Welcome to Forex Backtest Friday, a new post series where I share the backtest results of the market tendencies I investigate.

This week, we'll take a look at the classic Bollinger bounce.

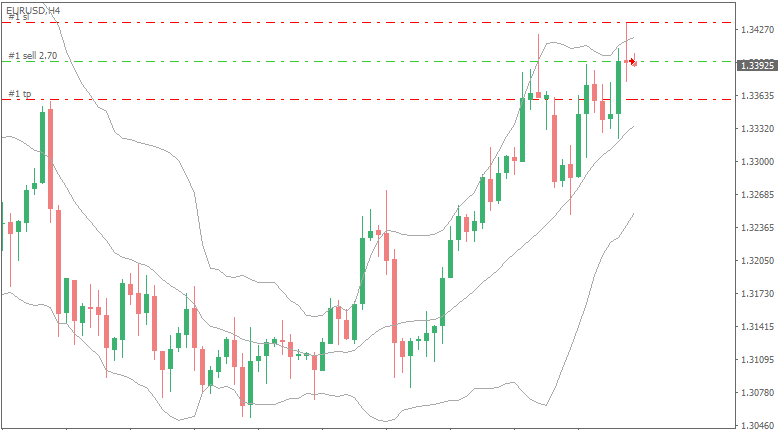

The idea behind it is that after bouncing off the upper or lower Bollinger band, there is a tendency for prices to move back towards the middle of the Bollinger band channel.

example used in Babypips

Is there really such a tendency?

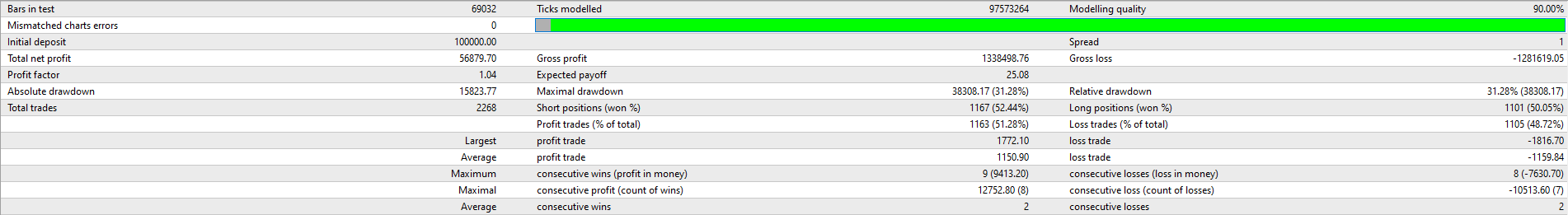

To test this, I coded an expert advisor and ran backtests across the 28 currency pairs from Jan 2009 to May 2020.

Bollinger band setting:

- Moving average period: 20

- Standard deviations: 2

Sell setup criteria (reverse for buy setup):

- Setup candle = Candle with top shadow crossing the upper Bollinger band

- The Setup candle must close below the upper Bollinger band

- The range of the candle before the Setup candle must be fully below the upper Bollinger band

Sell trade parameters (reverse for buy trade):

- Upon Setup candle close, enter a sell trade

- Stop loss = 1 pip above the Setup candle

- Profit target = same as the stop loss allowance (1:1 risk-reward)

*Note: This is not a proper trading strategy. I'm using only the most basic (crude) parameters to test for a mean-reversion tendency following a bounce off the Bollinger bands.

Backtest settings:

- Test period: 1 Jan 2009 - 31 May 2020

- No trades to be taken within 1 hour of market open

- Maximum 1 trade per currency pair, per day

- Trading costs are not considered

The Results

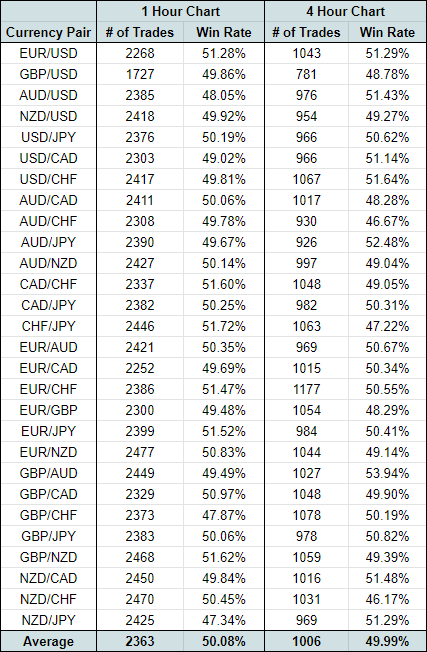

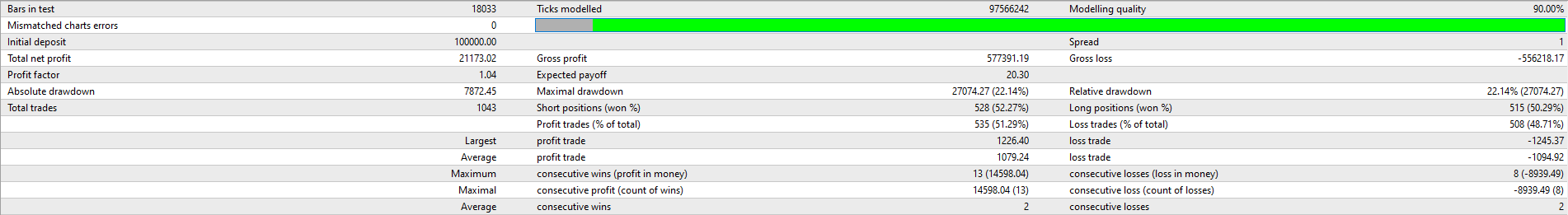

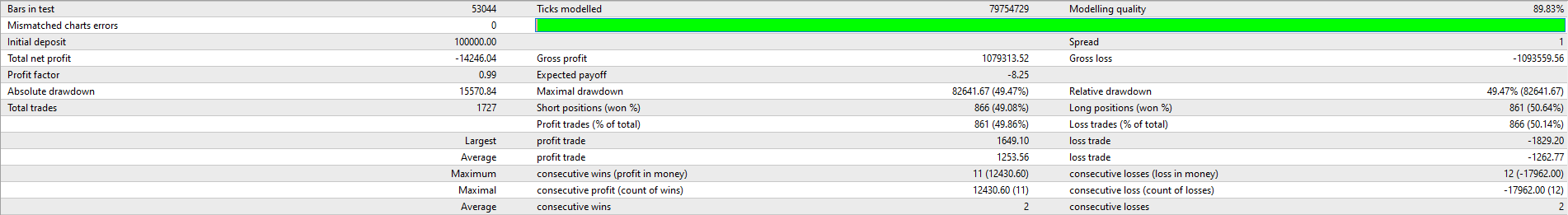

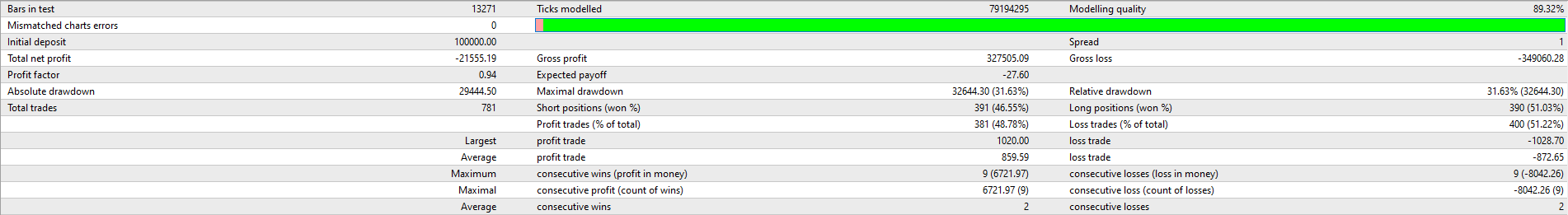

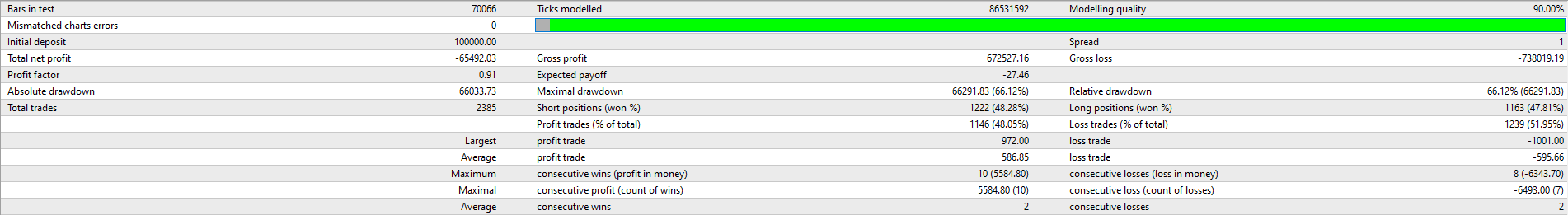

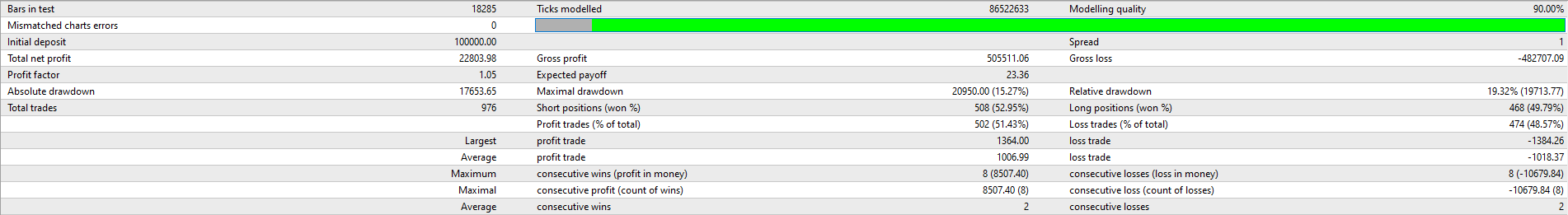

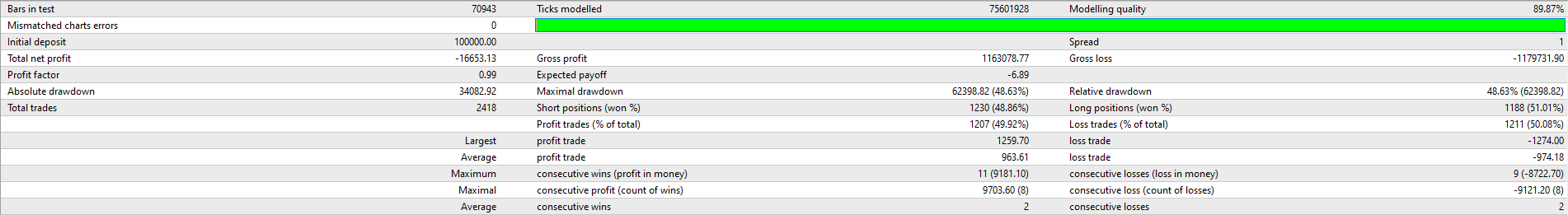

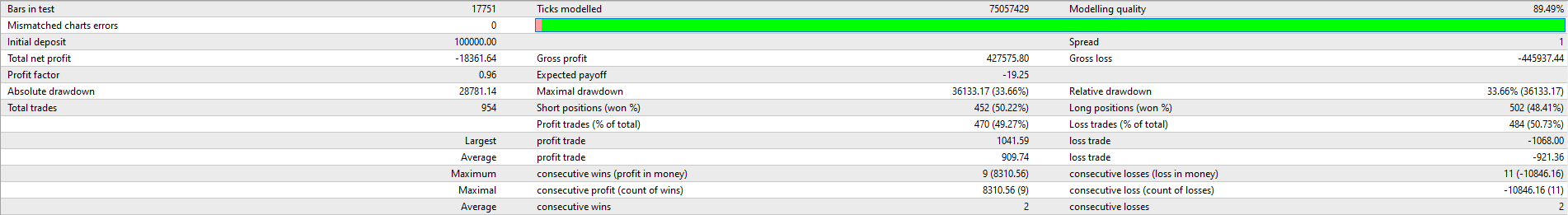

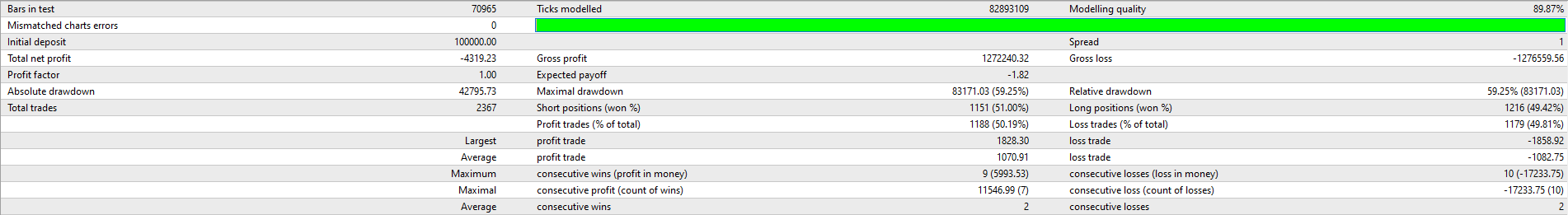

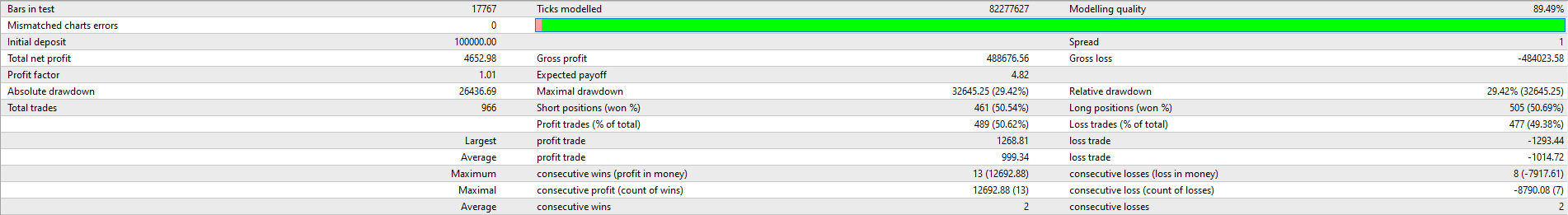

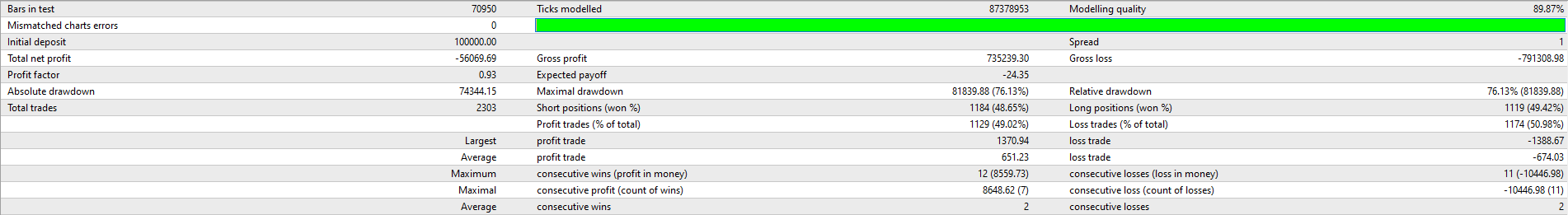

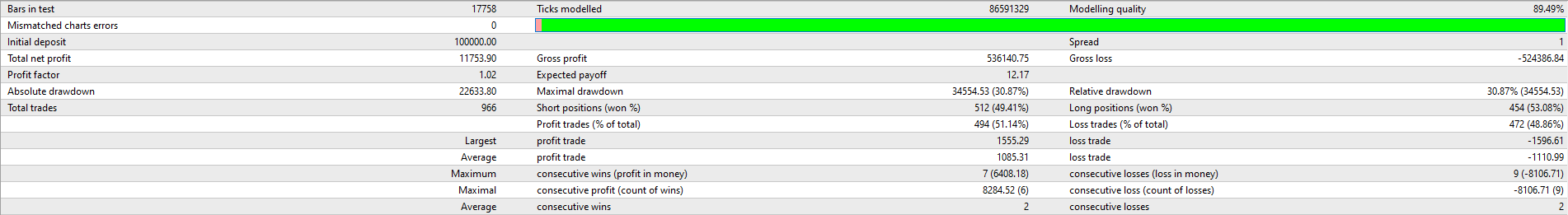

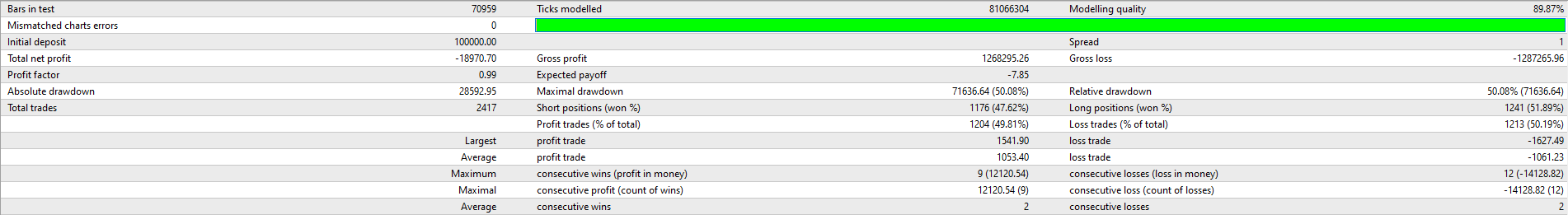

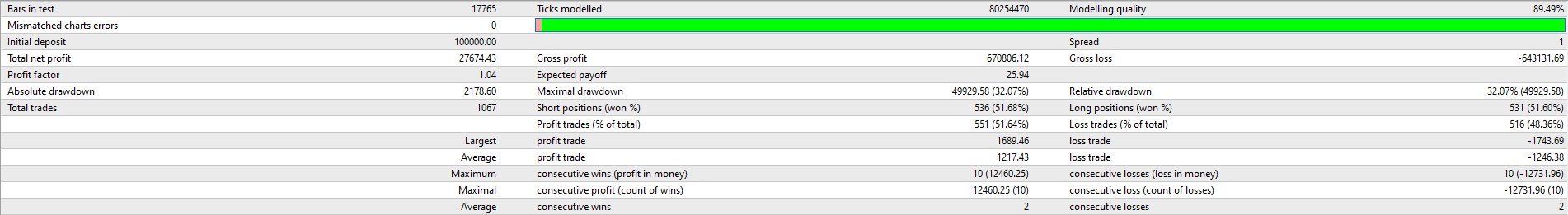

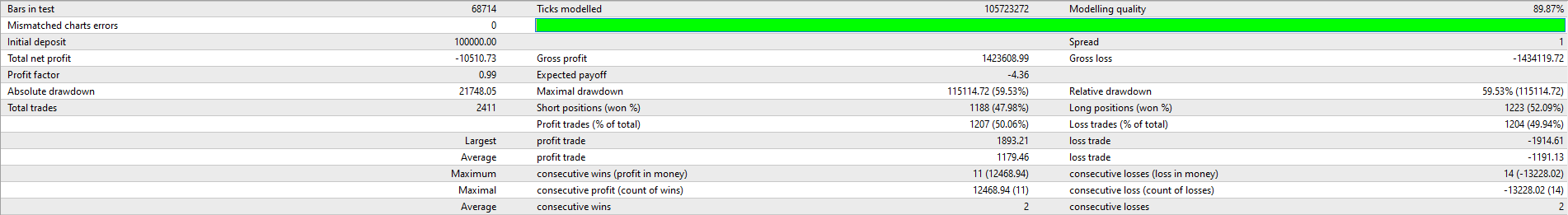

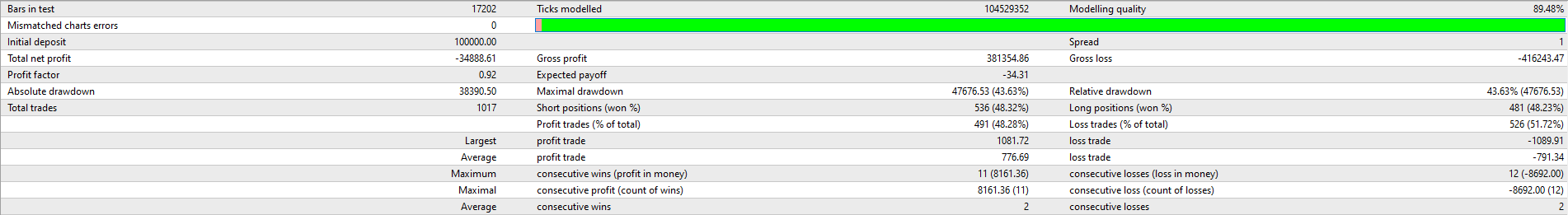

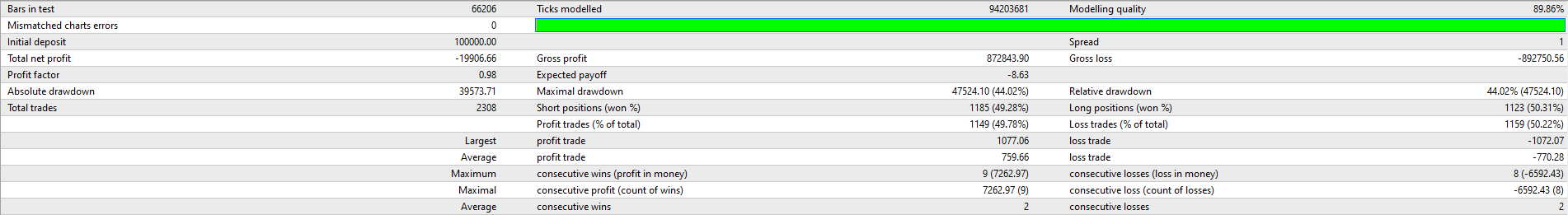

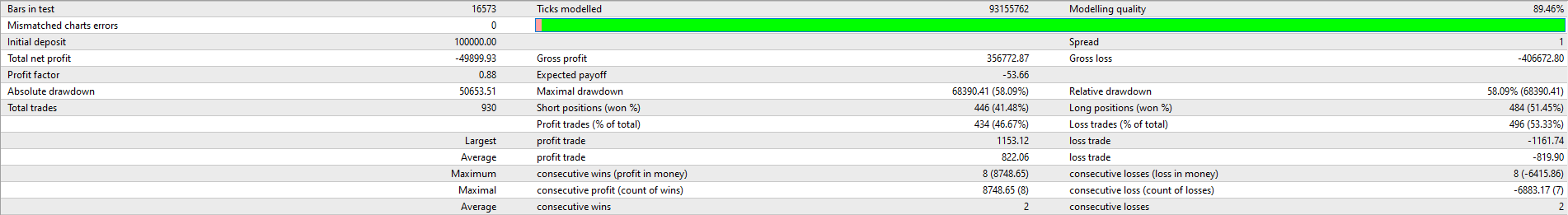

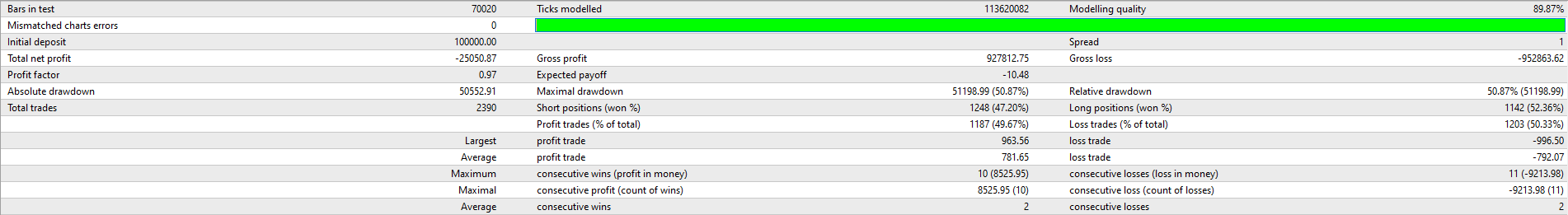

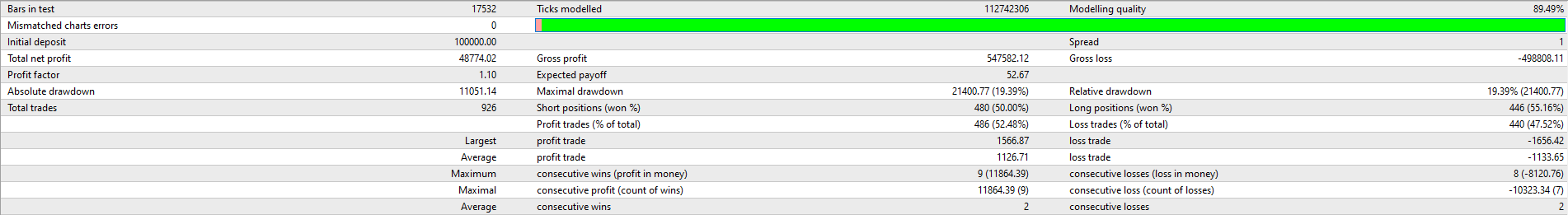

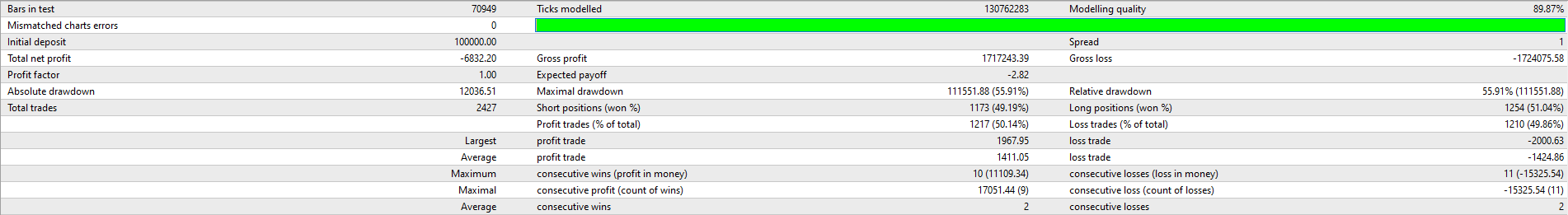

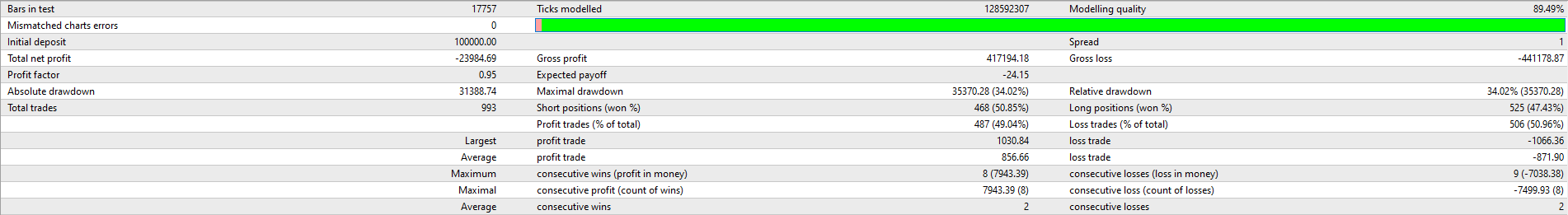

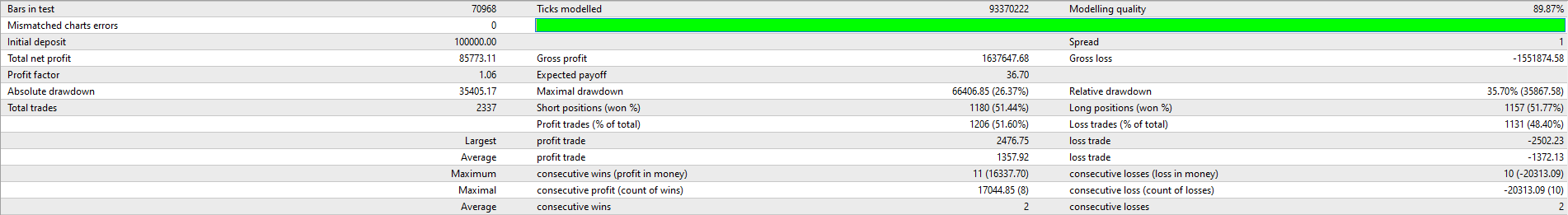

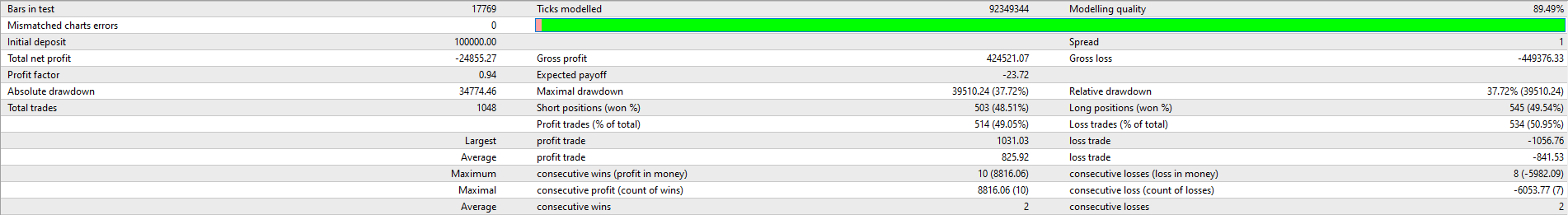

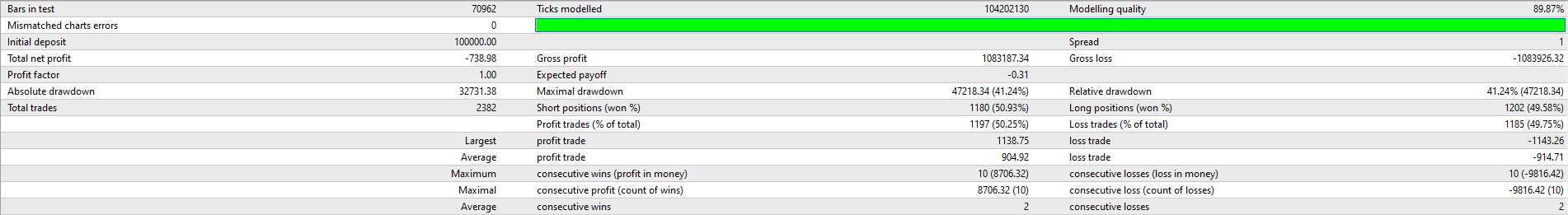

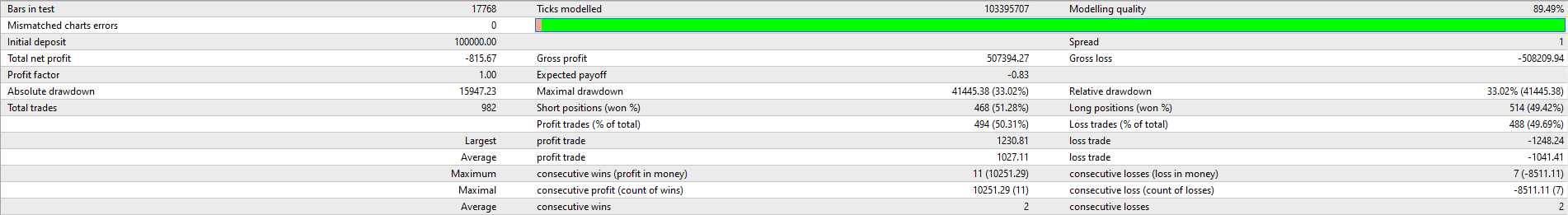

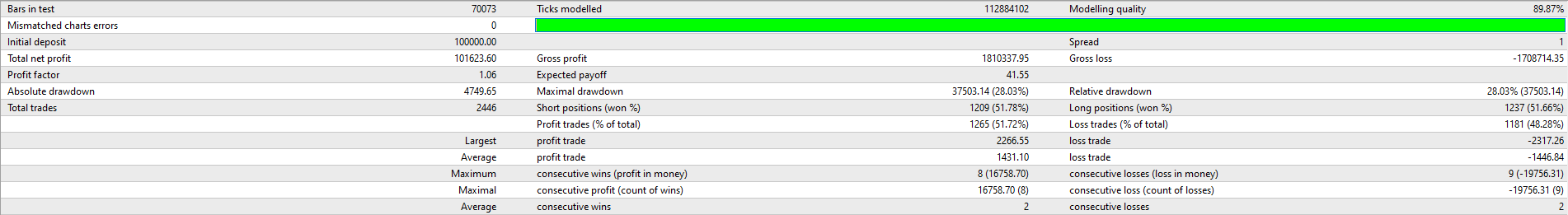

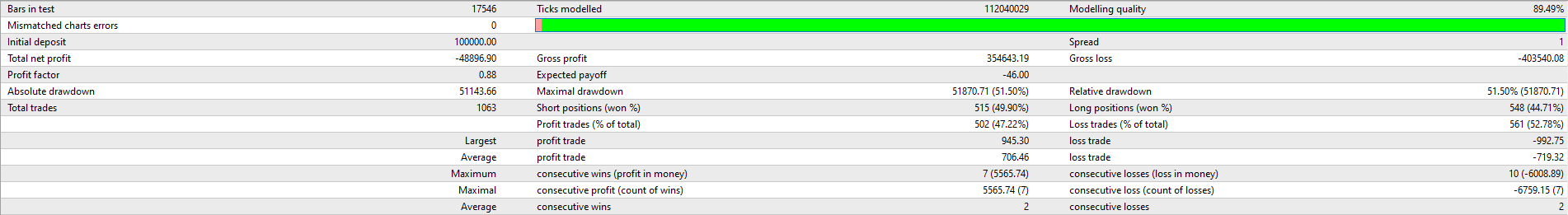

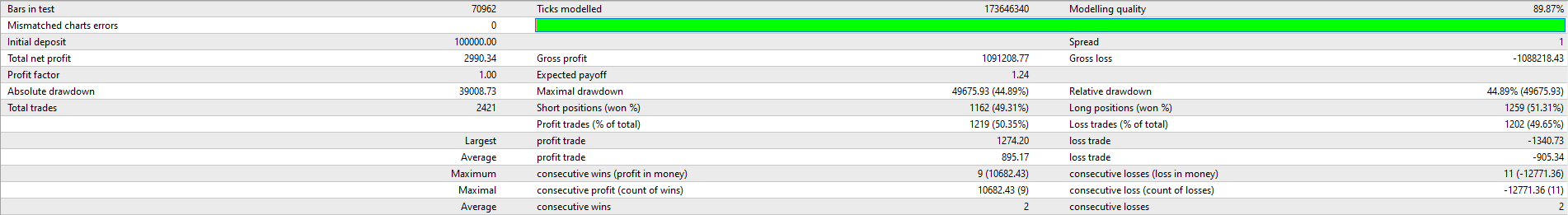

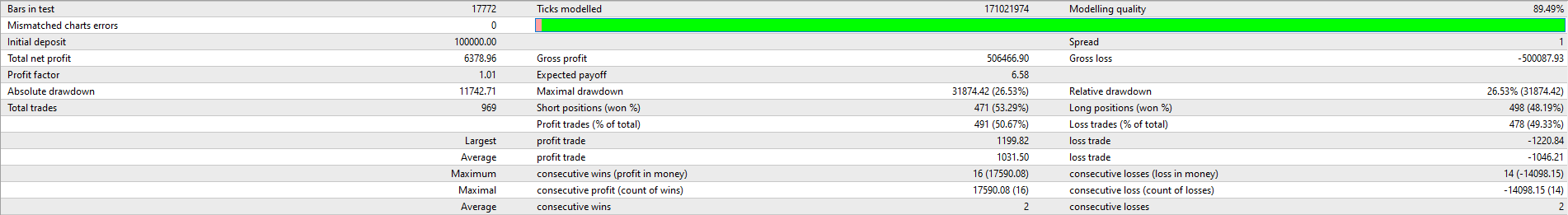

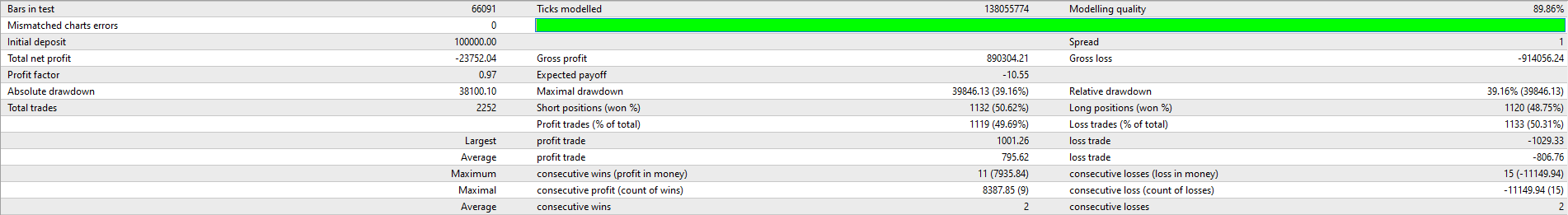

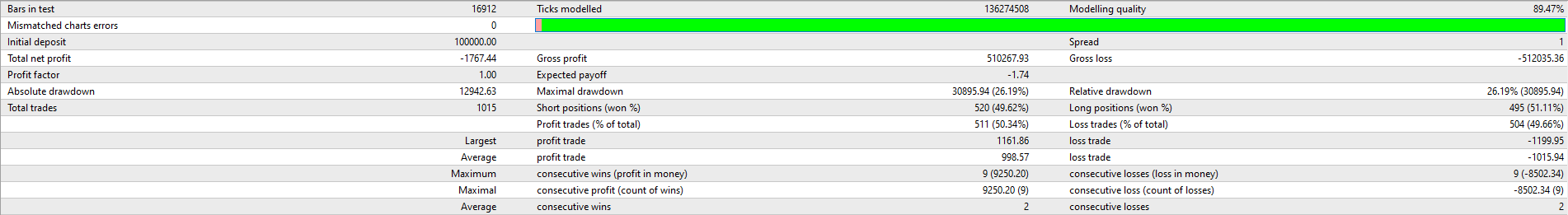

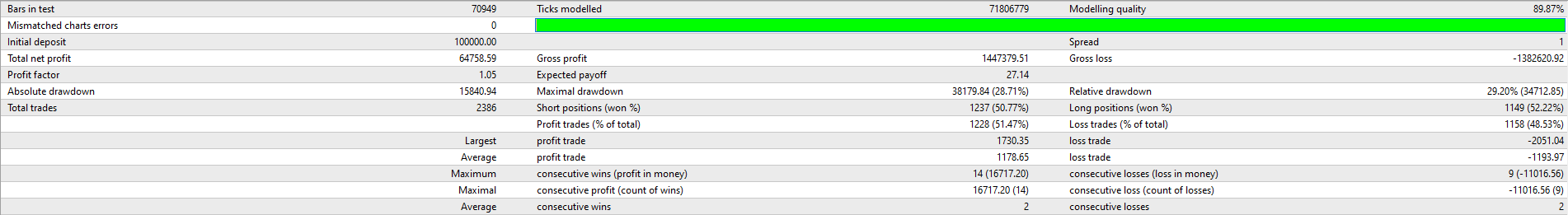

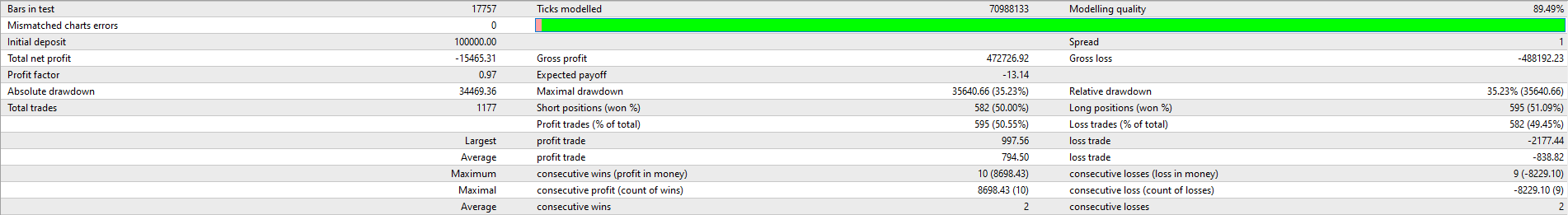

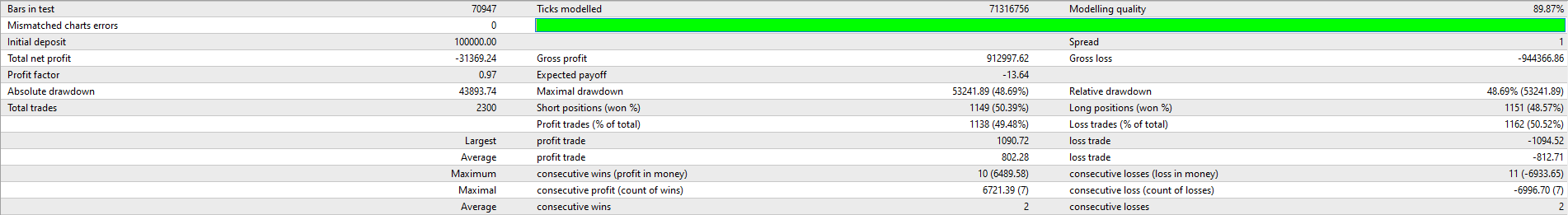

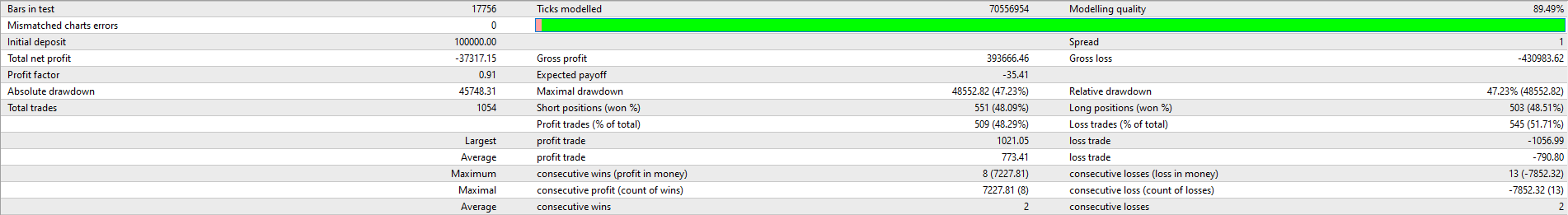

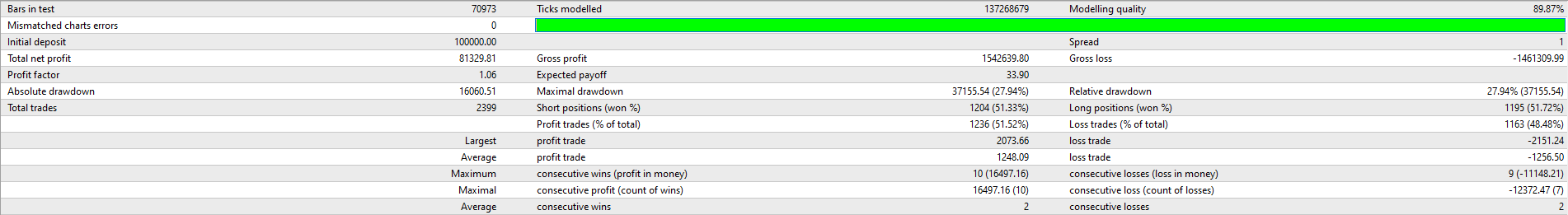

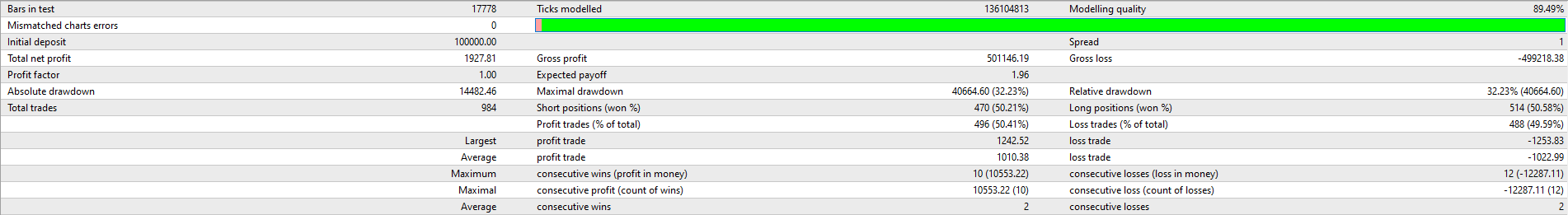

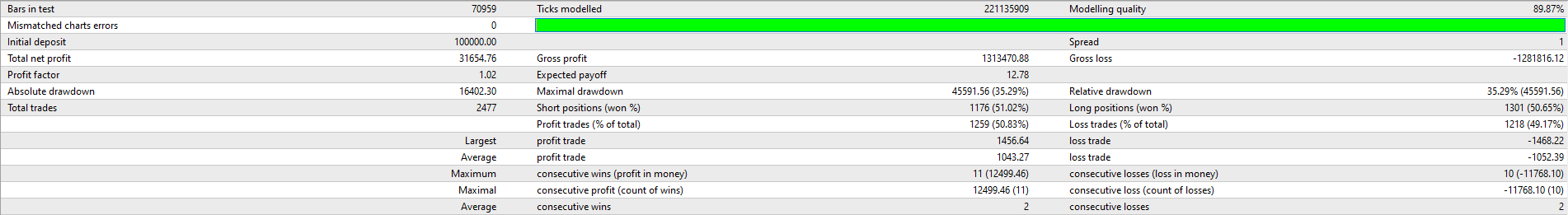

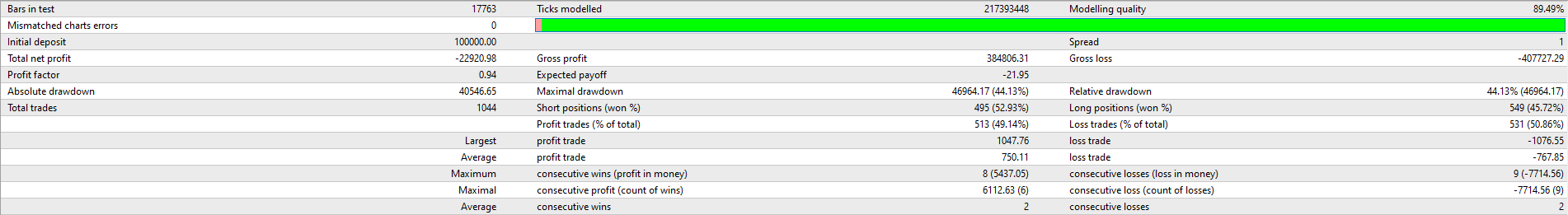

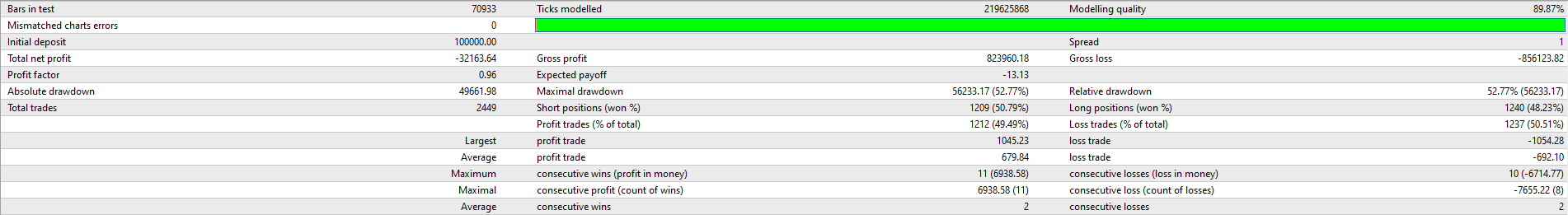

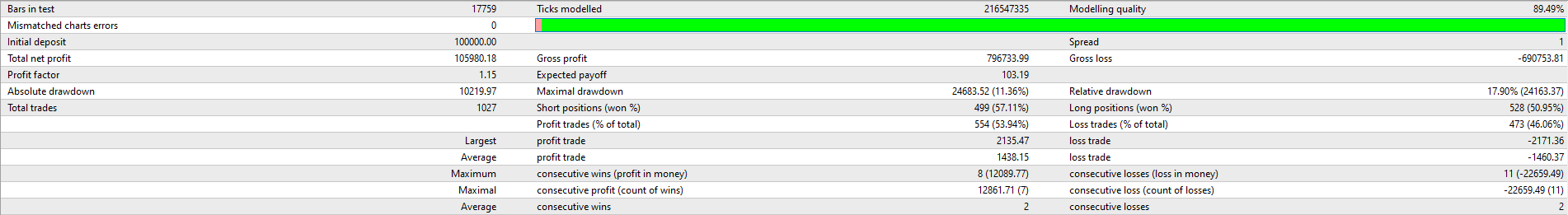

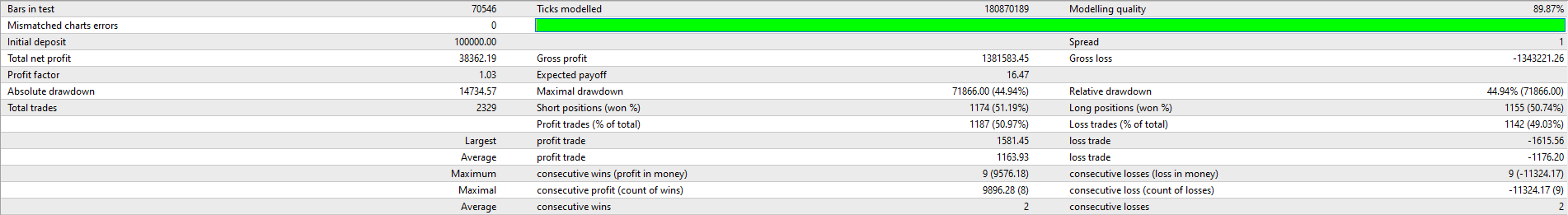

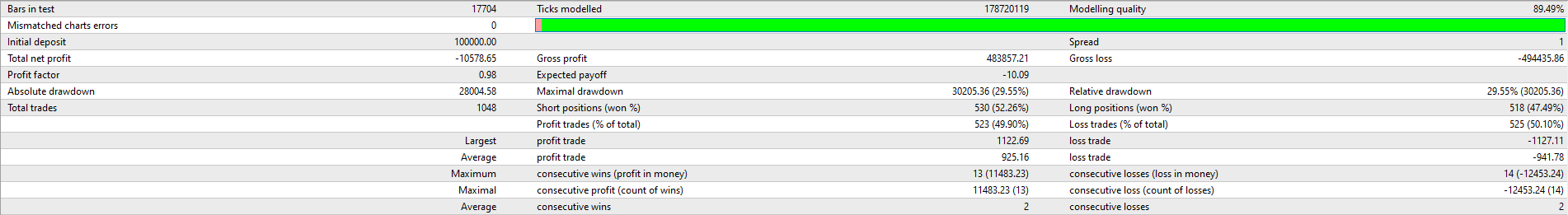

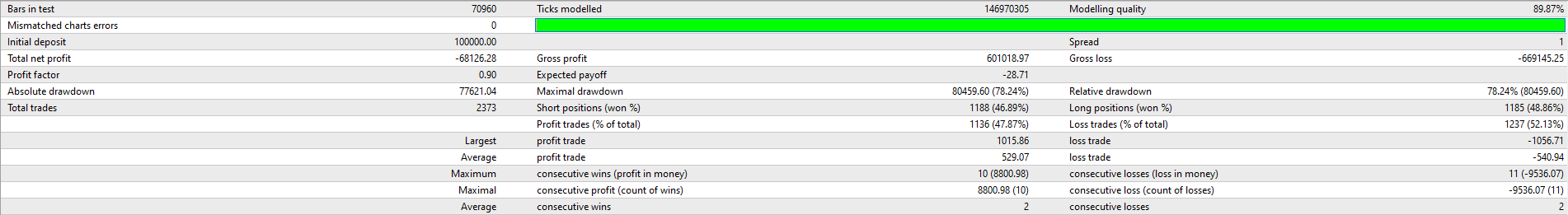

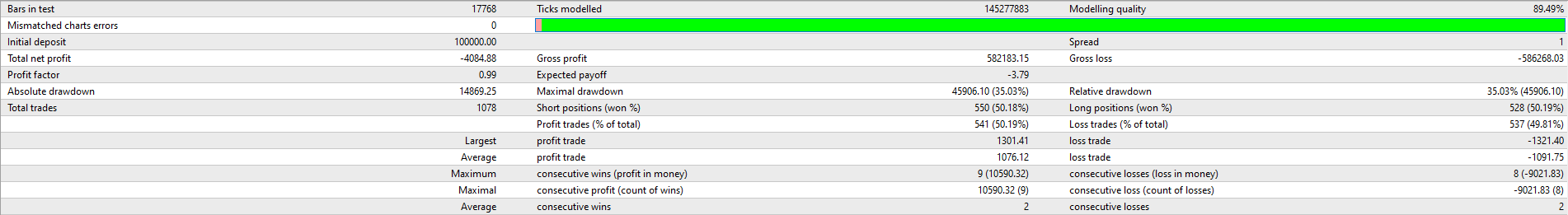

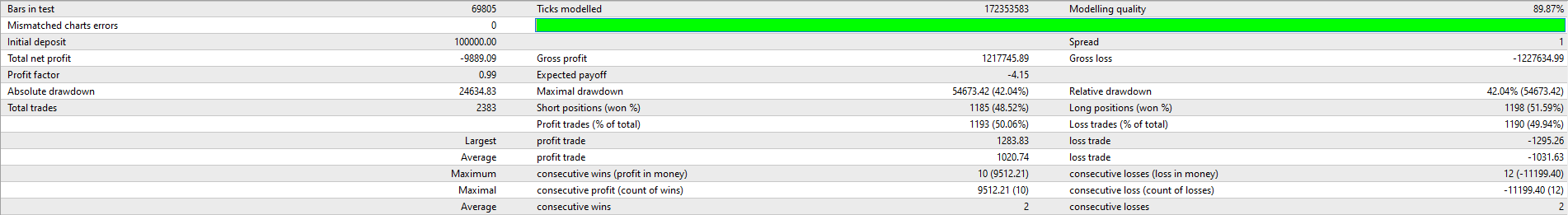

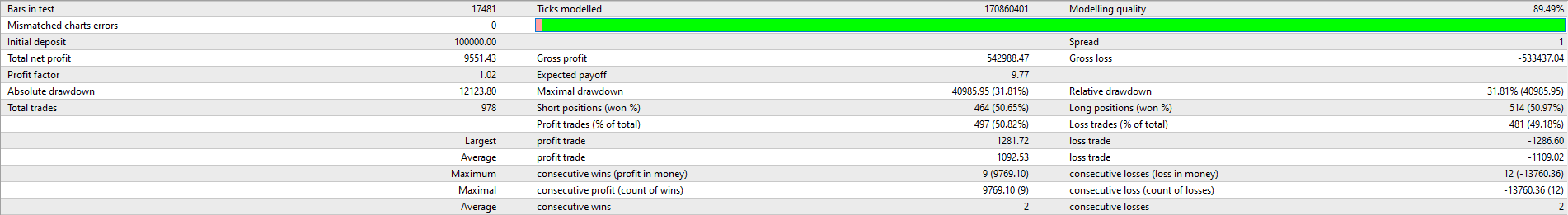

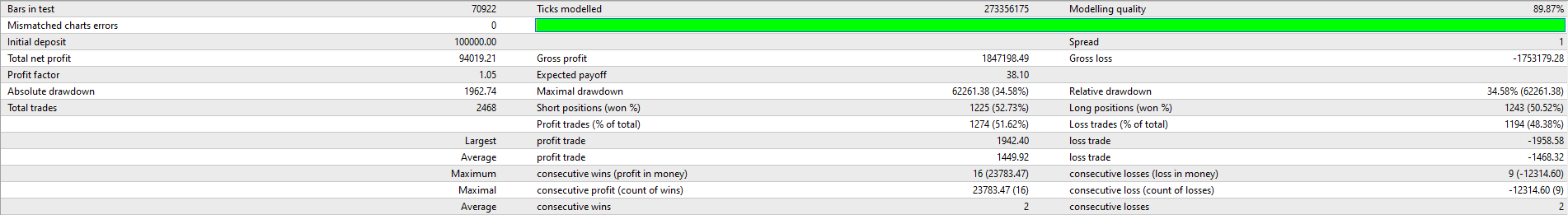

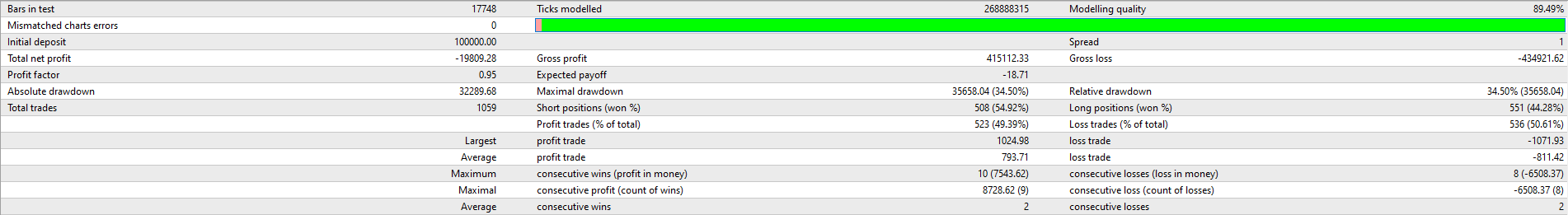

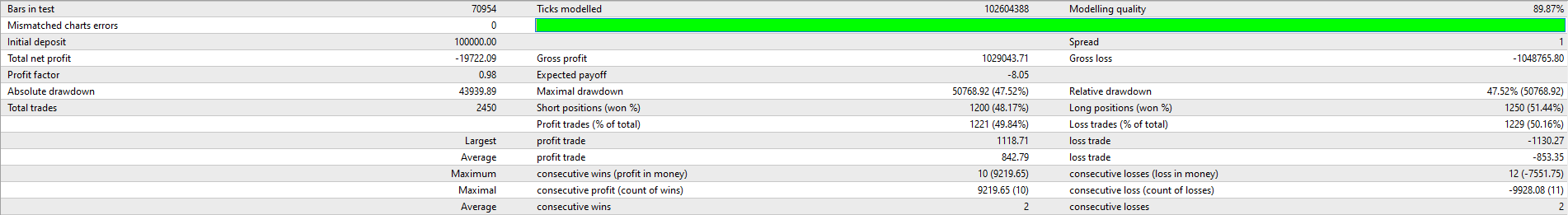

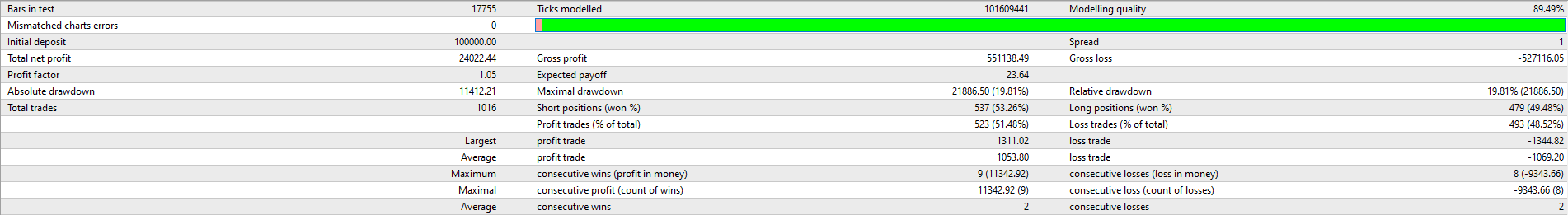

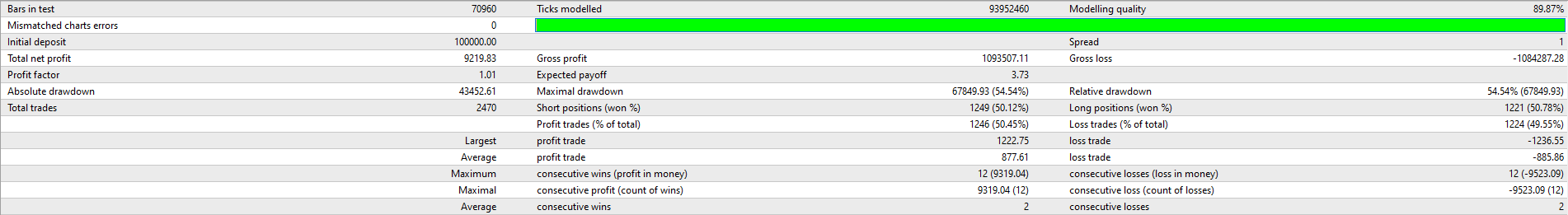

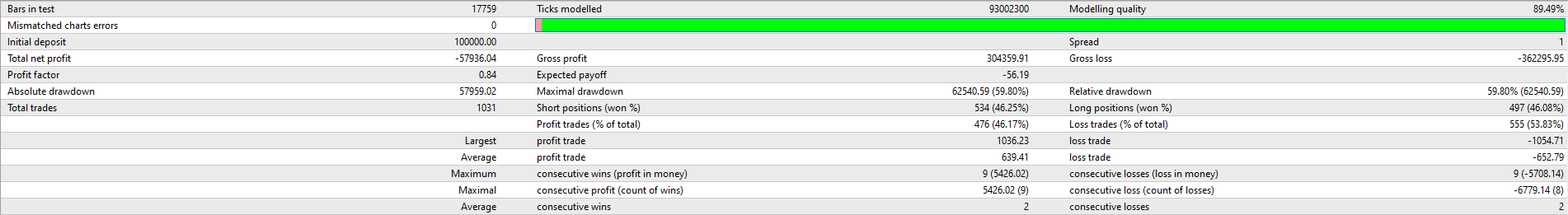

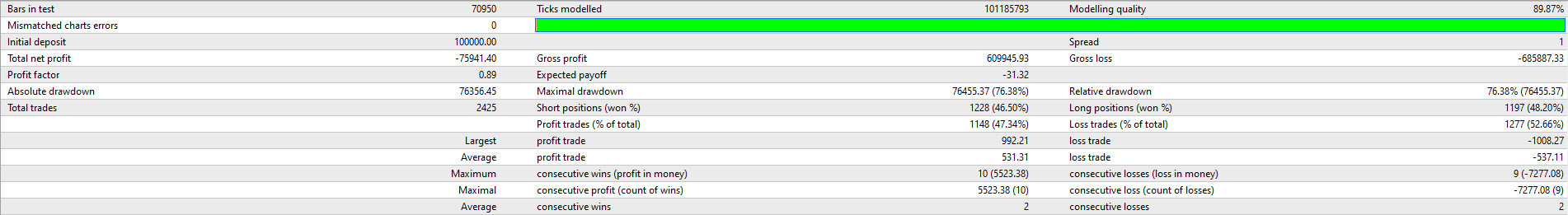

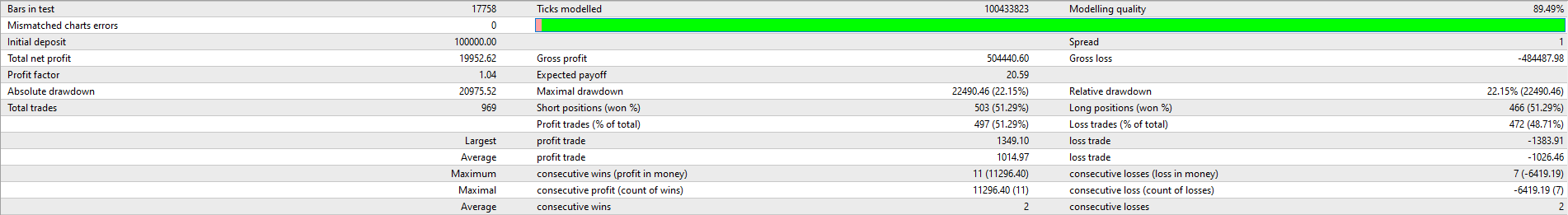

Here are the results of the backtest (click to view):

*Note: These results do not account for trading costs, so ignore the net profit/loss amounts. These backtests are designed to only measure the Bollinger bounce tendency (i.e. win rate).

And here's the summary of the backtest:

The average win rate is approximately 50% on both the 1 hour and 4 hour charts.

So the result is quite clear: There is no observable edge to the Bollinger bounce. Prices are just as likely to move up or down following a "bounce" off the Bollinger bands.

This is quite a surprising result to me, as I've seen many people base their trading strategy on such Bollinger "bounces" over the years.

The data, however, says that the winning probability is no better than that of a coin flip!

Your thoughts?

This is the first of the Forex Backtest Friday series of posts. How are you liking it so far? Would you like me to keep publishing my backtest results?

Is there anything you'd like me to add or remove from future backtest reports?

What effects/technical indicators should I test next?

Let me your thoughts in the comments section below.

Hi Chris, Thank you on all this data. I think this has great potential.With some tweaking on the risk reward side. Great work Jeff

Hi Jeffe,

Sure, I’d be happy to investigate further. What risk-reward are you looking at?

Just that the trade could auto close at the center line? Maybe that would be more profit? Just should have stated it at a risk one to get three?

Hi Jeffe, I see what you mean. The thing is that I’m testing for the tendency (win rate) of a “bounce”, so a 1:1 risk reward ratio would be the fairest way to do that. If I used a different risk-reward ratio, I would be introducing other factors that would not make this a fair test.

Yeah your so smart. That makes great sense. I think this has great potential if there was a way to enter the trade to catch the inner 1/3 of move. give the outer 1/3 to the sharks. Walk with the sure money and move onto the next time. Scale up with 5% on the the new positive total. Thanks for your help. Jeffe

Wow!

Great work Chris.

Can I nick the code/ software you used to backtest, please!! Email 😊

Could you try backtesting 200 EMA cross fro both H1 and H4

i.e buying when candle crosses and closes above EMA, selling when it does the reverse.

Your report was very thorough, keep up the good work.

Looking forward to reviewing the results of your next backtest.

Hi Kev, appreciate the kind words.

I’m simply using the MetaTrader 4 strategy tester. The code is not available for download but if you have some MQL4 experience I might be able to give you some suggestions – just drop me an email about it.

About the 200EMA cross idea, where would the SL and TP be set?

How about the MACD crosses. Or moving above or below the zero line..

That would be interesting backtest..

Gary

Hi Gary, thanks for the suggestion. 🙂

Very nice analysis…

I am also a coder and writing EAs for years. Let me know if you need help.

Hi Giri, I might take you up on that!

Try MACD( 12-26-9) , enter when signal line crosses the zero line.

Hi Zippy, thanks for the suggestion.

Really valuable insight.

Thanks, George!

Very Good insight Chris. The stochastic maybe?

Thanks for the suggestion, John. It’s much appreciated.

Consider adding the Stochastics 5, 3, 3 to the same test. I’ve found that works well seeing overbought/oversold. When they match up, the win rate could be awesome. I use both in my trading. Thanks for considering. Your work is awesome. Ken

Hi Ken, thanks for the suggestion, I’ll check it out.

Chris,

Have you tried the donchian channels they give one the resistance high and lowon any hour you are using from week,day,and any hour.

Harry

Hi Harry, I’ve not had practical experience with Donchian channels so I’m not familiar with them. Where would the stop loss be placed?

Nice work. Although overall there is apparently no edge to using Bollinger bands mechanically, there seems to be when filtering out classes of primarily losing trades, i.e. looking at taking only short trades. I wonder if there are other such filters you could apply that would make a more robust strategy – e.g. above or below a 5 day moving average etc.

Hi Jules, interesting point. Can we get a mechanical edge by combining two (or more) effects with no edge on their own? Seems like something worth thinking about.

Hi

This is why I first got into Forex, I’ve spent the last 30 years working as a programmer and the idea of coding and EA and then making money with no further effort sounds appealing.

Over the years, I’ve coded up hundreds of them, including all the common ones, MCAD, various MA’s, BB, WPR, RSI, etc.

If you run any of them for long enough, over enough different currencies, they all do worse than 50/50. Tossing a coin does come out as more reliable than any of the common technical indicators. Which is odd considering how many sites quote them as gospel for profit-making.

For long term profit, I’ve found that it’s the fundamentals which matter.

Hi Steve, I am inclined to agree. As they say, however, there’s only one way to find out for sure.

Great work. Very informative.

Thanks

Irv

Hi Chris, I love backtests. Great way to figure out how many called “profitable” trading strategies are not working. My first one was years ago the Bollinger Bands. I bought the book “John Bollinger – Bollinger on Bollinger Bands” the classic. I did not just read it, I was studying it very diligently…..I still failed and could not get better result then 50/50. I am pretty sure the problem was in me. Please continue this backtest series, it is very interesting.

Thanks

Sandor

Hi Sandor, I suspect your story is a lot more common than many traders realize. There are so many people talking about technical indicators that it SEEMS like they have some predictive value. Only when we actually do a backtest will we find out that it’s often not the case. Thanks for the comment.

Man, I am loving the incredible work you put into your trading and business. I love your Forex Backtest Friday. I have a question about that Bollinger bounce, you tested 1:1 risk to reward ratio, what will happen if you extend it to 1:2 or 3. If you can make a 50% win rate, you will have a massive return at the end of year.

Hi Mugwaneza, appreciate the kind words. It’s unlikely the 50% win rate will hold if the risk-reward ratio is extended, although I suppose it might be worth testing later on. For now, I’m just sticking to the commonly used technical indicators to see if they have any predictive value at all.

I think your risk to reward can change in result, 1 pip is enough like a coin flip, if we test 20 pips what happens in result?

Hi Ali, thanks for the suggestion.

To me, a 20 pip stop loss will defeat the purpose of the “pinbar”/setup candle signal.

Do you have a different perspective on this?