If I had to use a metaphor, I’d say that trading is a lot like predicting the actions of shoppers in a mall.

At the individual level, I can’t accurately predict if a particular shopper is going into walk into Levi’s and buy a pair of jeans.

Whether Susan buys a pair that day might depend on whether she’s in a good mood, whether she felt fat, or what she had for lunch. And there are an infinite other factors that could easily change her mind.

If I had to bet that Susan would walk away with a new pair of jeans that day, my odds of winning aren’t good.

But what if I broadened my scope to bet on a different level?

How about betting on at least 10 people buying a pair of jeans from Levi’s that day?

Which is a bet I’m more likely to win?

- That one particular shopper (Susan) would buy a pair of jeans from Levi’s on Monday; or

- That 10 people would buy a pair of jeans from Levi’s on Monday

Obviously, I’d be more likely to win the second bet.

This may seem like common sense, but it’s certainly not common in trading practice.

Short Term Amusement

Too often, traders look to the short time frames to predict where the market will go in the next few hours.

To make money, they have to be right about (1) the market moving within a very limited time period, and (2) it moving in the anticipated direction.

This is like zooming in to the individual shopper and predicting that Susan will (1) buy something, and that (2) it’s going to be a pair of jeans.

That’s a tough call. Predicting the outcome of the small-scale is excruciatingly difficult.

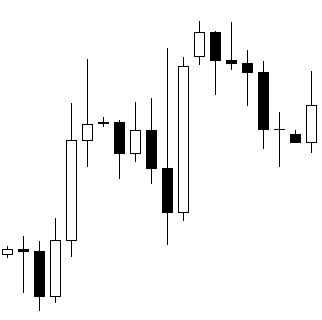

Here’s a live example of market prices moving in a completely unpredictable manner, on the EUR/USD 1 hour chart:

I have yet to see a trading method that can consistently handle price movements like this.

On the daily chart however, such erratic moves are but a small blip:

Look at both charts again – in which time frame would it be easier for you to trade in?

The Bottom Line

When trading in the short term, you’re setting yourself up to be slapped around by the inevitable, random price swings in the market. These swings are often meaningless, and can turn around just as quickly as they began.

On the larger time frames however, price moves are a lot less random.

Trading is a game of playing the odds; Two traders can be trading the same currency pair, but if they’re trading on different time frames, they’re playing different games.

Which is the smarter thing to do? To play the game where the outcome i more random, or less random?

Hi Chris

I liked your blog posting very much and would have liked to join you in your method of trading previously except for Paypal is impossible for me to pay through and Facebook is another country as far as I am concerned and I do not want to be on it.

i wish you well in your wonderful method and will aspire to sort something out along the same lines in due course.

All the best from Merrilyn

Hey Merrilyn,

No worries – I’m just happy that you find my posts to be useful.

🙂

Hi Ross,

Good questions. Hopefully I’ll be able to clarify some of your doubts.

1) We have indeed won all of our trades so far – this is fact that can be verified with any of our Planting Pips members. However, this is not to suggest that we will definitely continue to win all of our future trades. Nobody can predict what will happen in the future – we can only report on facts that have actually (i.e. already) happened.

It’s perfectly fine to be skeptical, which is why we’re offering a 60 day trial. You may cancel at any time by yourself, or by sending us an email.

2) I can’t speak for the other reports you’ve subscribed to, as they are written by someone else. All I can say about this issue, is to judge each program by its results and not to assume that I stand by what others have written (and vice versa).

3) The agreement for Planting Pips stands as advertised. At any time during the first 60 day trial, you may cancel if you don’t wish to continue, for any reason. After the 60 days, you may still cancel at any time, for any reason.

Thanks for your comment, and please feel free to drop us an email if you have any further questions.

Hi Chris.

Thanks for your reply. Later today I will sign up for your trial planting pips. If it turns out as you and your members say, and it works with the IG Markets trading platform, then opting out won’t be opted.

Re Facebook. I agree with Merrilyn and don’t want any part of it. I just hope we won’t miss out on anything because of our choice and concerns re Facebook.

Thanks.

Regards.

Ross.

Hi Ross,

Don’t worry – Planting Pips will work with any trading platform. I have an IG Markets account as well. 🙂

Hi Chris,

This article is dead on. I entered a EUR/USD trade in the right direction and at 6 pips before a major turn basing my decision on a 4H chart. My entry, stop and limit were based on this 4H chart. But when price moved 70 pips away and in my anticipated direction, I moved my stop to break even. I was stopped out because the decision to move to break even was based on the 15 min chart after seeing a nice move with many candles.but the 4H chart still had only one candle. I should have waited. The 15 min chart is choppy compared to the 4H chart. Lesson learned!

Arthur.

The market is tricky that way…

Hi Dear Chris,

Please do me a favour. How can I use smaller time frames to predict the market on larger time frames? I seem to have settled for the 4H chart. Please advise me.

Thank you.

Uche.

Hi uche,

In my observation, it’s quite the opposite.

It’s more reliable to use the larger time frames to predict the market smaller time frames. 😉

Hi Chris.

First time to comment your blog because my english is very poor.

I have learned many thing from your dream forex book and now I keep see this blog to learn from your experience.

Can I ask you which timeframe you using for trading now

Hi Quach Gia, I’ve mostly be trading off the daily time frame now.