In the only sport that has both men and women competing with each other, Julie Krone is the most successful woman jockey in American horse racing history.

I don’t know much about the horse racing, but after reading a few articles about her I was instantly intrigued by her tenacity and determination to succeed.

Here’s what you need to know about her:

Throughout her career, she has been thrown off horses and trampled over, had her heart bruised, broken her back, leg and several ribs, shattered her ankle, fractured both hands and suffered post traumatic stress disorder from these injuries.

And in those days, women were (unofficially) discriminated against in the horse racing industry. After all, it is still by many standards, a male-dominated sport.

But despite these setbacks, Julie went on to become the first female jockey to win the Triple Crown race in 1993 and the first woman to be inducted into the National Museum of Racing and Hall of Fame in 2000.

Talk about succeeding against the odds!

One thing in particular she said, when asked about how she dealt with horse owners who didn’t want their horses ridden by a girl…

She replied: “Keep showing up!”

“I discovered that if I showed up every day and did my best, eventually they’d put me on a horse just to get rid of me.”

This was (mostly) meant as a joke, but there’s a profound truth behind it.

Consistency over Intensity

When I was a kid, I had several bad experiences swimming, including one time when I was sure I was going to drown in the deep end of a pool… until a nearby swimmer heard my cries and saved me from a certain watery fate.

Since then, I developed a strong fear of drowning.

Then a few years ago, after I quit my job, and in response to a post in Tim Ferriss’ blog, I felt a sudden urge to confront this fear.

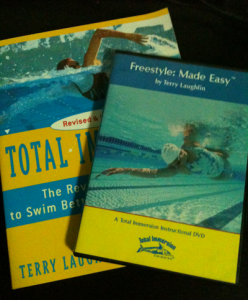

I bought the recommended book and DVD, and began working on how not to drown like a panicked chicken.

Over the next few months, I went to the pool every alternate day until I understood the basics of swimming — not just on a conceptual, but kinesthetic level.

99% of the time, I’d leave the pool bloated from swallowing too much water, feeling like I haven’t improved one bit.

But I just kept showing up.

Every Monday, Wednesday and Friday, there I was at the pool flailing my arms about like a madman. Sometimes, I’d “swim” 20 meters after a few minutes of struggling, but most of the time I’d just be moving my arms and legs around without progressing more than 5 meters.

If you’ve ever tried running underwater, you’d know what I mean.

Unconsciously though, bit by bit, I slowly got the hang of things.

A few months later, I found myself swimming half the length of the pool. It still tired me out, and I knew I still had long way to go, but at least now I didn’t look like a drowning chicken. At least, I looked more like a mildly uncomfortable duck.

There was improvement.

Today, I make it a point to swim 5 – 10 laps at the pool twice a week. Unlike many other forms of exercise, this is one I thoroughly enjoy. I am no longer afraid of being in deep water.

Now I know this sounds really cliche, but looking back on all this, I realized the key to this achievement was persistence.

It wasn’t about how hard I tried. I didn’t push myself over the edge by trying too hard. On the contrary, I took things at my own pace. Whenever I got tired, I stopped and took a rest. I didn’t try too hard at all.

But the one thing I did, was show up consistently.

And it made all the difference.

Unfortunately, the opposite often happens when new traders come into the market.

They’d spend hours upon hours staring intensely at price charts, and give up after a few months of having no results. This is a typical example of training with high intensity and low consistency. This is not the recommended way to practice trading.

What This Means For Your Trading

Do you show up every day in the market? Or do you just open up your charts whenever you “feel like it”?

One paradox of trading is that it requires the commitment to keep showing up, and yet the more time you spend looking at charts, the less effective you’ll be.

It’s easy to get frustrated and make bad decisions when you spend too much time staring at the computer screen – you’ll look for “something” to trade when you should probably be staying out of the market for the moment.

So take things at a comfortable pace and don’t force yourself to “trade hard”.

Just take things easy… but make sure you keep showing up.

We would like to thank you once again for the stunning ideas you gave Jesse when preparing her own post-graduate research in addition to, most importantly, for providing each of the ideas in a blog post. Provided we had known of your blog a year ago, we would have been kept from the unwanted measures we were having to take. Thank you very much.

great insight

thanks

Hey guys, thanks for your kind words. The idea behind this post has influenced my life in many positive ways, and I hope it will do the same for you.

Many years ago I was introduced to martial arts. Never had an interest in it before then. I’ve always been reasonably good at sport and took to it like a duck to water. Trained hard, enjoyed the physical exertion got to be invited to grade for my blackbelt 7 years later (I trained mostly 4 times a week, until the last 6 months where I trained 8 and 9 times a week). Something happened and I don’t even remember what it was now but I just stopped. Some 12 months later I passed someone in the street from the Dojo (place of training) and they’d mentioned to me that there had been a clean up at the dojo and someone had found a brand new blackbelt with my name embossed on it. I was shell shocked, it was then that I realized the sensai had more faith in my ability than I did. I went back to training (this sounds like a bit of a Rocky Balboa story). Worked really really hard and then 9 weeks out from the next 2 day blackbelt grading I blew my knee while training. 3 days later I was in an operating theatre getting my knee “fixed” and 3 days after that I was on an exercise bike. Sometimes there is nothing like road blocks to make you grit your teeth and “just do it” regardless of the pain. I had 7 weeks to go before the grading and I was absolutely determined not to fail or let anything get in my way again. I passed the exam, totally and utterly exhausted along with 17 others and was given a standing ovation in front of 300 people………nothing is impossible

Hi Tim,

Great story. Thanks for sharing!

As an older adult I learnt to ride a bicycle for the first time. I never learnt in my childhood. Despite struggling with balance, steering, and cornering with a few falls. I persevered every day with practicing. Now some 2-3 years later I ride in city traffic.

An excellent example. 🙂