March was a super extraordinary month in the markets.

The big news was that the US stock index fell so aggressively it eclipsed even the 2008 crash:

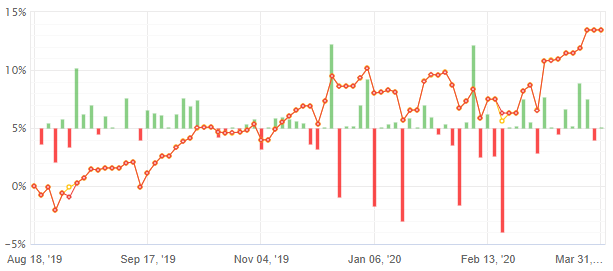

Price volatility across the currency markets shot up to some of the highest levels I’ve ever seen, and it’s been a horrible month for most traders and investors.

So how did the TF strategy perform during this period?

Let’s take a look.

Mar ’20 Trading Update

As it turns out, the TF strategy was not affected by the sudden spike in volatility. It completely side-stepped the mayhem in the markets.

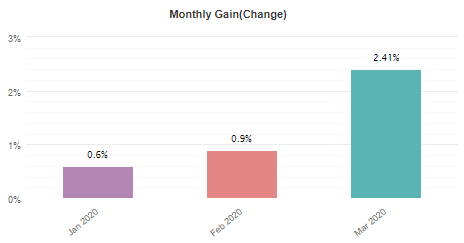

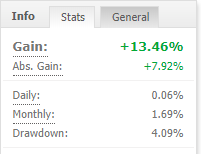

As of March ’20, the TF strategy gained +2.41% with almost no drawdown. In light of all the crazy things going on in the market this month, I’d say this is a good result.

The gain-to-drawdown ratio improved from 0.39 to 0.41, and as mentioned in last month’s report, this is something I’m happy with and hope to maintain.

All in all, the biggest takeaway for me was seeing how well the TF strategy handled the extreme market volatility this month. What we saw was an unprecedented shock that caused a large amount of market damage… and the TF strategy was robust enough to get through it with barely a scratch.

Here’s why this is important: It’s one thing to know how a strategy ought to behave in theory, but having it actually tested in the biggest market crash in decades – in real time, with real capital – is another thing. You never really know how a strategy performs under heavy stress until it goes through a shock event like this.

I am now convinced that I should be allocating a larger portion of my capital to trading this strategy. So in the coming weeks and months, I’ll be diverting more of my funds to it.

What’s New: Lockdown

With most countries enacting travel restrictions these days, I am pretty much “grounded” until the coronavirus is under control (in Asia, at least).

So right now I am playing the role of good citizen: staying indoors and only going outside when necessary. Thankfully, I am back in my home country (Singapore) where the authorities seem to be keeping the outbreak mostly contained.

Wherever you are in the world, I hope you’re keeping safe and staying healthy.

The case for true financial independence

With all the businesses bleeding cash right now, and with so many people soon to be out of a job, I am reminded of a big reason why I gave up a corporate career and got into trading.

This is a “business” that doesn’t depend on customer demand, isn’t at the mercy of suppliers, and has zero HR or logistics problems. In my mind, trading is the best “business” to get into simply because it embodies the purest form of financial independence – your ability to make money depends on one, and only one factor… You.

Think about it. There are many entrepreneurs and businessmen out there who did everything right, and yet, because they depend on customer demand – which has collapsed in a number of industries today – have no choice but to shut their business down.

And the same thing goes with employees. If the business you work for can’t survive with 6 months of negative income (and most can’t), guess what? You’ll soon be out of a job. You are financially dependent on the same factors as your company is.

Now look, I hate to be the guy that says “I told you so” at a time when so many people are hurting. But the best time to take trading seriously was 2,3,4 years ago. The second best time is now.

If you wait until things get ugly before you start pursuing financial independence, it’ll be too late.

This isn’t the first time the world goes into crisis, and it won’t be the last. If you’re fine with being financially dependent on factors that are outside your control, then I have nothing for you.

But if you want a money-making skill that is truly recession-proof and doesn’t depend on external factors, then consider getting serious about trading.

It’s not an easy skill to pick up, and it will take a few years before you get a hang of things, but in my opinion a lifetime of financial independence is worth a significant amount of sacrifice.

What do you think? Let me know in the comment section below.

I agree 100 % with you iam in trading and still learning how to trade . Iam also in another business

and what you mention is true and even happening with me thats why i decided to trade the markets.

Good to hear, Mario. It’s never a bad idea to take one’s financial independence seriously.

You hit the nail on the head Chris. Amist the financial crisis that’s rocking the world now, traders Are calm and unaffected by the elements. This is the right time to take trading seriously.

I totally agree that trading is a very important skill to learn, and also that it is not easy to pick up. But also that Chris is a superb teacher of it!

True that. We have to be financially independent nowadays. I have just started learning and hope that with your insight I can go somewhere.

Thank you for that

You’re welcome. Drop me an email if you’d like me to elaborate on anything in particular.