June had been a month of hits and misses, with less time spent on active trading and more time spent on building algorithmic capabilities.

Here’s a review of what I’ve been up to over the past four weeks.

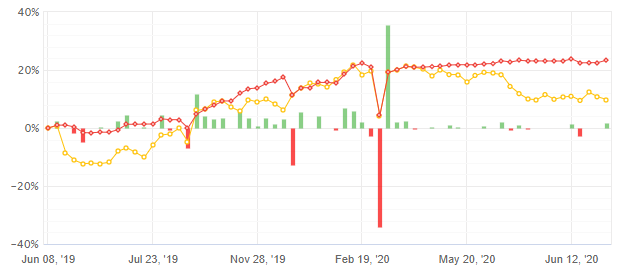

Discretionary trading account in drawdown

The overall market sentiment has been bullish, fueled by expectations of further Fed “money injections” and stimulus packages from the White House.

It seems that the worse Covid-19 situation gets, the higher the stock market climbs as it has learned to expect more handouts from the central bank and the government.

I misjudged the market’s reaction (i.e. lack of concern) for the alarming increase in infection cases, and had to spend most of the month nursing a couple of underwater positions.

With a growing ‘second wave’ of Covid-19 infections now rapidly spreading across the US, it remains to be seen if the market sentiment will remain at elevated levels.

While I am not bearish right now, I am not bullish either. There’s a high degree of uncertainty and I don’t think it’s wise to bet on a clear outcome either way. My opinion is that – in the absence of sudden big news – the overall market outlook is most likely to be ranging in the forseeable future.

For now, I’ll be looking to avoid taking on new positions until I’ve eased the drawdown on this account.

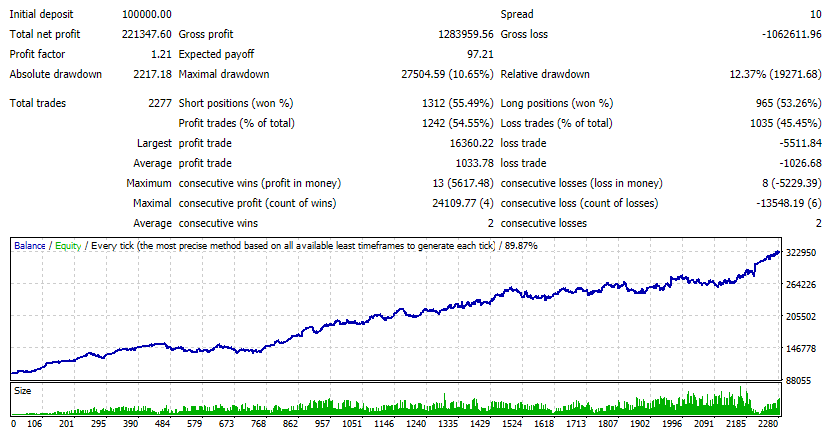

Automated Forex trading

I’ve been brushing up on my coding capabilities (with lots of practice), and am getting the hang of things. A backtest project that previously would have taken me a week to complete can now be done in a few days. The process of creating new algorithms is becoming easier and more intuitive for me.

Here’s the backtest result of one of the algos I’ve been working on.

Of course, not every backtest result looks like this. The vast majority of the algos I’ve worked on turned out to be failures.

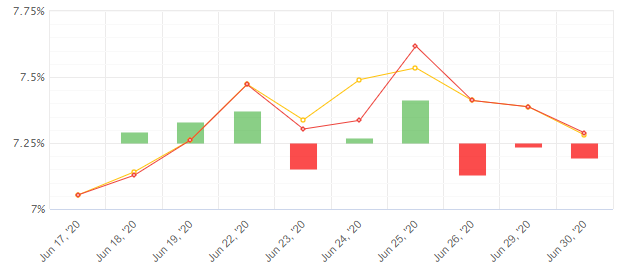

Forward testing now in progress

I’ve started forward testing some of my algos (on a scrappy demo account) to weed out any bugs I may have missed during the backtesting phase.

Once I’m confident there are no major bugs, I’ll be running the algos on a brand new account to track performance.

Zero emotion trading

I was already aware of this benefit of algo trading, but experiencing it firsthand still surprised me.

Since the algo trades are opened and closed without me being there, I feel almost nothing about them. In fact, most of the time I only know about the trades when I check in with the algos to make sure everything is running smoothly.

I find that being one step removed from the “trading action” makes it easier for me to make objective decisions. It’s easier to think clearly when I don’t feel like I’m being pummeled by the market. This is something I suspect will ultimately improve performance but it’s still early days so I’ll just have to wait and see.

All in all, I’m happy with the progress on the algo trading front, and will continue investing more resources into it.

By this time next month, I’ll hopefully be able to report more detailed performance statistics.

Q&A

I’ve received a few questions from last week’s update:

Q: Hi Chris. How hard is it to pick up algo programming? I want to learn this skill but it seems difficult. When I look at computer code my mind goes blank.

A: Haha, I totally understand what you mean. I don’t have a technical background and have zero prior experience with coding. I actually started 2-3 years ago but took a long time to get myself up to speed because I was self-taught and didn’t really know what I was doing.

Coding is basically about writing down a set of instructions for the computer to carry out. You just have to learn how to write your instructions in a “language” that the computer can understand. That’s all there is to it. I’d say it’s easier than learning a new foreign (human) language. As with all skills, the more you practice the better you get at it.

Q: What programming language are you using?

A: I code mostly with MQL4; It’s the programming language native to the MetaTrader 4 platform.

Q: Do you think algo trading is something that can be ‘set and forget’?

I’d say to a certain extent, yes, but not entirely. As far as I can tell, all algos will require some level of monitoring and the occasional adjustment.

Right now I’m checking in on my algos twice a day to make sure there are no errors and to fix any bugs I find. I also expect to be tweaking the trade exposure levels once every month or so. Other than that, once an algo is running I don’t touch (or even think about) it at all.

If you have any questions you’d like me to answer, just drop me an email or leave a comment below.

Chris you’re right about robots needing some level of regular monitoring. Those robots I found on the internet that loaded on my demo? All the profits they were making has been wiped out including a very substantial amount on the original balance on the account. I had a feeling this might happen since have no idea how to code a robot let alone tweaking it for stable if not optimal performance. A robot is just like any other device. You want it to keep functioning normally? You need to maintain it regularly. Else you’ll come home one day only to see that the robot has wiped out not only your profits but your original account balance too.

Hi Okeke,

My thoughts exactly. As the market phase/regime changes, so too must the robot.

Good insight, thanks!