(In order to understand what is margin in Forex trading, you first need to understand how trading leverage works: Understanding Forex Leverage)

So as you know by now, it’s not the maximum leverage, but the actual leverage that harms our trading account.

However, the maximum leverage does play an important role in our trading, and must not be ignored.

To understand its (potentially harmful) effects, we’ll need to take a look at the concept of margin.

Understanding margin helps us figure out the volume of currency we should be trading with, and more importantly, how much we should not be trading with.

What is Margin in Forex trading?

Let’s begin where we left off.

As discussed in this post, we trade with leverage by “borrowing” from our broker.

And just like any other financial institution, the broker requires us to put up a certain amount of our capital as collateral to enjoy the privilege of borrowing.

This collateral is often called the used margin.

And it’s determined by the maximum leverage, and our trading volume.

At 100 times leverage, if we want to trade 100,000 units (Dollars, Euros, whatever) worth of currency, we’ll first need to be able to set aside (100,000 / 100) 1,000 units of that currency in our trading account.

At 50 times leverage, if we want to trade 100,000 units worth of currency, we’ll first need to be able to set aside (100,000 / 50) 2,000 units of that currency in our trading account.

So… at 50 times leverage, we cannot trade 100,000 units of currency if we have less than 2,000 units of currency in our trading account.

However, at 100 times leverage, we can trade 100,000 units of currency even if we have less than 2,000 units of currency in our trading account (but more than 1,000).

Basically, this means that the more the (maximum) leverage, the larger volume of currency we can trade with. This can be a good or bad thing, depending on how well you understand the risks involved.

Now let’s talk about the second type of margin.

It’s called the free margin, or available margin.

And it’s simply whatever is left of your trading account, after setting aside the used margin.

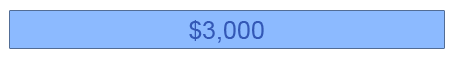

Let’s say you have a $3,000 account with a maximum leverage of 100 times.

You take a trade with 5 mini lots ($50,000) on the EUR/USD.

The used margin is: ($50,000 / 100) $500.

The free margin is: ($3,000 – $500) $2,500

By the way, the free margin is also called the available margin because it’s the amount that’s available to be used as “collateral” should you decide to take another trade.

All this may sound a little confusing at this point, but just bear with me.

I promise it will get clearer as I explain it with the next example.

Margin Example

Joe funds his first trading account for $3,000 at 100:1 (or 100 times) leverage.

Immediately, he looks at his trading chart and sees an opportunity in the EUR/USD. Joe decides to buy one standard lot.

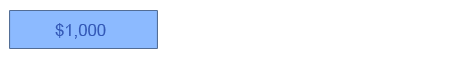

One standard lot is $100,000… and at 100:1 leverage, Joe needs to put up $1,000 of his account money as collateral.

$1,000 of his account will thus be set aside — this is the used margin.

Now, Joe’s open trade position will be allowed to decrease in value to a maximum of the remaining value in his account (i.e. the $2,000). This amount is the free margin, or available margin.

If Joe suffers more than $2,000 in paper losses on the trade, his position will be automatically closed because he only has $2,000 of free margin in his account to absorb the paper losses.

When there is no more free margin to absorb the paper losses, Joe will get the much-dreaded Margin Call.

His trade will be automatically closed by the broker and the $2,000 in paper losses will immediately become an actual deduction of $2,000 from his account, leaving the $1,000 that will now be “unlocked”. Since the trade has been closed, the $1,000 collateral is “released”.

Main Takeaways

So what are the major takeaways from all this?

1) The more the maximum leverage, the larger the volume of currency we can trade.

A $3,000 account with maximum leverage of 50 times can potentially trade with $150,000 worth of currency.

A $3,000 account with maximum leverage of 100 times can potentially trade with $300,000 worth of currency.

2) The more capital in our trading account, the more we can “borrow” from the broker.

A $3,000 account with maximum leverage of 50 times can trade with $150,000 worth of currency.

A $10,000 account with maximum leverage of 50 times can trade with $500,000 worth of currency.

3) The more our maximum leverage, the lower the used margin for our trades.

When trading 5 mini lots at 50 times leverage, the used margin is $1,000.

When trading 5 mini lots at 100 times leverage, the used margin is $500.

Viewed from another perspective, the more our maximum leverage, the more free margin will be available in our account (after taking a trade).

When trading 5 mini lots at 50 times leverage on a $3,000 account, the free margin is $2,000.

When trading 5 mini lots at 100 times leverage on a $3,000 account, the free margin is $2,500.

So… high leverage actually improves the survivability of our trading account, because there’s a larger buffer (free margin) for prices to go against the trade!

However, do remember that with a larger free margin, we also stand to lose more capital from our account, should we get a margin call…

4) The more trades taken, the smaller the free margin.

Every time we add on to an existing trade, we increase the used margin and decrease the free margin in our account.

And since our account capital is fixed, this means the more trades we hold at the same time, the less the survivability of each individual the trade.

5) The larger the trades taken, the smaller the free margin.

Just like the previous takeaway, the larger the volume we trade with, the smaller the free margin left in our account.

Your Margin Is Your Danger Meter

Amateur traders often blow up their accounts because they don’t understand how margin works.

They take trade after trade without realizing that their free margin gets smaller and smaller, leaving less and less room for market prices to fluctuate against their trades.

Always pay attention to your used margin and free margin… or even better, stick to the rule of never using more than a certain percentage of your account as the used margin.

My Rule of Thumb

Generally speaking, I don’t commit more than 20% of my account as the used margin.

So, for example, on a $50,000 account at 50:1 leverage, I will not commit more than ($50,000 x 20%) $10,000 of my account as the used margin.

This means that I will trade up to maximum ($10,000 x 50) $500,000 worth of currencies, or 5 standard lots, in total.

I can take 5 trades of 1 standard lot each, 2 trades of 2.5 standard lots each, or in any other combination.

Another example

Tom has a $3,000 account at 100:1 leverage.

He makes a promise to himself never to trade more than ($3,000 x 20%) $600 of his account as the used margin.

In other words, he will only trade up to ($600 x 100) $60,000 worth of currencies, or 6 mini lots, in total.

Of course, this is just a guideline, and you should modify it according to your trading style and time frame.

Traders who trade on the longer time frames may wish to have a larger free margin to allow enough room for prices to fluctuate against their trade(s), while intraday traders may be more comfortable trading with a smaller free margin.

This post was not written to tell you “what to do”, but to equip you with the proper information to make your own decisions. Once you understand what is margin in Forex trading and how it works, you’re much less likely to end up blowing up your account.

If you like what you’ve learned, please make a comment below or share this post with someone who can benefit from it!

good work Chris. Thanks

Finally a clear and clean understanding of margin and leverage.

Thank you

Hello Chris,

The leverage forex is a useful tool but deadly!

in hand is like giving a child a gun!

attention to the first trader is much better for you to have a lever 1: 10

At least prevents you combine serious trouble.

Good job. Good trading.

Guido.

It’s good to know this which will keep you out of trouble. thank’s for the explaination. It will be very useful. Ed

Hi Chris, nice artical and nearly understand it all, but there was one thing that you did not answer clearly enough because I have missed it and have spend a good 60 min on this.What is Equity and Margin?

On the trading account you get Balance, this is what you have in your account. Then Equity? Margin? and Free Margin, this is how much you can go into the red before a Margin call as explained in your articale.

The problem I have you have your profit/loss number, and the above numbers where none of them tie up.

Hope to hear from you on this

Cheers

Euan

Hi Euan,

Equity refers to the money in your trading account (it’s the same thing as the Balance you mentioned). Often, this is also referred to as your capital. So basically they all mean the same thing.

Technically, margin also refers to your capital, except from a different point of view. It’s concerned with how much drawdown your broker will allow, before closing a losing trade position (without your approval) for you.

Thanks Chris for the explanation.

What a better way to understand Leverage and Margin.

The best explanation of Margin and Leverage that I have seen.

I think of Margin as the maximum the broker is prepared to lend you, and Leverage as the amount you actually borrow from your broker.

Thanks Chris

Hi Chris, thank you very much for the excellent explaination!

Wish i knew this earlier…

Unlimited blessings,

Naseema

Thanks Chris for your explaination

Hello Chris, Thank You very good I now have a much better understanding .

You’re most welcome, Ralph.

Glad this post made a difference to you.

I do very much appreciate you clear and concise explanation regarding leverage and margin. No one I know has explained to me better than you. Thanks you for your concern for us who are just learning these matters

Leland

Great explanation yet again Chris

Have had many discussions about the so called protection that “Low leverage” gives traders … I have always taken the opposite few that the more Leverage your account has the safer it is and the more profits you can make …. BUT of course you have to manage your trade risk ratios properly

I often use the example of how much property you can buy if your bank only gives you say a 50% mortgage

So if you have say $100k then you could only buy 2 properties

BUT…

If they loaned you say at 90% mortgage you could buy 10 properties and hopefully get any profit gains on the whole 10 properties

BUT ..

Of course it would be much more prudent to buy only say 6 properties and keep $40k up your sleeve for a buffer

The higher leverage is way better/safer if managed correctly as you suggest. Why so many so called trading experts and brokers claim otherwise is beyond me

Cheers

Kevin TDT

I’d agree. It’s probably a case of blindly repeating what’s being said everywhere without thinking for oneself.

Brilliant. Thank you. Never understood most of this until now. Great info

Glad to be of service, Mark.

Awesome informations that I never heard online from other experienced traders.

Thanks and keep inspiring people.

If you don’t understand what stocks are, you certainly don’t want to be buying them on margin!

Thank you, I needed to understand how to choose my leverage ratio and lot size before trading on a real Forex Acc. I’m loosing quite a bit on my Demo acc🙈

You’re most welcome Milli.

Don’t sweat it, that’s what a demo account is for – making errors without risking real money. 🙂

Youv’e done an amazing job describing to details. Excellent.

Can you also explain the Spread of the trade, how it works combined with the calculations?

Hi Kim, appreciate the comment!

Are you referring to how the spread works with calcualting the stop loss/profit target, or something else?

Hi say if I had 10k in my account and I was given 1:20 leverage. If I traded all 10k with open position and I saw 10k next morning in negative or red as market dropped. Did I lose any more than 10 k?

Hi Vipin,

You can theoretically lose more than 10k unless your broker provides a guarantee that you won’t (some brokers do).

Tip: NEVER trade with the full amount of your deposit.