July saw the confirmation of a major shift in the fundamental landscape.

Previously, the financial markets had been responding mostly to economic developments and data trends.

In recent weeks however, the dynamic has changed and the markets are now focused on only one metric: government stimulus.

This has led to some very one-sided price moves, which has been both a good and bad thing for my trading.

First, let’s talk about the bad.

Discretionary account at breakeven

Back in May/June, I was holding on to two positions: EUR/USD and CHF/JPY.

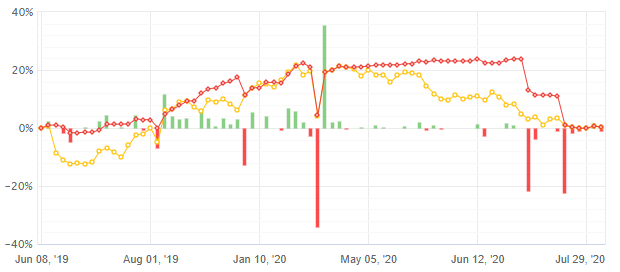

Then, as the fundamental sands shifted, the USD fell off a cliff:

Since I was short EUR/USD, my position went underwater quite quickly.

As was usual, I then looked to scale out of the position on pullbacks, but the market did not give me much of a chance – the EUR/USD shot up with practically no retracement.

On hindsight, I had underestimated the stimulus put forth by the Federal Reserve and the White House. It resulted in a strong stock market rally and the tanking of the US dollar.

As the Covid-19 situation worsened, risk sentiment began to surge. This signaled a major change in perspective as the market stopped caring about the rising number of infections or the looming US recession. Suddenly, all it cared about was the expectation of more stimulus programs. The usual dynamic had reversed: bad news was now good for the market because people are expecting to be bailed out by the government and the Federal Reserve.

And while the EUR/USD was rallying aggressively, the CHF/JPY was pulled along for the ride as the correlation of the two currency pairs tightened.

In the end, I cut off both positions – thankfully – quite early on, before the EUR/USD rallied another 450+ pips.

Nevertheless, the damage had been done. The loss was not catastrophic but significant: the equity on this account has gone back to breakeven.

I did the best I could to limit the damage, but the combination of:

- being positioned in the wrong direction

- on two separate positions that became increasingly correlated

- and were surging without a pullback

…proved too much to handle.

The only consolation is that I managed to keep my initial capital intact.

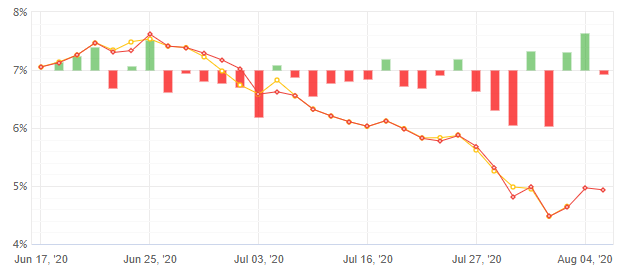

Algo forward testing off to a bad start

The strong price surges (across multiple currency pairs) worked against the algorithms that are undergoing forward testing.

The algos are programmed to profit from price fluctuations under normal circumstances, but the recent market environment has been anything but normal.

Unsurprisingly, the performance on this demo account has been weak.

In the backtest over 11 years the drawdown period can last for quite a few months, so I’m not too concerned about the algos at this time. We’ll see if things pick up again once market conditions get back to normal.

And now, finally, some good news.

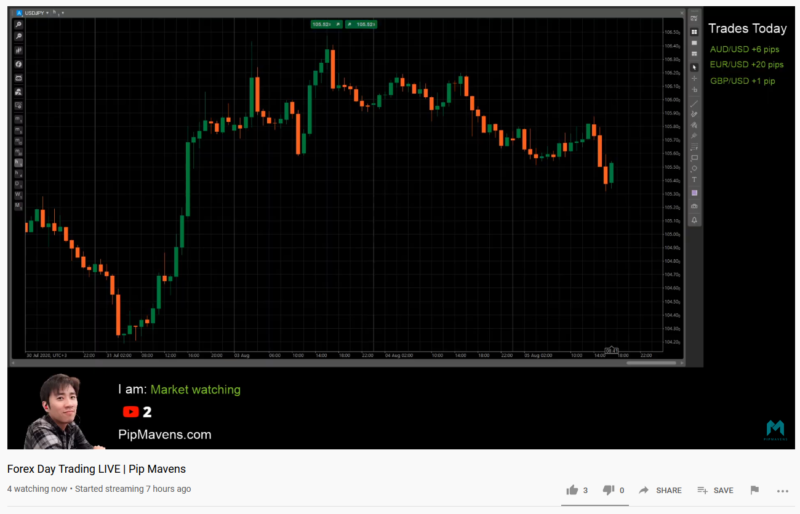

Day Trading (Live Streaming)

The markets have entered a phase where short term trading is favoured; so that’s what I’ll be doing for the foreseeable future.

And with most of my time being spent at home these days (amid the Covid lockdowns), I’ve been live streaming my day trading activity on YouTube.

So if you want to hang out while trading, just subscribe to my YouTube channel. I typically start streaming about an hour into the London session.

That’s all for today’s update. Thanks for reading, and see you in the live stream!

Leave A Comment