Binary option trading is a relatively new development in the retail trading world. Five years ago, no one had even heard of it.

Since 2012 however, the popularity of binary options surged as a result of aggressive marketing by binary option brokers, and the promotion of binary trading software by the trading “gurus”.

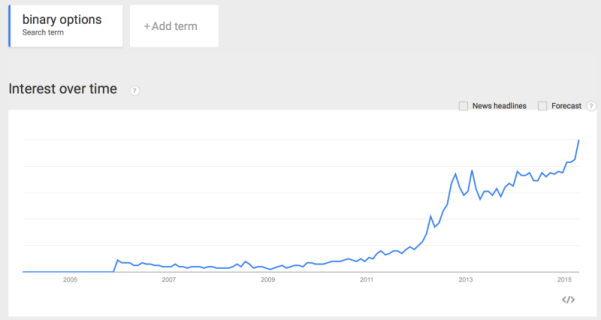

Right now, interest on the topic continues to grow at record levels:

Popularity of search term “binary options” in Google

Given its current popularity, binary options are likely to be the first “asset” that beginners start trading with.

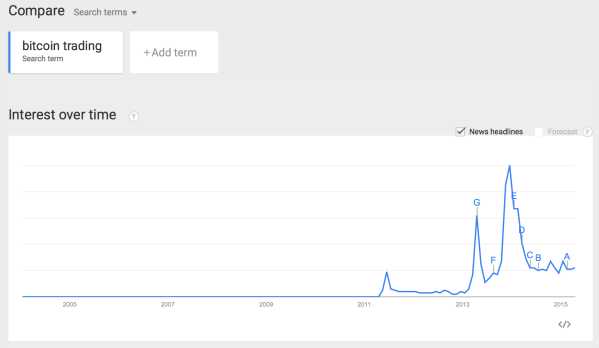

However, just because something is new and popular… doesn’t mean it’s worth doing. (Who remembers the fuss over bitcoin trading?)

Popularity of search term “bitcoin trading” in Google

Opportunities come and go all the time in the retail trading space… and it’s important for us to tell the difference between sustainable business models and short-lived fads.

So let’s take a moment to examine binary options, and see if it’s something we should be paying attention to.

But before we do that, let’s first take a quick look at traditional (i.e. vanilla) option contracts.

Vanilla Forex Options

Traditional option contracts were initially introduced for people to hedge against future uncertainty. (Learn the basics of how it works here.)

For example, a German company selling cars in the United States would worry about high EUR/USD exchange rates in the future.

Why?

Because then they would be getting revenue in a weaker currency (USD) while having to pay expenses in a stronger currency (Euro) in their home country. This results in a significantly lower net profit, or even worse, a net loss.

Forex option contracts were thus introduced to solve this problem, as any losses stemming from currency fluctuations could be offset by profits made from buying options contracts.

To continue with the example, the German car company may choose to buy EUR/USD call options, which would profit from an increasing EUR/USD rate. Thus, any operational losses in the future (due to a high EUR/USD rate) can be offset by the profits gained from those option contracts.

This is, and continues to be, the main purpose of Forex option contracts.

Now of course, in order for the German company to buy call options, someone has to be willing to sell it to them.

Perhaps, a financial institution in France does not believe that the EUR/USD will continue to strengthen over the next 12 months, and so is willing sell call options to the German company.

(This, by the way, is how financial markets work. Participants have varying views of the future, and so trade against each other in line with their own expectations.)

In this transaction, the German company pays a fee (in buying call options) to protect against future currency risk, while the financial institution gets paid to take on that risk.

To summarize:

- The German car company looks to limit future currency risk by buying call options

- The financial institution (or speculator) collects a fee from selling call options and assumes the currency risk

More generally:

- Option buyers pay a fixed fee for the potential of a very large profit

- Option sellers collect a fixed fee for the potential of a very large loss

Forex Binary Options

In a vanilla option trade, the buyer does not know in advance the amount of money he stands to win. Similarly, the seller does not know in advance the amount of money he stands to lose. The amount is ultimately determined by how far the market price moves.

In a binary option trade however, the trader will know in advance the exact amount he stands to win or lose, before taking the trade. Binary options are named as such because there are exactly only two possible outcomes: you either win a fixed amount, or lose a fixed amount.

Binary options ask a simple question: will the price be above [price level] at [time]?

For example: will the EUR/USD be above 1.3000 at 4.30pm? If you think so, you buy the binary option. If you don’t, you sell.

That’s pretty much all there is to binary options.

Upside of Binary Options

As you can see, binary option trading can be simply explained and is easily understood. This is a big benefit to new traders, as they can quickly learn the basic mechanics and start trading right away.

A related benefit of this, is having to make fewer trading decisions.

In spot forex trading, for example, one has to decide:

- Where and when to enter the market

- The appropriate trading lot size to use

- How to manage the trade

- Where and when to close the trade

In binary option trading however, there are only 2 decisions to make:

- Whether the market price will be above a certain price level at a certain time

- How much to risk on the trade

As such, binary options offer a much simpler trading process. You don’t have to think about (or calculate) leverage and margin at all.

And, since the potential loss on each trade is fixed, you will never get a margin call.

Lastly, options offer traders the unique ability to make money by predicting where prices will not go. (This goes for all types of options, not just binary options.) This can’t be done in the spot Forex market.

So… does binary option trading sound good?

Sure it does!

Well… at first glance, anyway.

Now let’s take a look at the downsides of binary option trading. These are the things your binary option broker won’t tell you.

Downside of Binary Options

The most obvious downside of binary option trading is the lack of flexibility.

For example, if the market price moves even one pip against you upon option expiry, you’ll lose your entire stake. You can’t choose to defer your trade exit under any circumstances.

Also, with some binary option brokers, you can’t change your mind and close or modify a trade before expiry. In this sense, a binary option trade is typically an all-or-nothing proposition.

These points on inflexibility can be summarized by the following comment (found in the Forex Factory forums):

I once traded a forex news item where I closed a wrong call with a 20 pips loss, and ended up making 350 pips on the reverse trade, giving me a net profit of 330 pips. This scenario cannot be replicated in binary options.”

Lastly, the value of a binary option is fixed between 0 and 100, with the broker charging a bid-ask spread and often, a commission as well. The implication of these factors is that the average loss per trade will always be larger than the average profit. This is a structural (i.e. inherent) characteristic of the binary option game.

Thus, in order to break even, a binary option trader would have to win at least 55% of the time. Compare this to spot Forex trading, where a trader can be profitable by winning just 40% (or less) of the time.

My Personal Opinion

On paper, binary options are an opportunity seeker’s wet dream.

The promise of regular fixed payouts and a focus on short-term profits are exactly the characteristics that appeal to people looking for a quick buck.

Unfortunately for them, what feels good in trading is typically a losing approach.

You see… the only way to keep making money with binary options is to accurately predict market prices at least 55% of the time, and get the timing right. This is an exceptionally difficult feat to accomplish.

In other words, you can correctly predict future market prices and still lose because you got the timing wrong by a few minutes.

However

All this said, there may be a genuine opportunity here… and that is to be a seller of binary options.

Why? Because it’s a lot easier to estimate where prices will not go, rather than trying to predict where it will. Whenever the market settles at a particular price level, it is not settling at a dozen other price levels.

Does this make sense?

This root concept may then be expanded to form a complete binary option trading strategy that you can use.

Note however, that this is a benefit available to all types of options, not just binary options.

So Are Binary Options Just A Fad?

One reservation I have about binary options is that they do not serve a major commercial purpose. Unlike the spot and derivatives markets that serve to benefit society, binary options exist solely for speculation purposes.

In other words, it can be reasonably argued that binary option trading is not much different than a casino game.

Without a commercial purpose, binary options could be banned tomorrow and not impact anyone else other than the brokers and speculators.

Compare this to spot Forex trading, or Forex futures trading, upon which global commerce relies. These markets are unlikely to be closed or banned, because they serve a useful purpose beyond speculation.

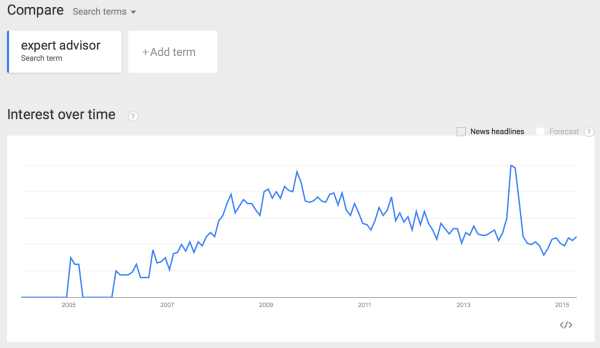

As a retail trader for the past 10 years, I’ve seen all sorts of gimmicks and fads come and go. Some years ago, expert advisors were the hot topic:

Popularity of search term “expert advisor” in Google

Slowly but surely, people are now gradually realizing that “automated trading” isn’t as amazing as it’s cracked up to be.

Will binary options follow suit?

My opinion is yes, I think they will.

Binary options do not provide any major benefit to serious traders, and I think that once the opportunity seekers get bored or lose enough money, they’ll lose interest and turn their attention to the next shiny object.

What Do You Think?

So… do you particularly agree or disagree with any of the points I’ve mentioned? Did I miss mentioning any important points?

Let me know what you think in the comments below!

Thanks for your clear and lucid elaborating about Binary Option Trading. I agreed your every points. Once again thanks.

Yes I agree with you. Thank you for the informative blog. All the aggressive advertising make it sound really good, they show accounts that look really good but infact for a winner there has to be a loser and they don’t tell you about that side of the coin. You can’t be all winners all the time as they make it out to be. Don

Many or most binary option brokers structure it in such that you can only breakeven if you win consistently at 60% of the time, not 55%. And if you really want to make a profit, you have to do better than 60% all the time. Now, that’s a tall order.

And most of these brokers are scammers, they will find all sorts of ways to defer or prevent you from withdrawing profits. This, they do by pushing you to accept bonus funds from them (you bank in $1,000, they give you 50% extra to top up to $1,500), and you then have to enter high volume trades to justify the bonuses.

The more you trade, eventually you will lose back all the profits to them.

Talk about unscrupulous brokers, they are the most lethal of scammers.

IG markets introduced “Sprint Markets” a little while back which seems similar to what you have just discribed. I gave them a bit of a go for a while, but if you didn’t average two wins out of three you didn’t make a profit. It was amazing how often I was in profit until just before expiry then it would go against me — right at the last minute. I gave them up and went back to normal currency trading. At least you can pull out if it goes against you, and control your risk with stops etc.

Cheers.

Ross.

Yes! Personally, the ability to manage positions is a big plus.

Yes! From my perspective, the ability to manage positions (in spot trading) is a big plus.

hohoho…., as usual, your opinion soooo awesome, mate! thank you, thank you, thank you.

yes, absolutely I agree with you. in forex trading, we could manage our positions with flexible. we could set up a profit target and stop loss with a clear money management. and that is a real business! but in binary option, ummm….I don’t think so. that is a pure gambling.

cheers!

santo

After reading through your write up, I will like to agree with some of your points. However, I also see some of them twisted to favor spot forex trading. For instance, in your point about bonus offered by binary option brokers, I see the same happening in spot forex. It all depends on the broker.

There are both genuine and scam brokers in both spot forex as well as in binary option, but you are writing as if there are no scam brokers in spot forex world.

I think what should be considered more while choosing whether to go for traditional forex trading or binary options trading is the trader’s personality.

Personally, I have traded traditional spot forex for 6 years without breaking even despite the fact that I have given my best to it, yet in less than 1 year in binary options trading I am already smiling back from my bank on weekly basis withdrawing profits.

My strategy that has failed woefully in forex for the past 6 years is already working magically in binary options trading.

The only point that borders me in your write up is “Without a commercial purpose, binary options could be banned tomorrow and not impact anyone else other than the brokers and speculators.” and I am seriously praying that such thing would not happen.

On this other point “Binary options do not provide any major benefit to serious traders, and I think that once the opportunity seekers get bored or lose enough money, they’ll lose interest and turn their attention to the next shiny object.” I keep wondering who you are refering to as serious traders, and why you think there are no opportunity seekers in spot forex. There is this statistics that says 95% forex traders loses money yet they have not lose interest in continually searching for the holy grail in spot forex. In as much as any trader could gamble with is money in binary options, the same is applicable to spot forex. Money management is the choice of individual traders whether binary option or spot forex.

Finally, I am of the opinion that you have a negative perspective of binary option. Maybe you have not given it a fair trial or your strategy does not work well with binary option.

Hi Frank,

Thanks for taking the time to weigh in on this. I think it’s instructive to hear from someone who is doing well with it.

I have a few comments to share in reply:

That’s a risk that I personally would not take. This alone is a deal breaker for me. It’s not a matter of whether I think it can happen, but whether there is any significant reason for it not to.

Yes I would certainly agree that there are opportunity seekers in both spot forex and binary options markets. I was trying to say that with binary options being the ‘new kid on the block’, and with it’s unique features, it would appeal more to the opportunity seeking crowd. I could probably have phrased this better.

Hi Chris

Although forex based I have to say I have dabbled in Binary Options and have to agree with your comments. Yes, there is a lot of marketing going on and brokers have tricks to tie you in etc.

But having been there bought the t-shirt and seen it first hand I am in the process of pulling out of all my binary accounts and returning funds back to forex.

I think the most important point you make is it is like a casino and they are trying to get you addicted. Brokers badger you non stop to make trade join this fund etc… but honestly I have given up answering the phone to them.

Malcolm

Hi Malcolm, thanks for sharing your experience with binary options… if only more people with first-hand experience like yourself would do the same.