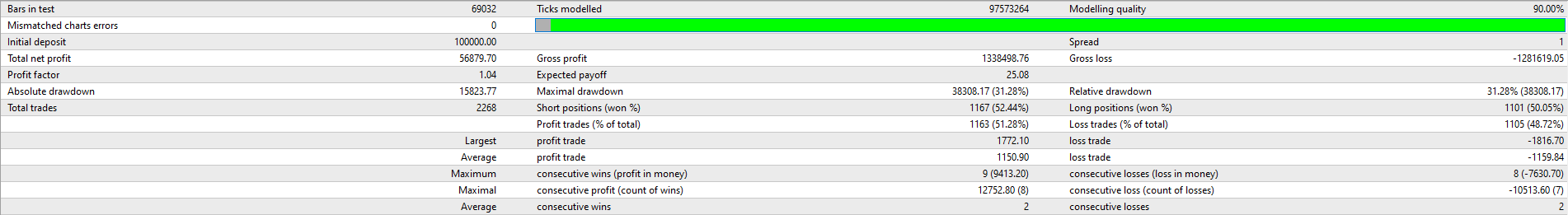

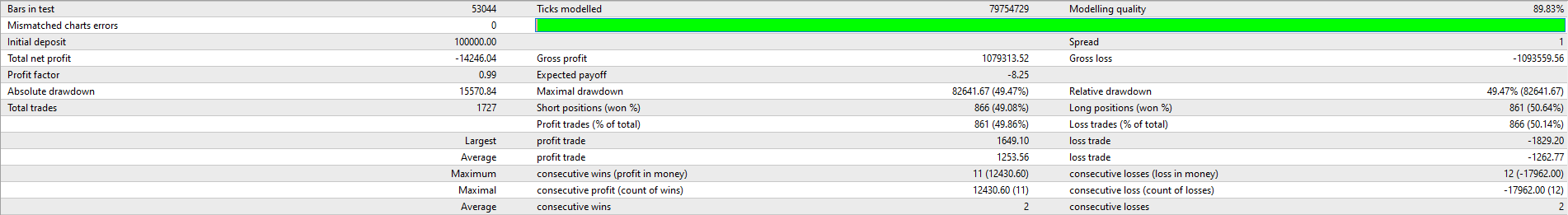

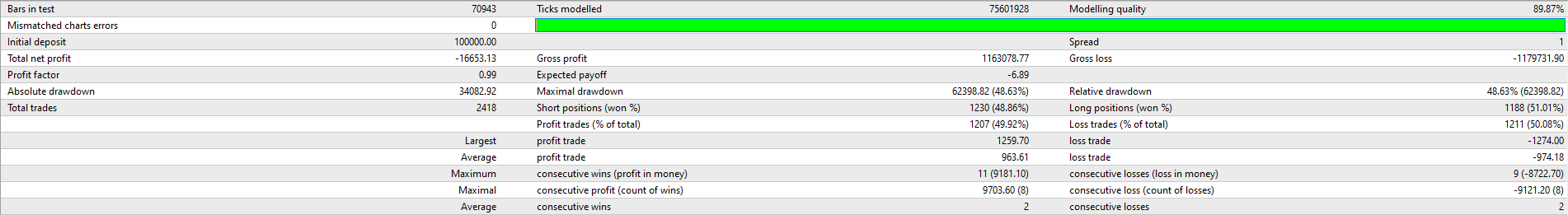

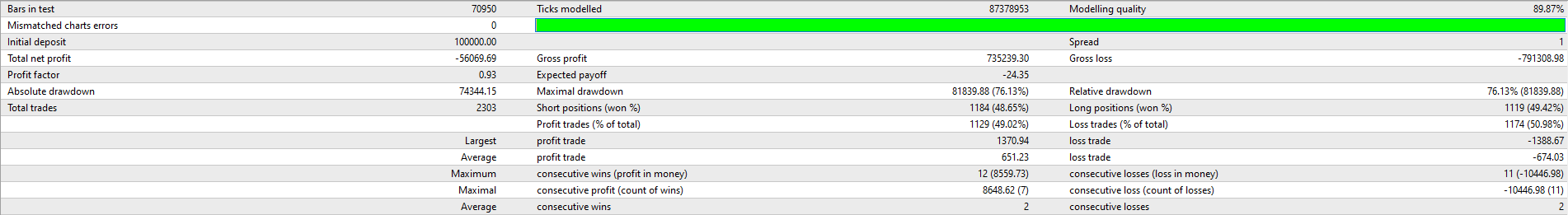

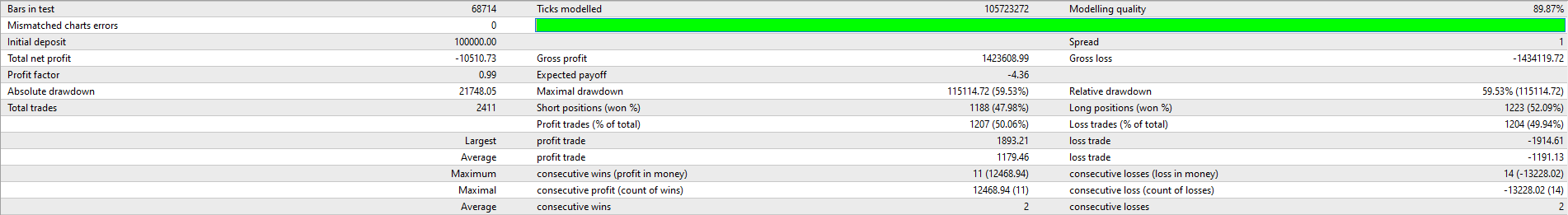

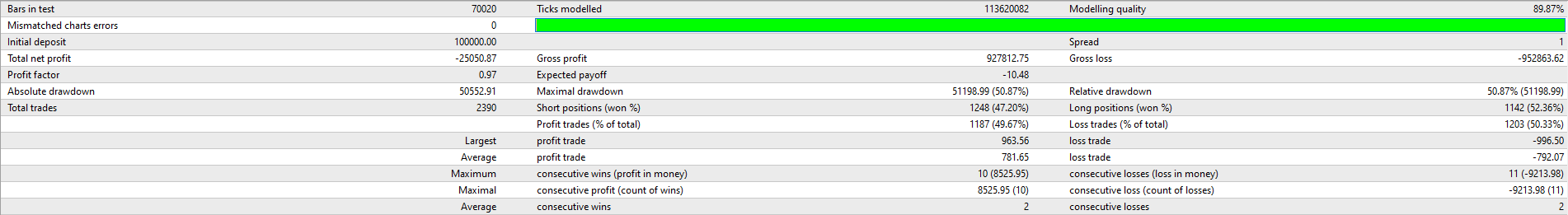

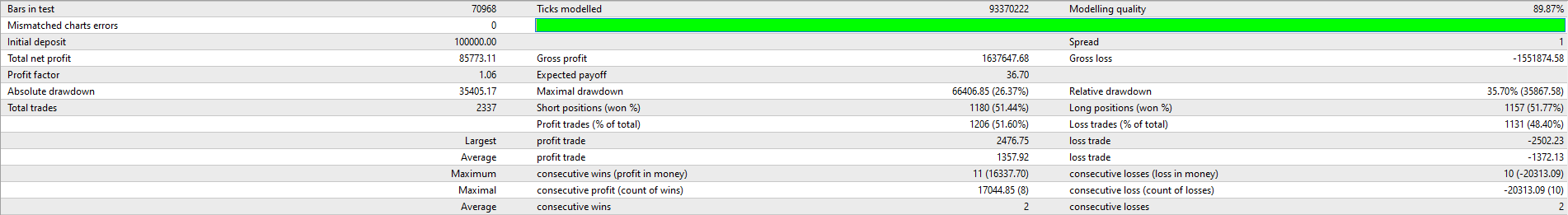

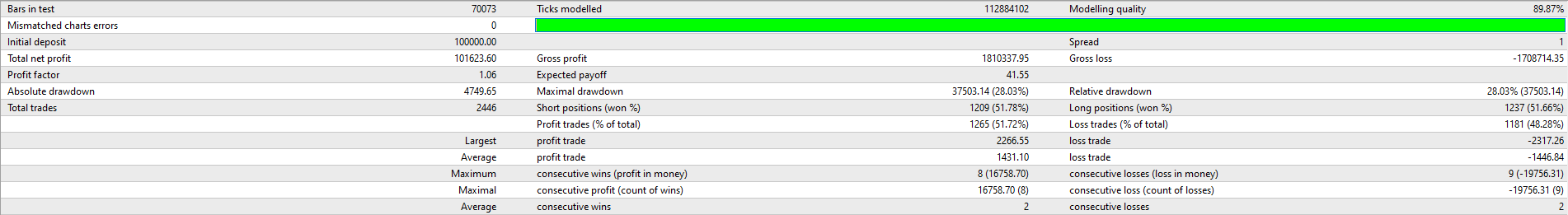

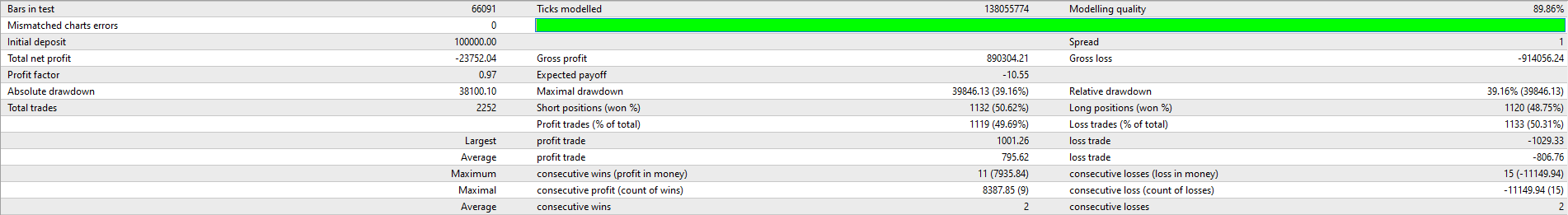

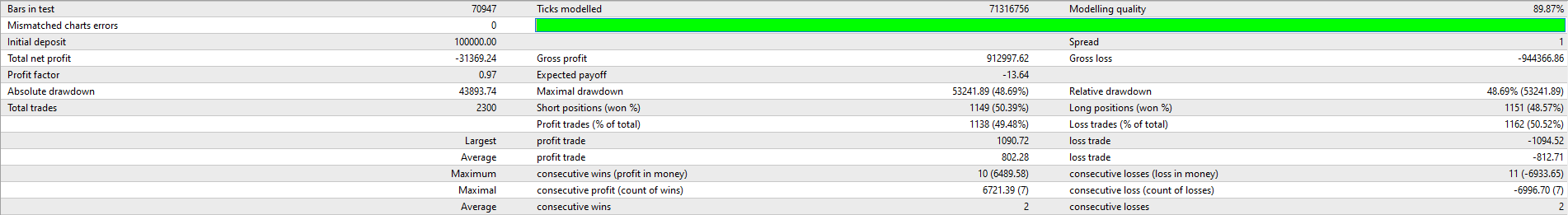

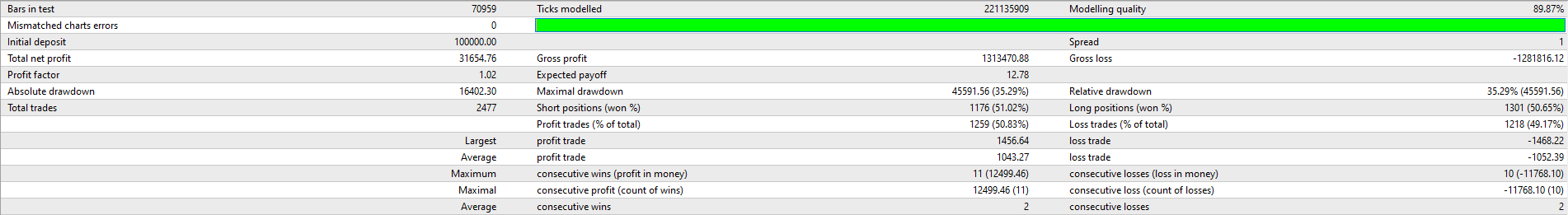

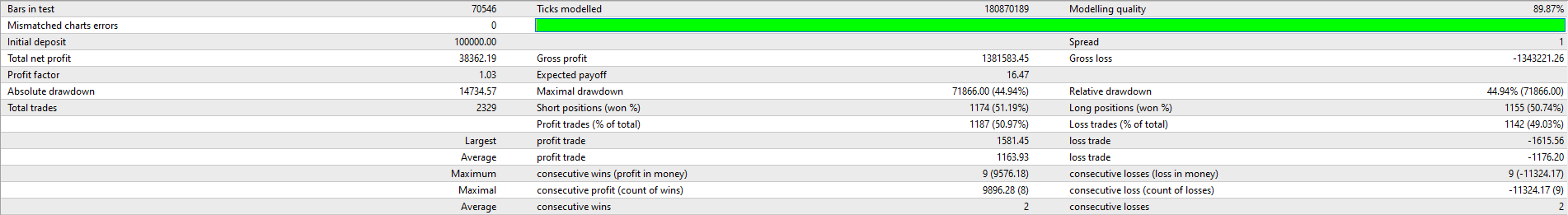

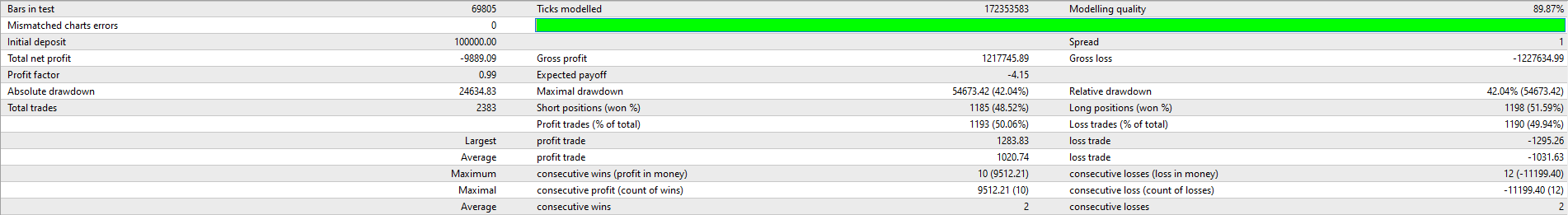

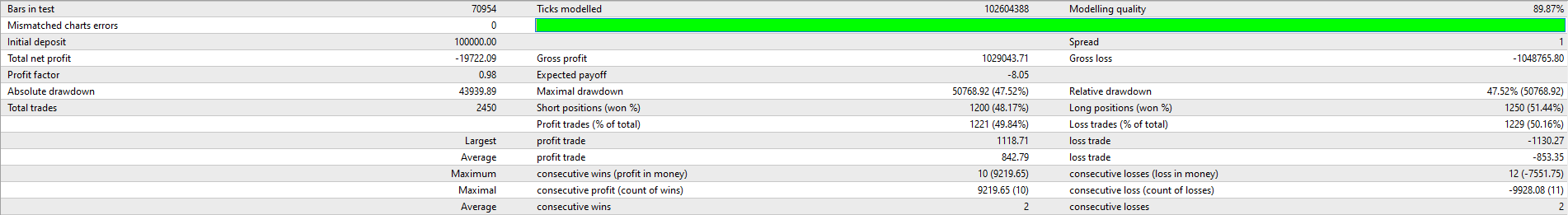

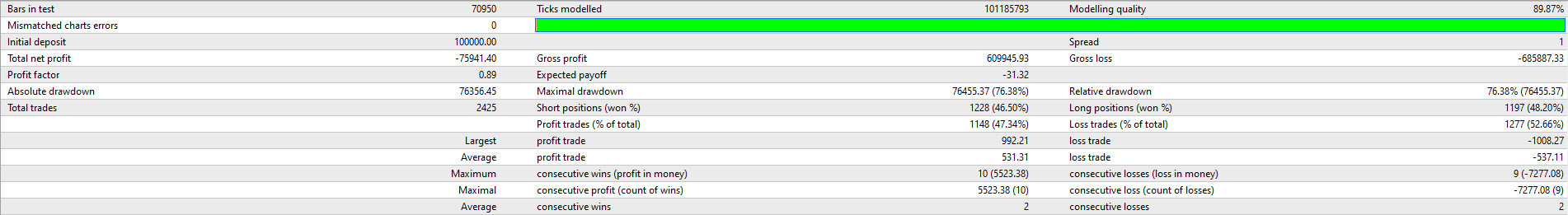

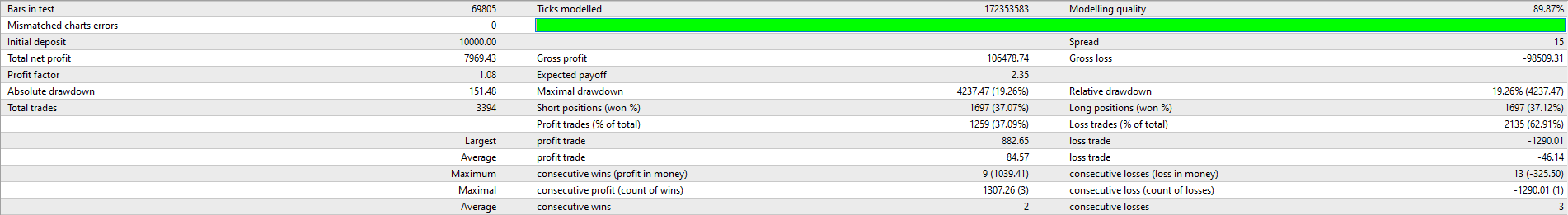

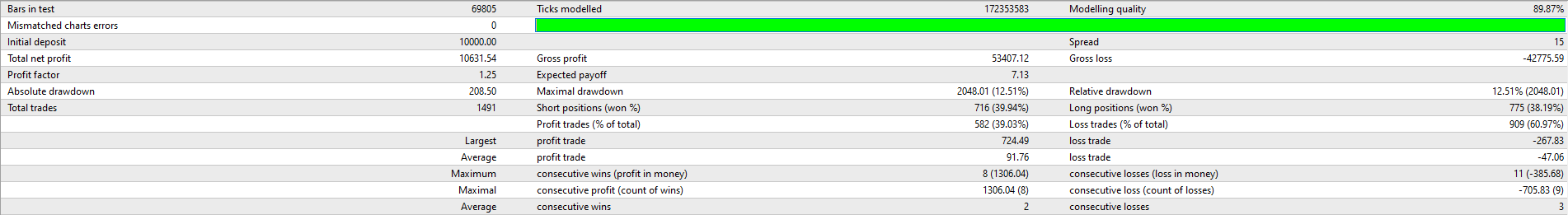

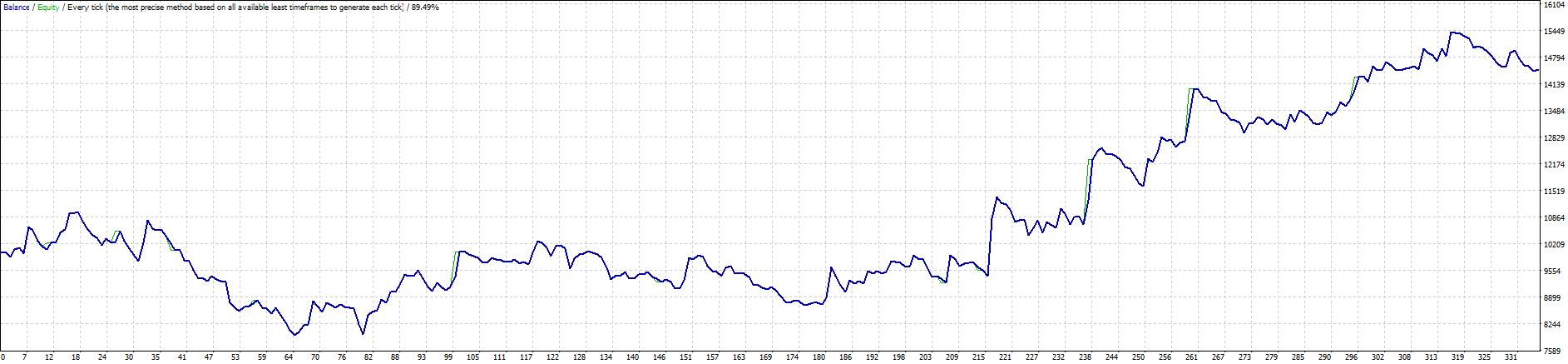

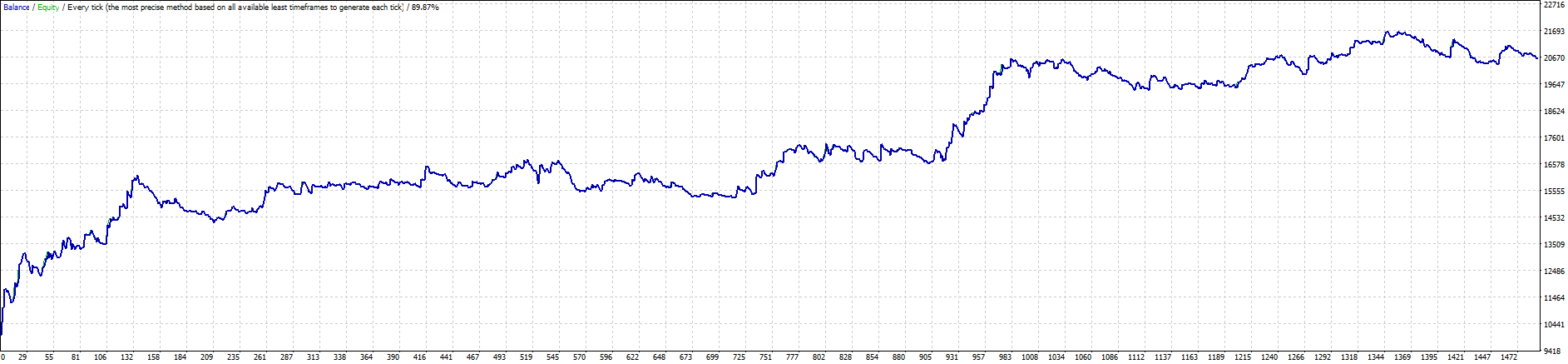

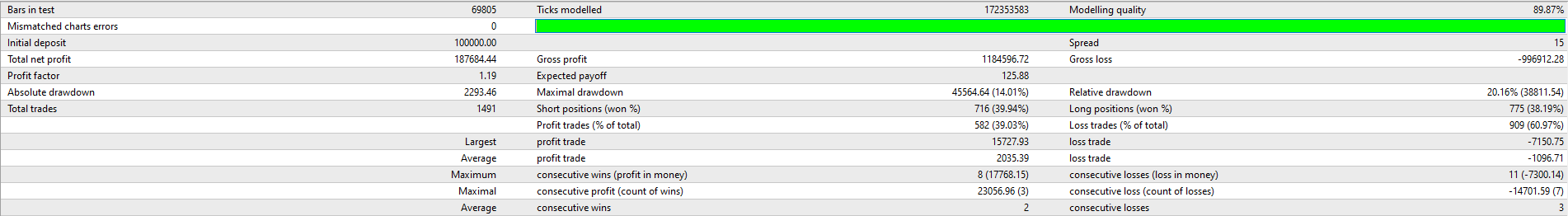

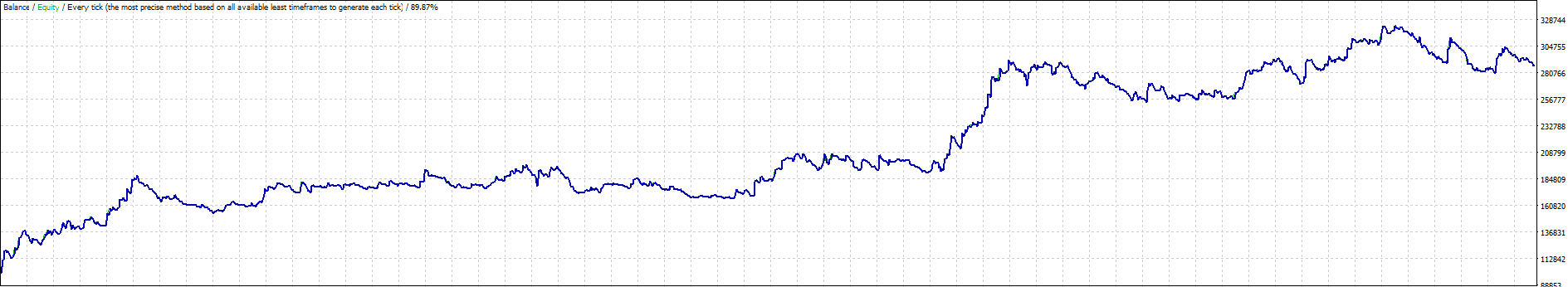

GBP/JPY 1 hour (includes 1.5 pip spread)

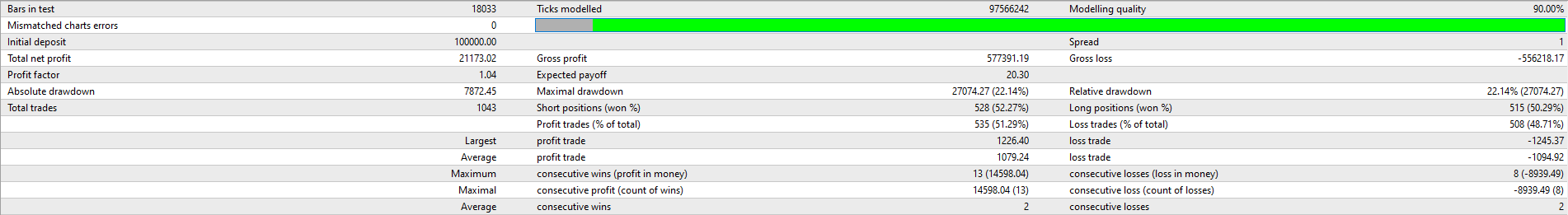

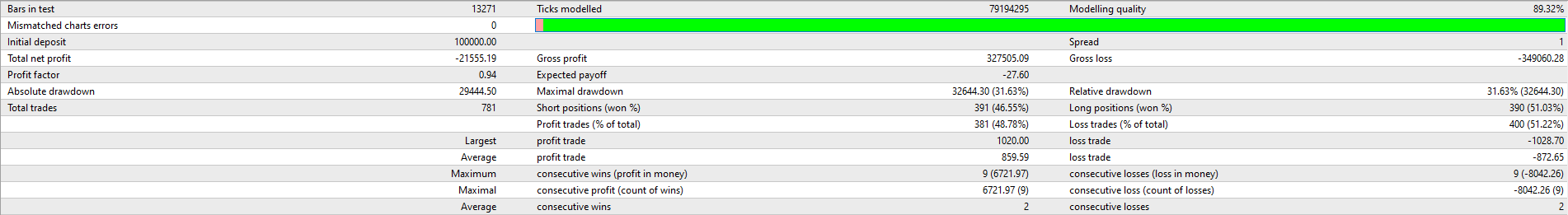

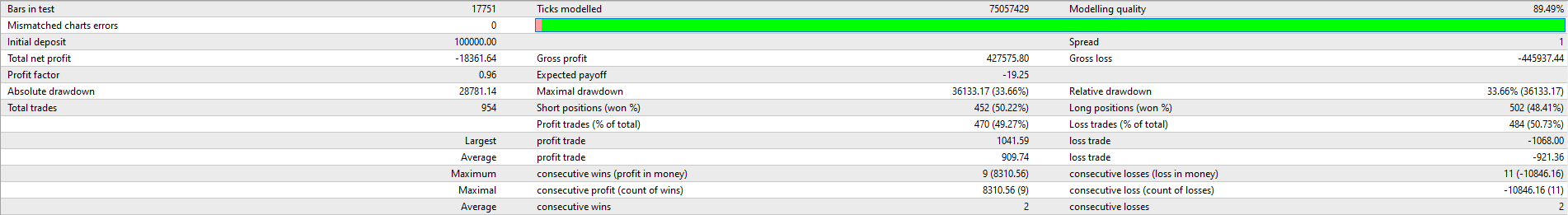

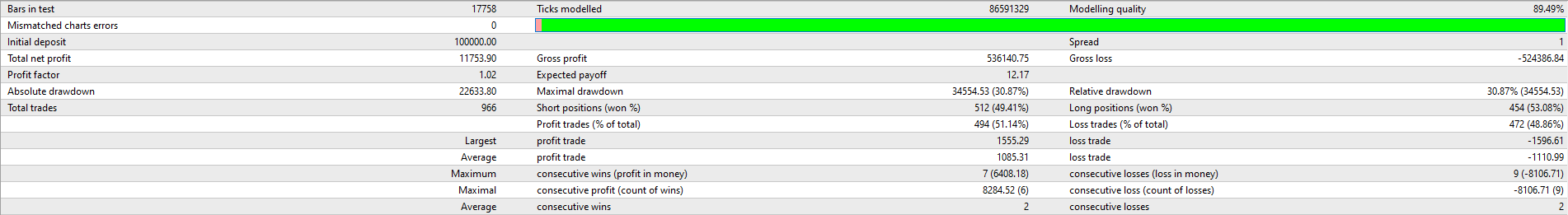

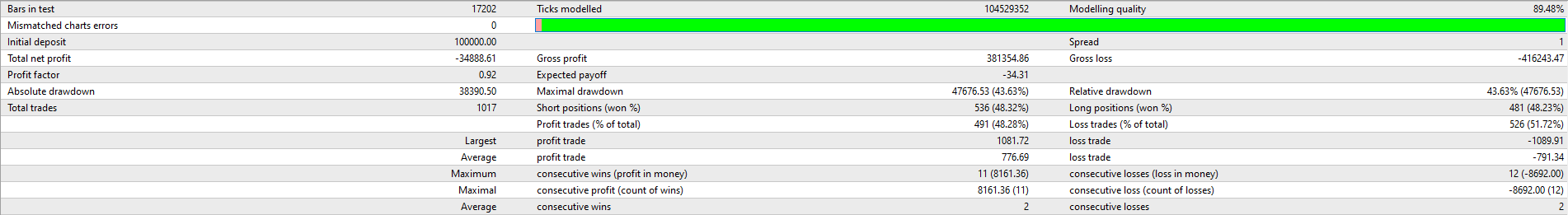

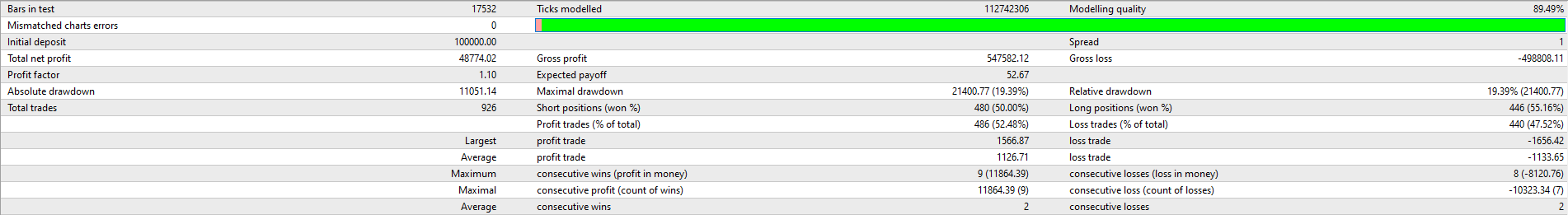

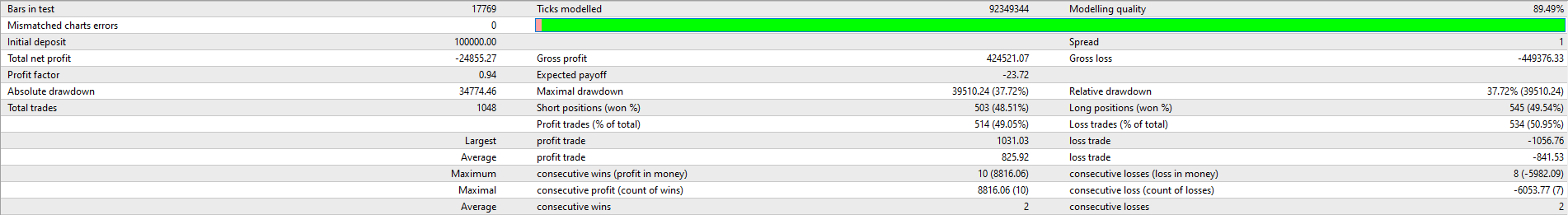

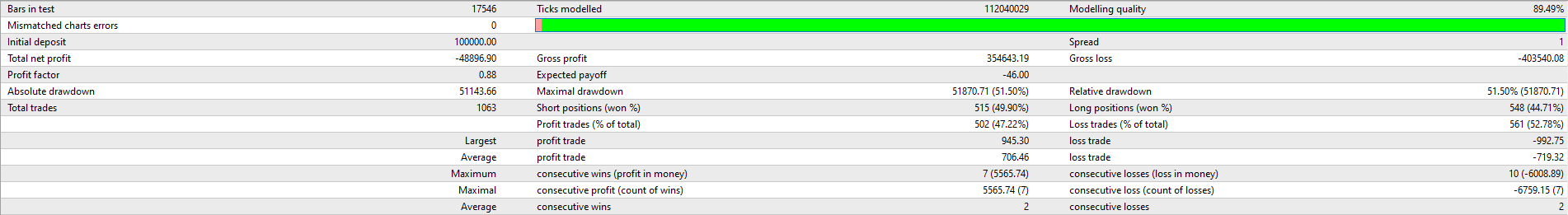

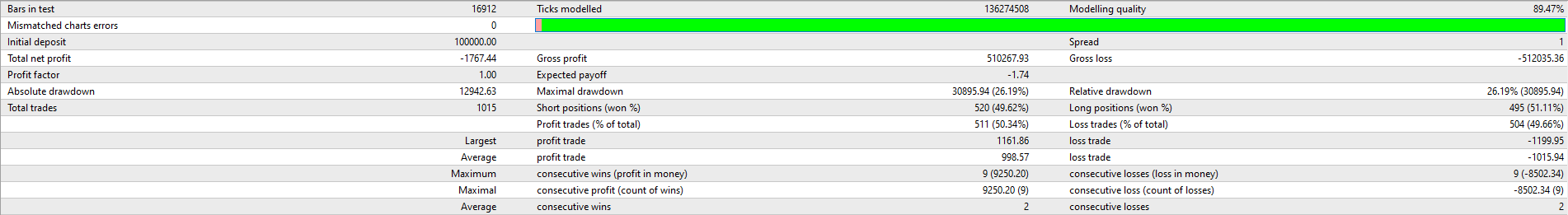

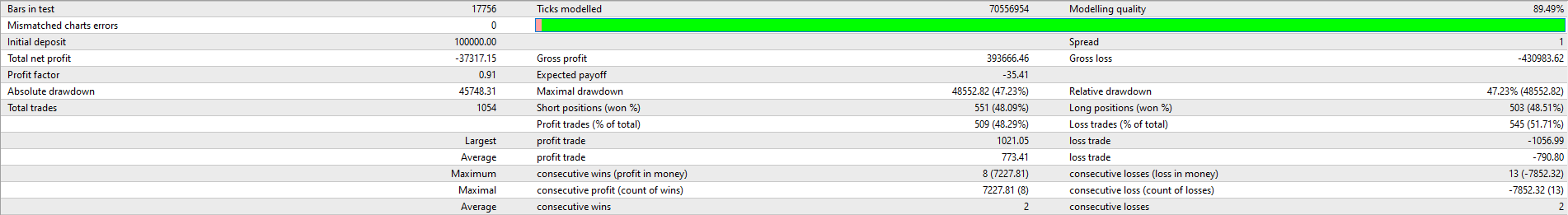

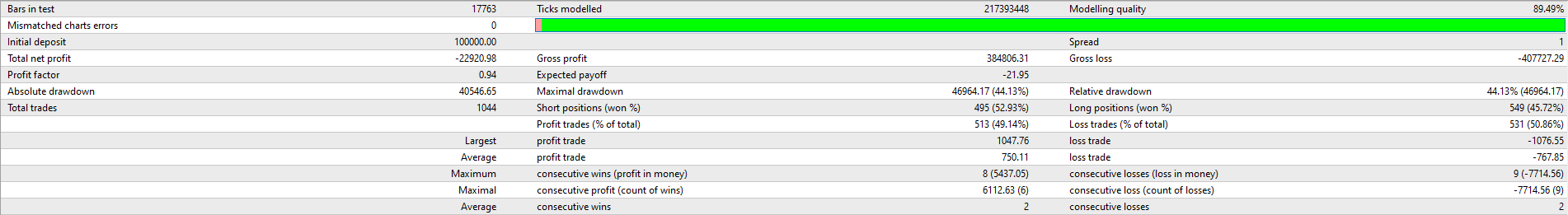

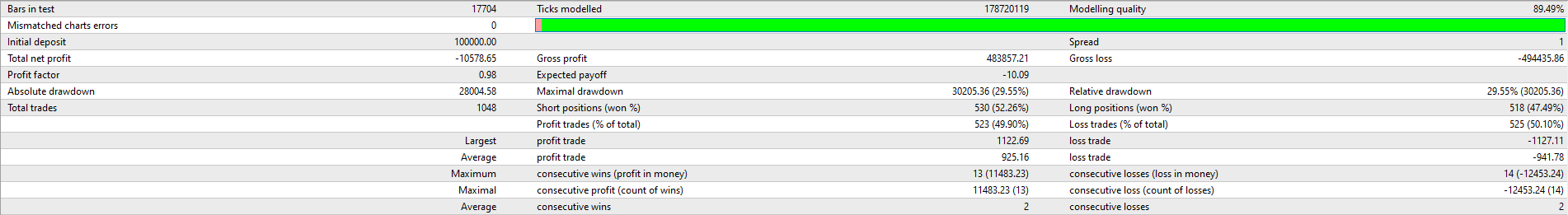

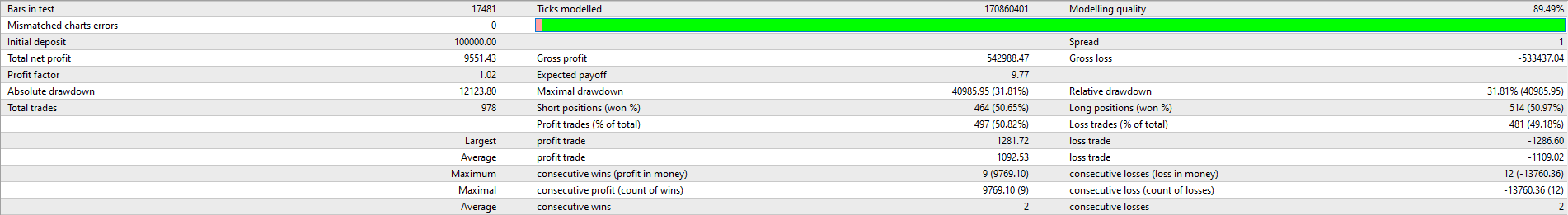

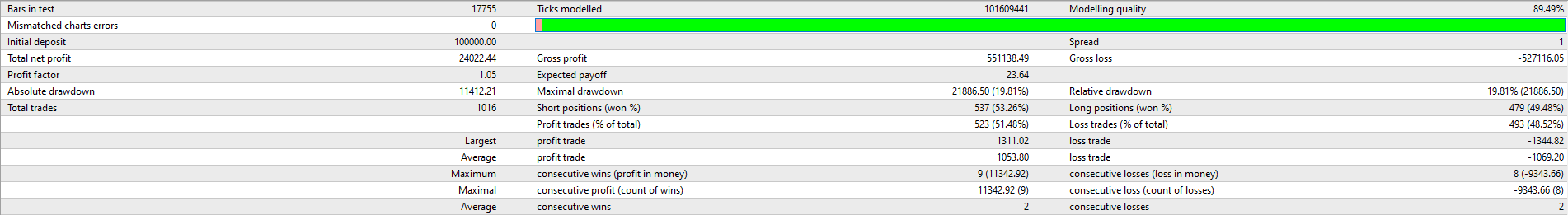

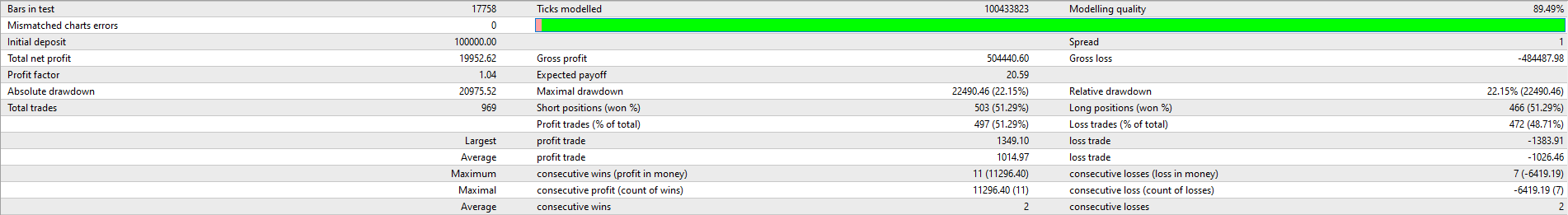

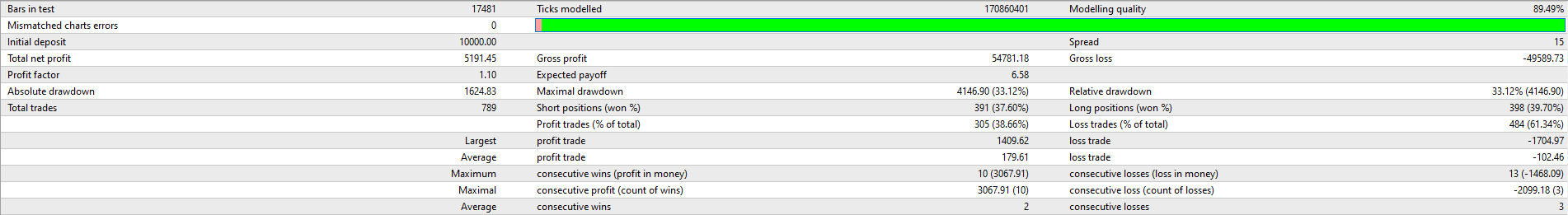

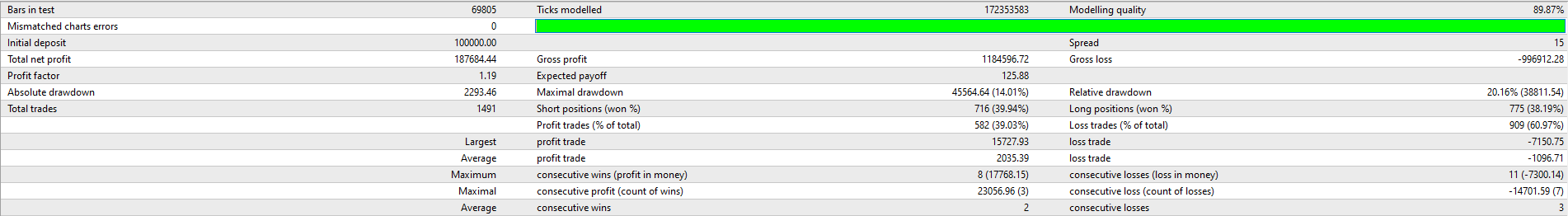

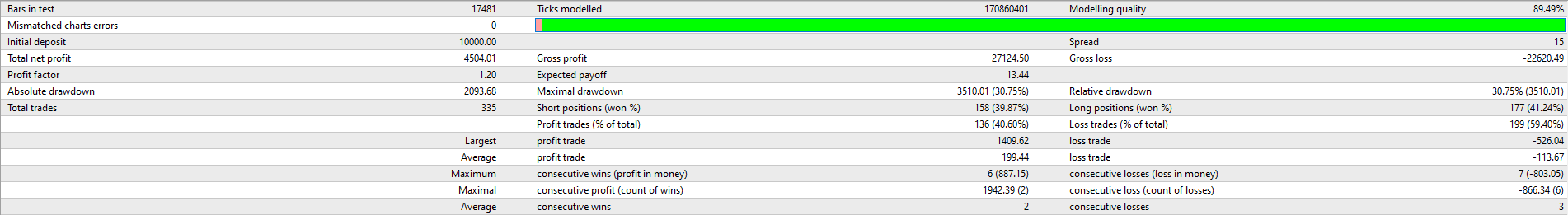

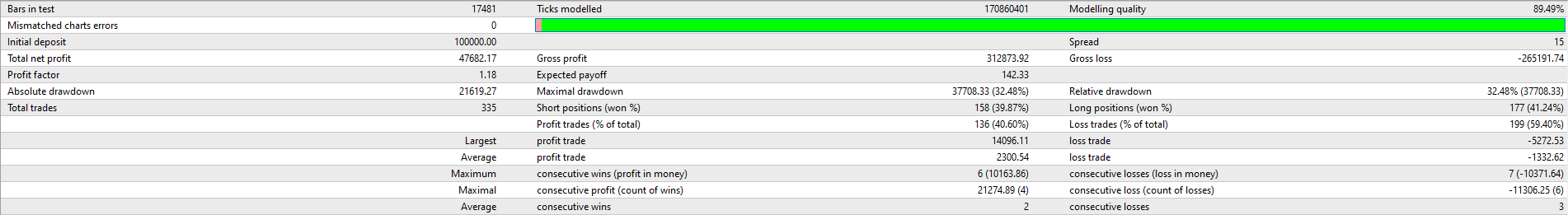

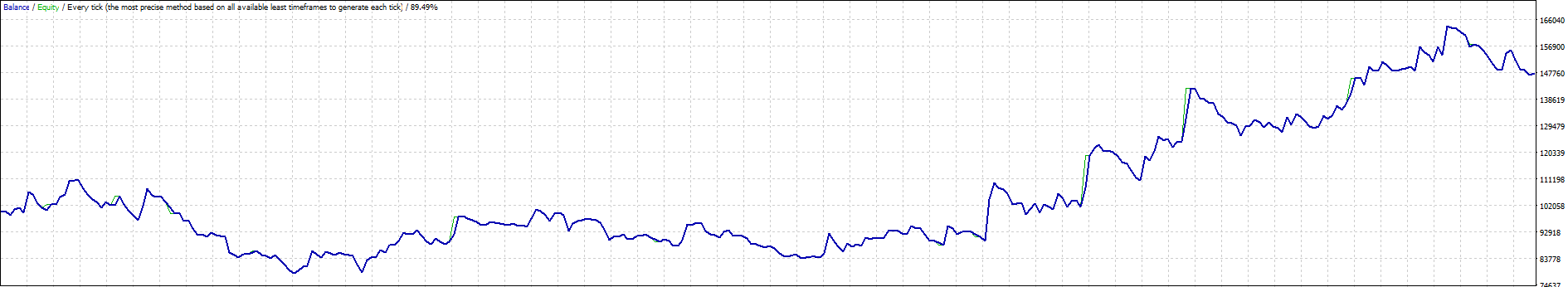

GBP/JPY 4 hour (includes 1.5 pip spread)

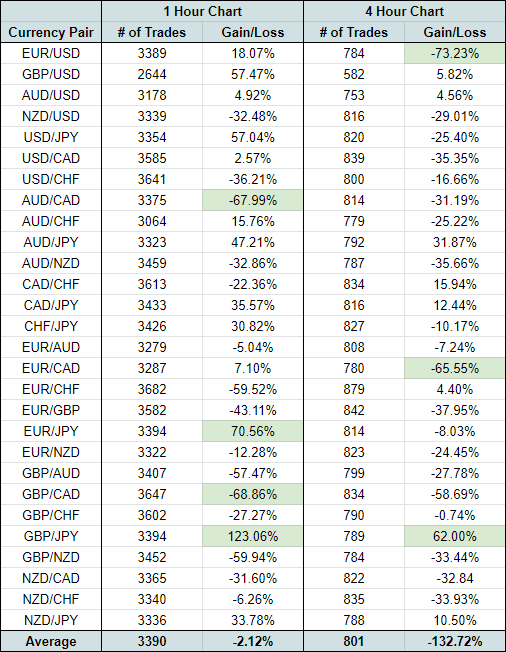

And here's the summary of the new results, compared with the original:

When applying the Kumo (Cloud) qualifier, there were 56% fewer trades taken across both timeframes. That's a big reduction!

And the result was a substantial improvement on the 1 hour chart and, interestingly, not on the 4 hour chart.

So it looks like - for the most part - the Kumo cloud is indeed an important aspect of the Ichimoku Kinko Hyo.

So what next?

There's just one more thing left to do.

Recall that in the first Ichimoku backtest I was using a fixed lot size of 1 mini lot per trade.

Now, I can start scaling the lot size based on the account capital. As the account gets larger, I want to be trading with a proportionately larger lot size (and vice versa as the account gets smaller).

To keep things simple, I'll start with 1x effective/actual leverage.

The Results

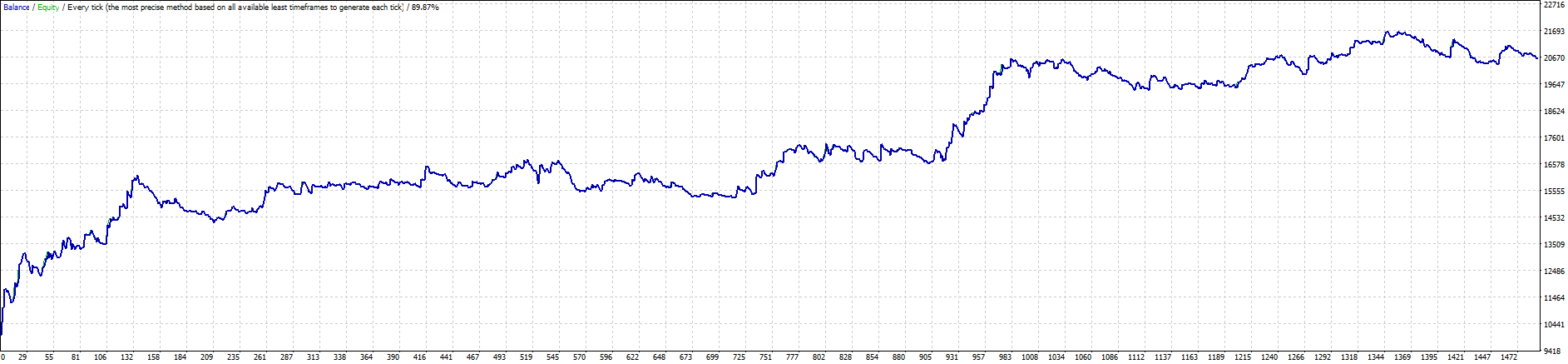

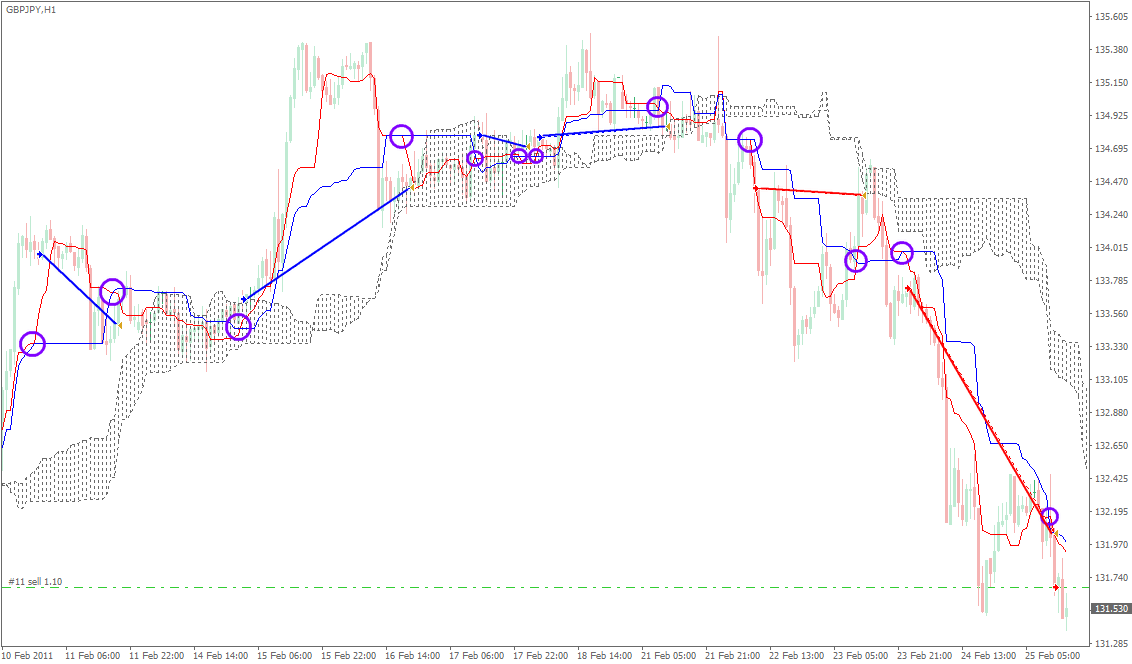

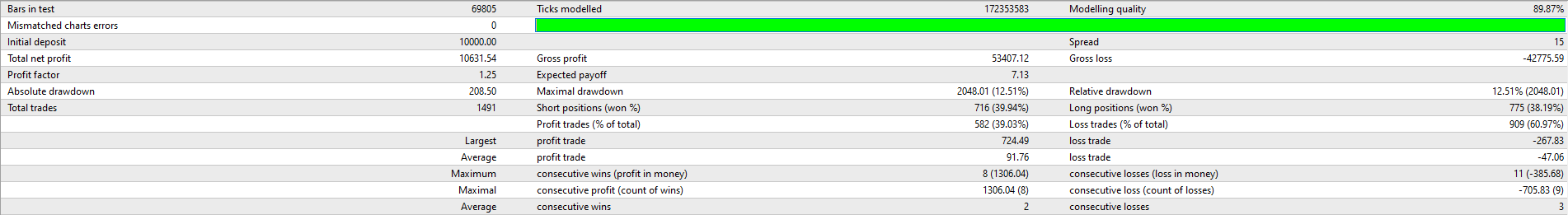

And here are the results (click to view):

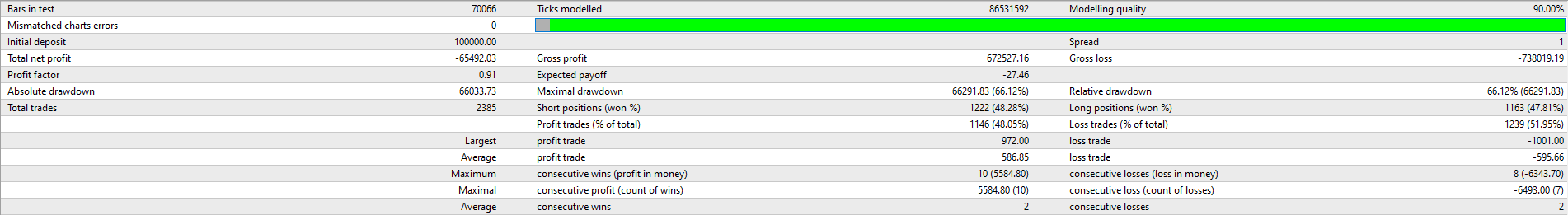

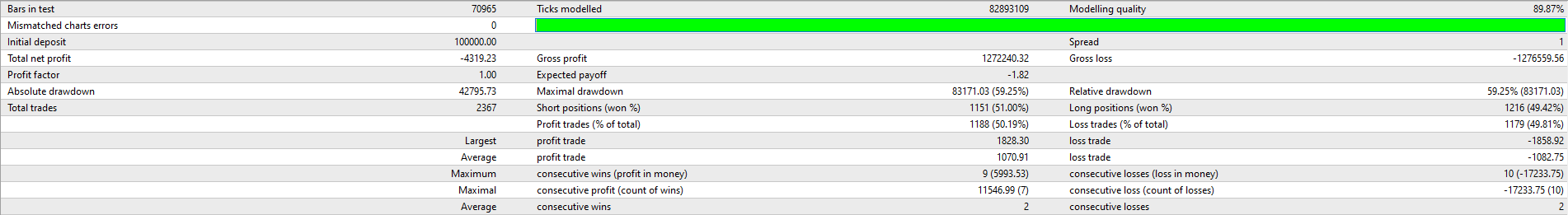

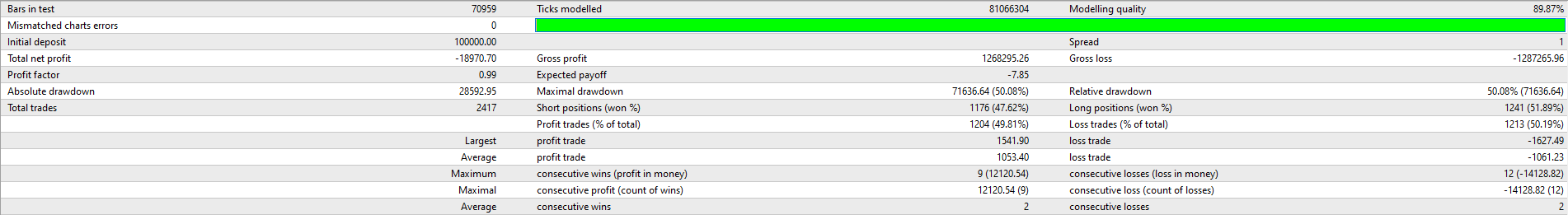

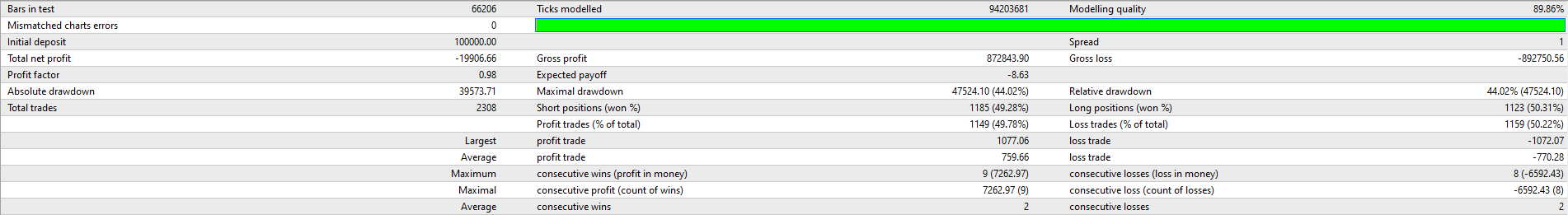

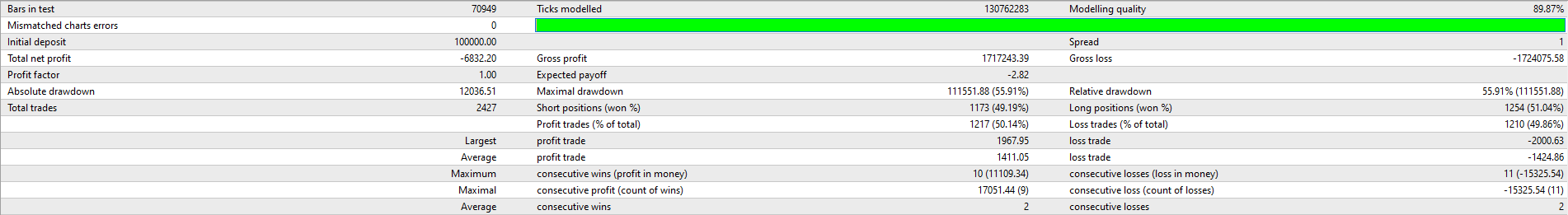

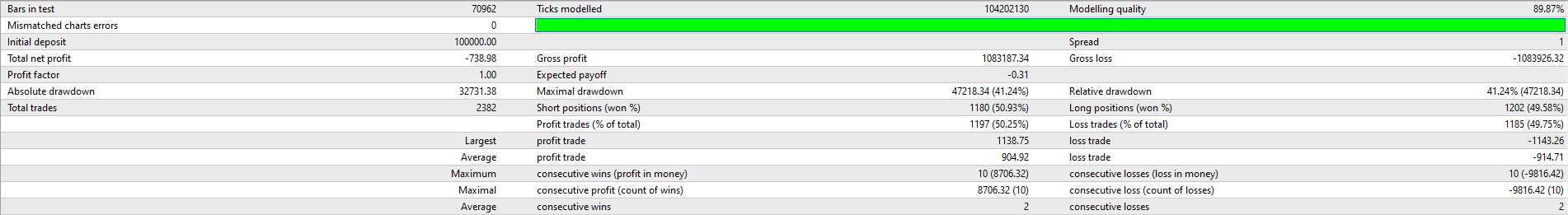

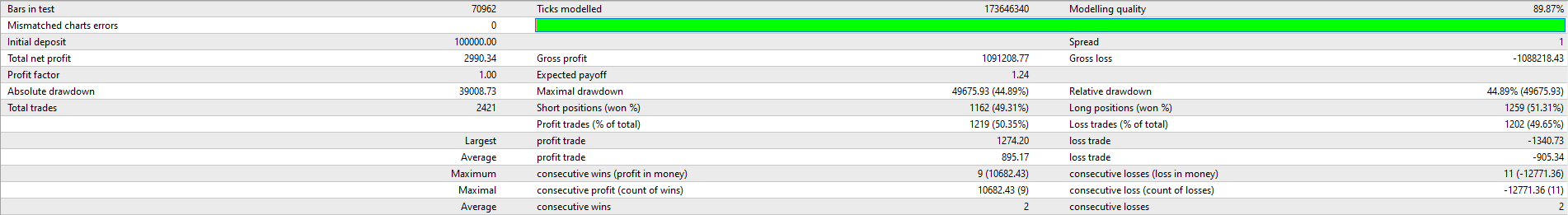

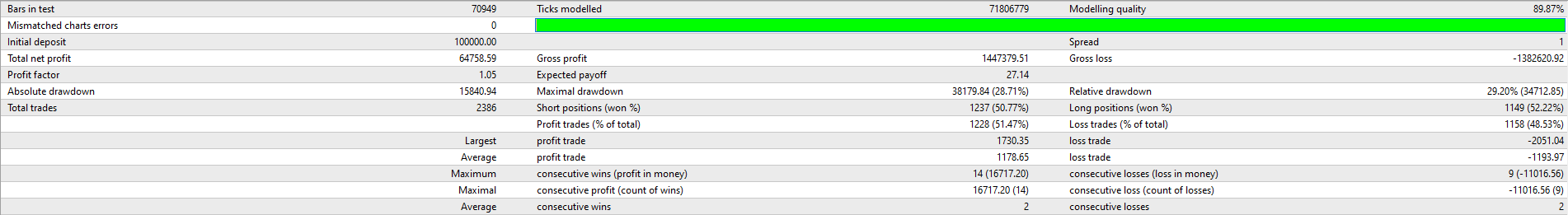

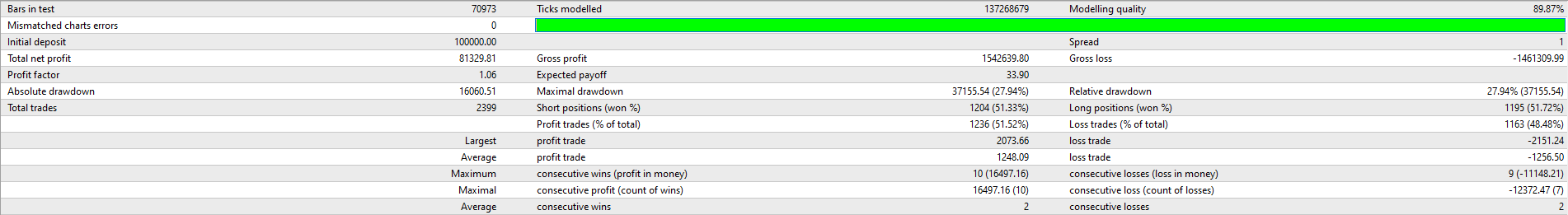

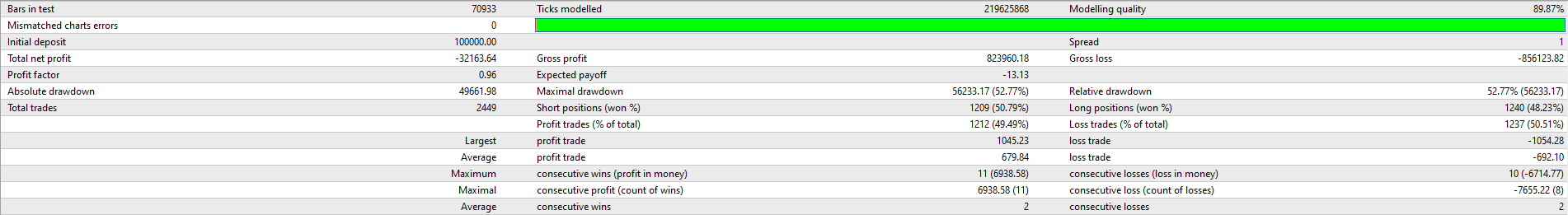

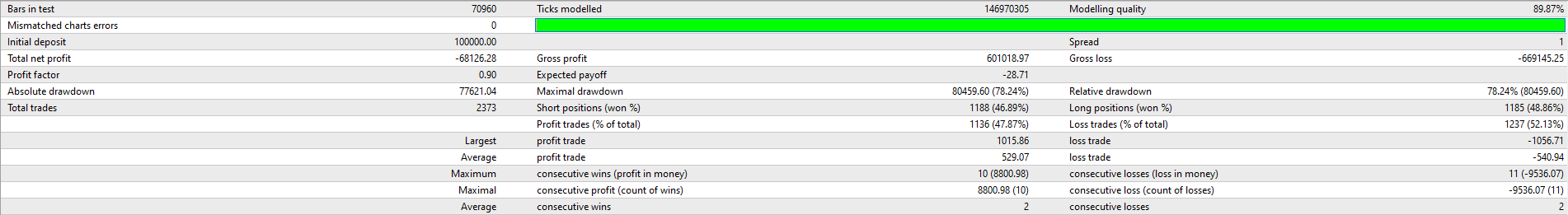

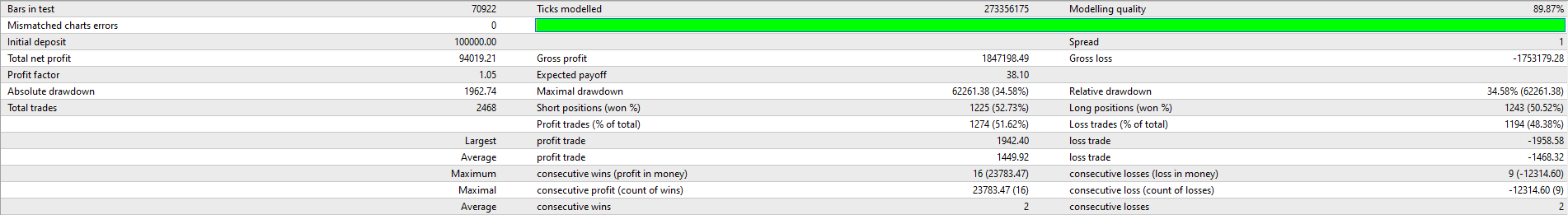

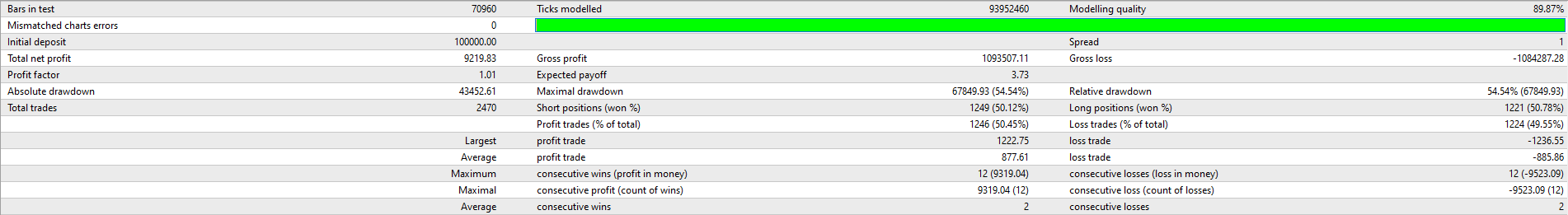

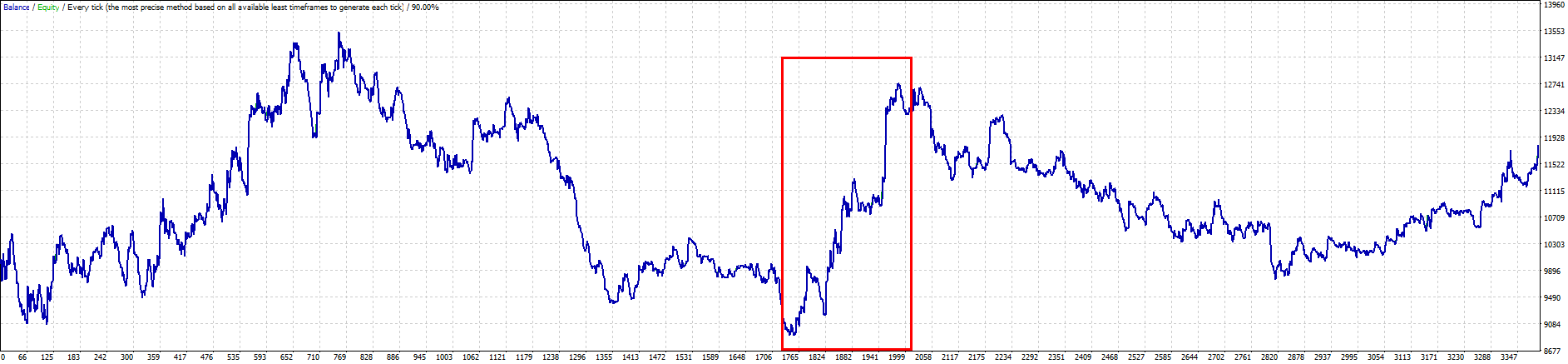

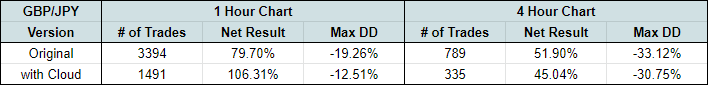

GBP/JPY 1 hour (1x leverage)

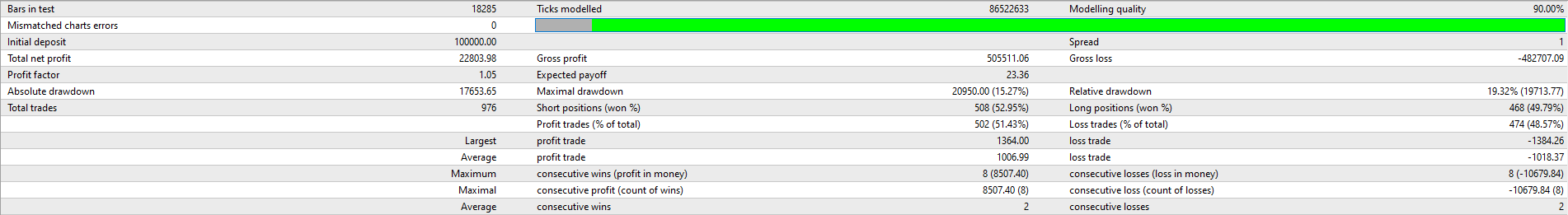

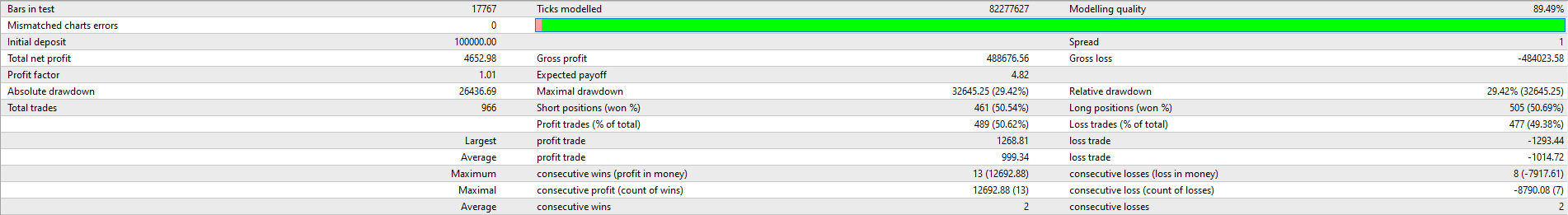

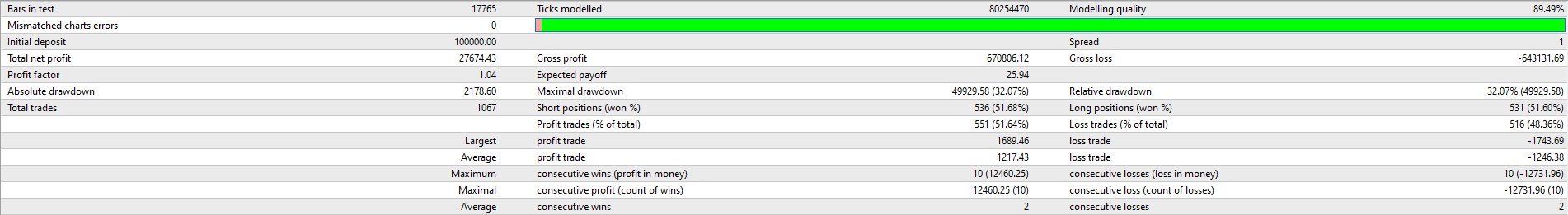

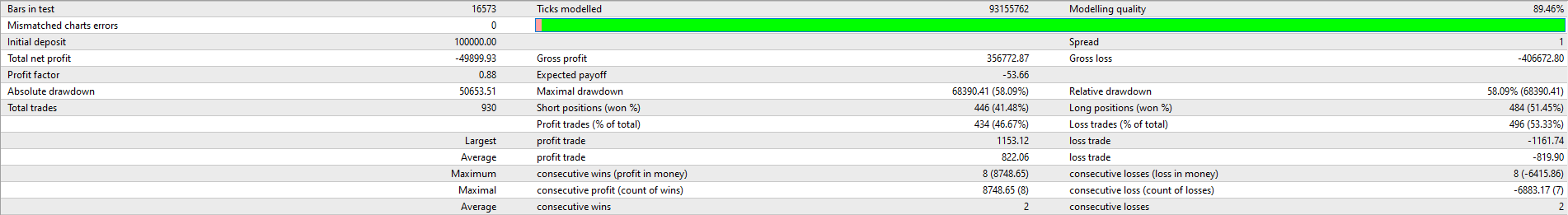

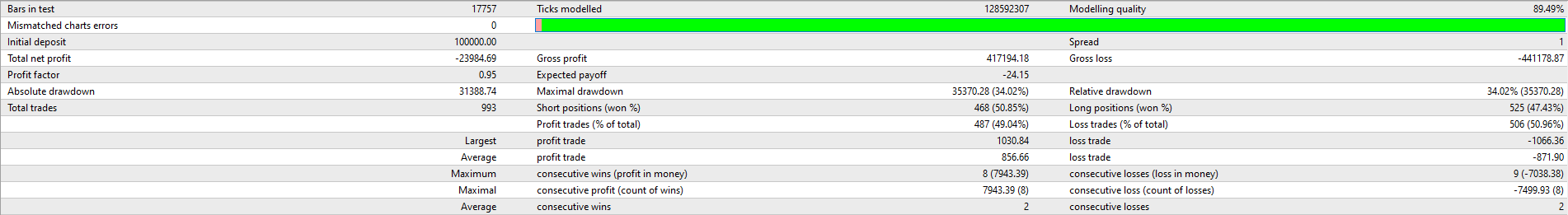

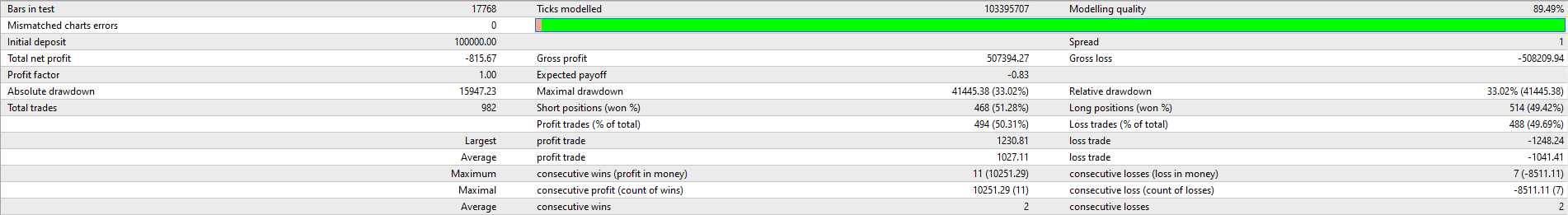

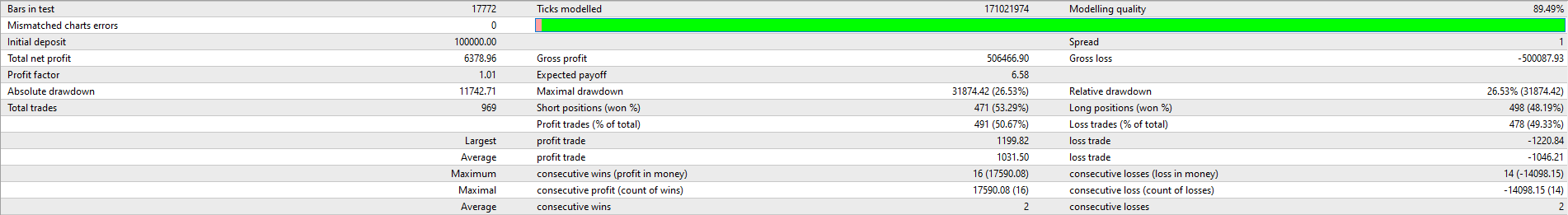

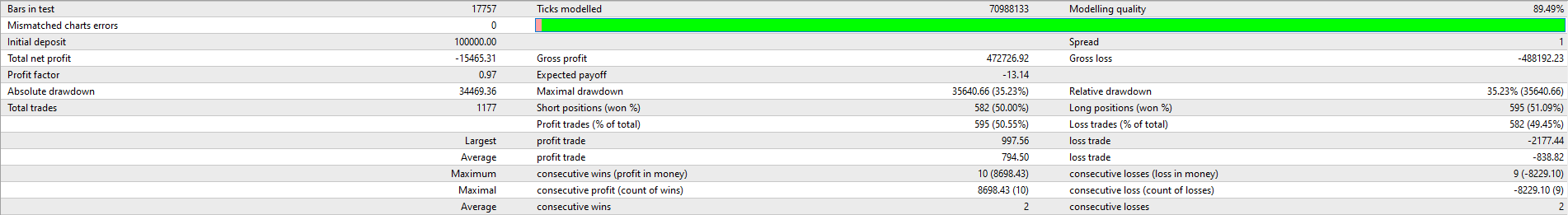

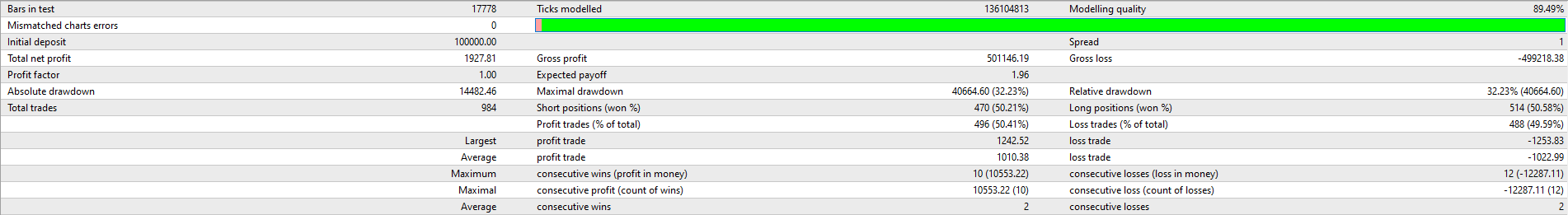

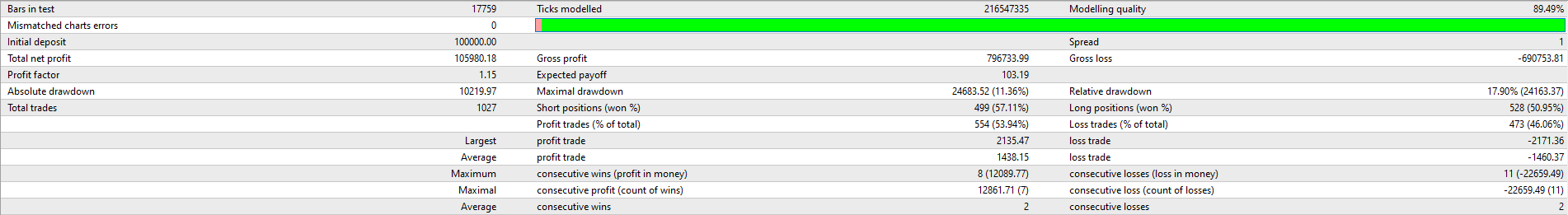

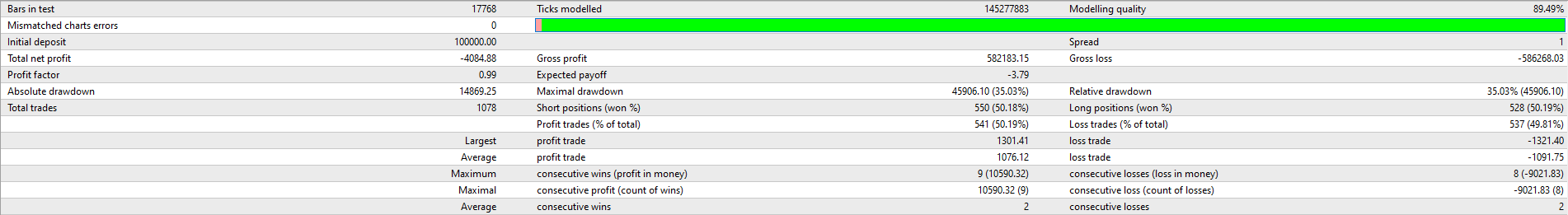

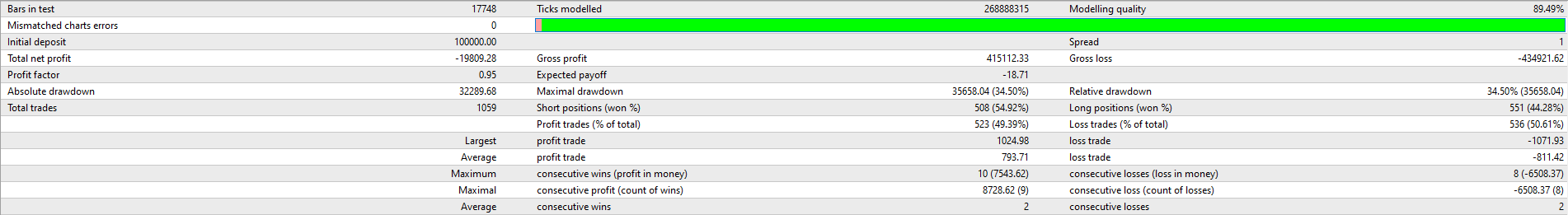

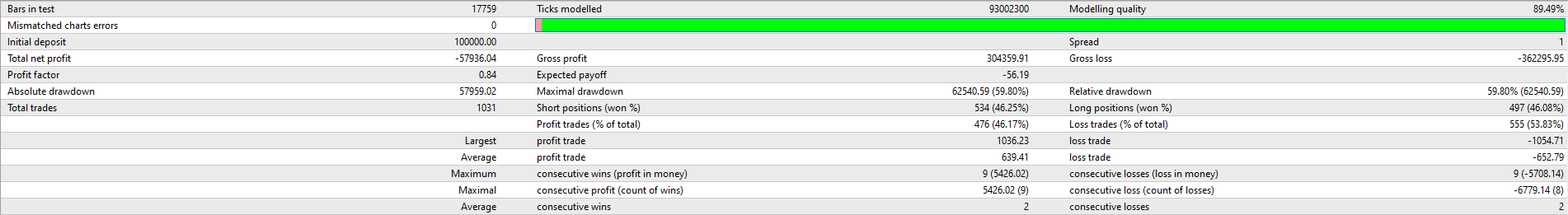

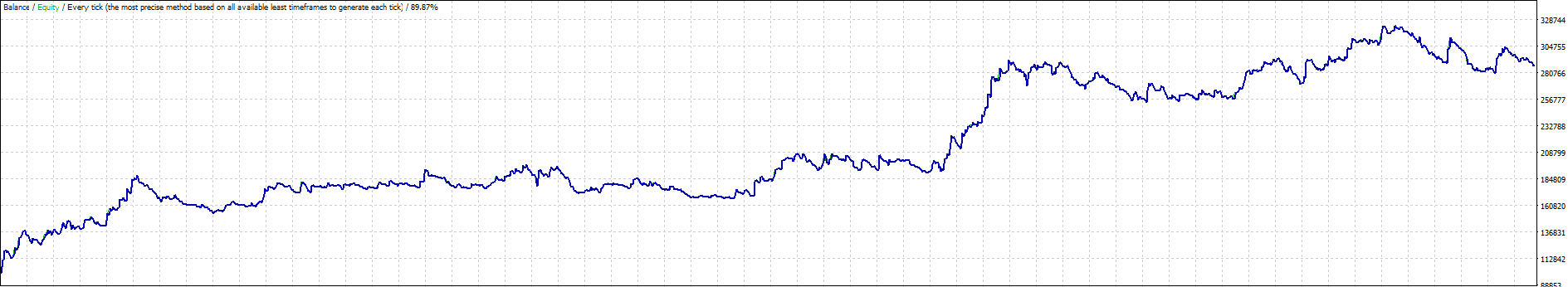

GBP/JPY 4 hour (1x leverage)

To summarize:

A drawdown of -20.16% is at the edge of my comfort level, so I decided not to increase the trading leverage as doing so would also increase the drawdown.

And so it looks like we have come to the end of this backtest!

Summary

- The Ichimoku Kinko Hyo indicator can be effective when applied to specific currency pairs, especially the GBP/JPY.

- On the GBP/JPY, it performs better on the 1 hour chart than on the 4 hour chart.

- When applying the Cloud qualifier at 1x leverage on the 1 hour chart, the backtest yields an average 17.1% per year with a maximum drawdown of -20.2% over the past 11 years.

This is a remarkable result, given there had been no parameter optimizations or use of special filters.

But, I have to say that this is not an easy system to trade.

Consider the duration of drawdowns:

- 3 Jun 2010 - 4 Jun 2012 (24 months)

- 13 Jun 2012 - 1 Feb 2013 (8 months)

- 12 Mar 2013 - 7 Jan 2015 (22 months)

- 20 Feb 2015 - 18 Feb 2016 (12 months)

- 2 Sep 2016 - 16 Aug 2018 (23 months)

- 4 Jun 2019 - Present (14 months and counting)

To trade successfully with this indicator you'd have to be able to tolerate up to 2 years of being "unprofitable".

So while the Ichimoku Kinko Hyo could have a place in a portfolio of multiple trading systems, it's probably not one to be traded on its own.

Your thoughts?

What do you think? Did I miss anything? Should I have approached the backtest differently?

Also, what other effects/indicators should I test next?

Let me know in the comments section below!