Forex Trading for Beginners > Basics > Types of Trade Orders

Types of Trade Orders

Trade orders are an essential part of every trader's toolkit.

When used properly, they allow you to express your market expectations in a highly detailed manner.

To be an effective trader, therefore, you need to thoroughly understand the different types of trade orders available to you, and how they work.

Ask vs Bid

At every given moment, there are two market prices.

This is counter-intuitive because in most areas of life we are used to seeing only one price for things.

For example, when looking to buy a new car, the asking price might be $60,000. We either pay this price, or we don't buy the car.

But that's from the perspective of a buyer.

From the perspective of a dealer, however, there are two prices for every asset: a price for buying, and a price for selling.

Obviously, to make a profit the dealer must sell each unit at a price higher than the price he bought it. As a business, it makes little sense to buy something for $70,000 and sell it at $60,000.

Now instead of cars, let's consider the buying and selling of a financial security, such as stocks.

When you're looking to buy a stock, your broker (dealer) offers to sell it to you at the asking price. This is the price they are "asking for", in order to sell the stock to you. In short, we call this the Ask price.

Conversely, when you're looking to sell a stock, your broker (dealer) will buy it from you at the bidding price. This is the price they are "bidding for" the stock you wish to sell. In short, we call this the Bid price.

In trading, the Ask price will always be higher than the bid price. This means that if you buy a financial security and then immediately sell it, you will incur a loss.

This difference between the Ask vs Bid price is called the bid-ask spread, or more simply, the spread.

The main takeaways here are:

- At every moment, there are two market prices for every financial security: the Ask price and the Bid price.

- You can only buy at the Ask price, and you can only sell at the Bid price.

- The Ask price will always be higher than the Bid price.

With this in mind, we are now ready to start looking at the different types of trade entry orders.

Market Order

The most basic type of trade order is a market order.

It enables you to enter a trade as soon as possible, regardless of the price it gets filled at.

When you enter a market order, you are basically instructing your broker, "Enter a trade immediately at whatever price I can get".

In this sense, a market order prioritizes urgency over trade execution price.

Limit Order

A limit order is somewhat the opposite of a market order.

It enables you to enter a trade at a specific price, regardless of when the trade gets filled.

When you enter a limit order, you are basically instructing your broker, "Enter a trade only at my specified price. If I can't open a trade at the specified price, don't open any trades for me."

In this sense, a limit order prioritizes execution price over urgency.

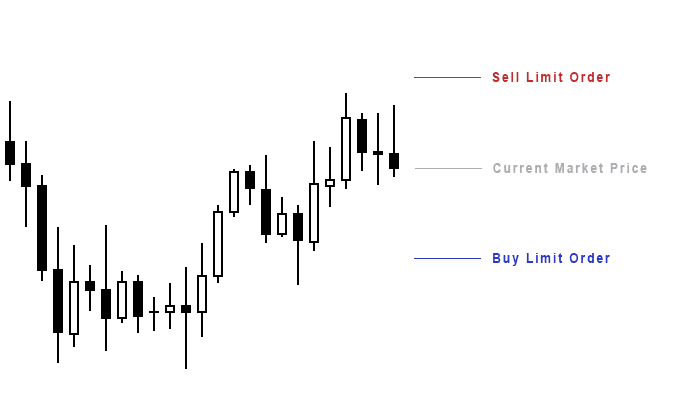

A special characteristic of limit orders is that you can only set a sell limit order above the current market price, and you can only set a buy limit order below the current market price.

You cannot set a sell limit order below the current market price, or a buy limit order above the current market price. That's the function of stop orders, which we'll cover later on.

Note to Forex traders: Limit orders work a little differently in Forex trading.

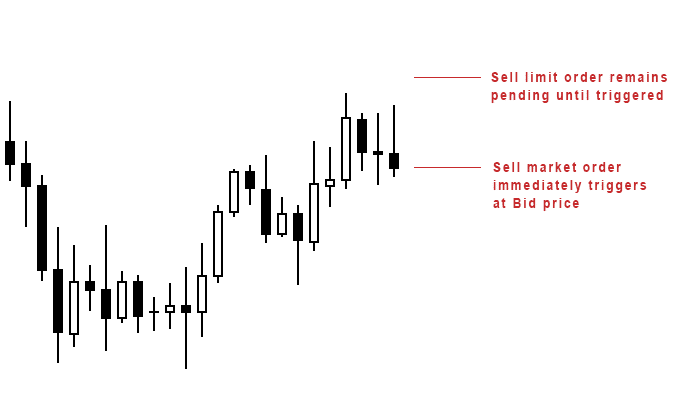

In Forex trading, limit orders get converted into market orders when the specified entry price is hit.

This means that unlike the typical limit orders (in stock trading, for example), limit orders in Forex trading do not guarantee that your trade will be filled at the price you've specified, and is subject to slippage.

Thankfully, since the currency market is highly liquid, most of your Forex limit orders will be filled at, or close to the price you specify.

It's a small difference, but it's something you should be aware of as a Forex trader.

Market Order vs Limit Order

The main difference between a market order vs limit order is that the former immediately results in an open trade, while the latter stays a pending order until the specified price gets triggered.

Market orders are best used in situations when:

- It's important for you to get into a trade as soon as possible, and

- There is ample market liquidity

In low liquidity markets, a market order is likely to result in your trade getting filled at a worse price than you intended.

Imagine entering a market order for a $5 stock, only to have your order filled at $5.50. You might have entered the trade instantly, but you've also taken a -10% paper loss!

Not a good way to start a trade.

So, as much as possible, consider using limit orders rather than market orders, especially if you're a stock trader.

Stop Order

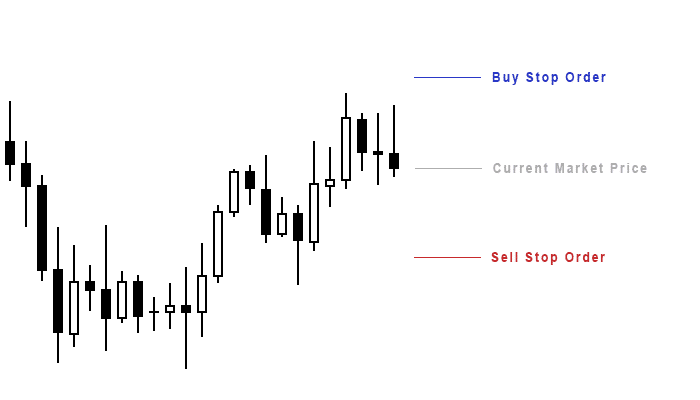

A stop order is a standing instruction to:

- Open a 'Buy' trade at a level above the current market price, or

- Open a 'Sell' trade at a level below the current market price

As such, you can only set a buy stop order above the current market price, and a sell stop order below the current market price.

Limit vs Stop Order

A limit order is similar to a stop order in that both start out as pending orders, and only result in an open order when the specified price is triggered.

The main difference between a limit vs stop order is where each buy or sell order is allowed to be set, relative to the current market price.

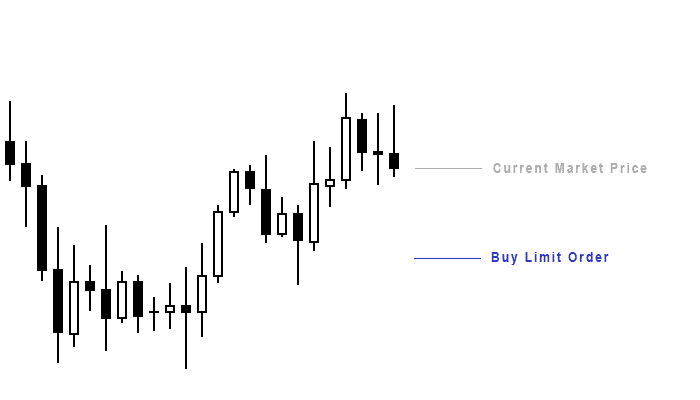

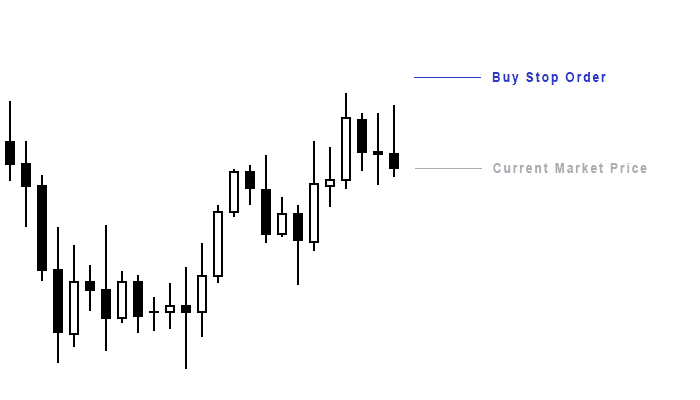

Buy Limit vs Buy Stop

A buy limit can only be set below the current market price, while a buy stop can only be set above the current market price:

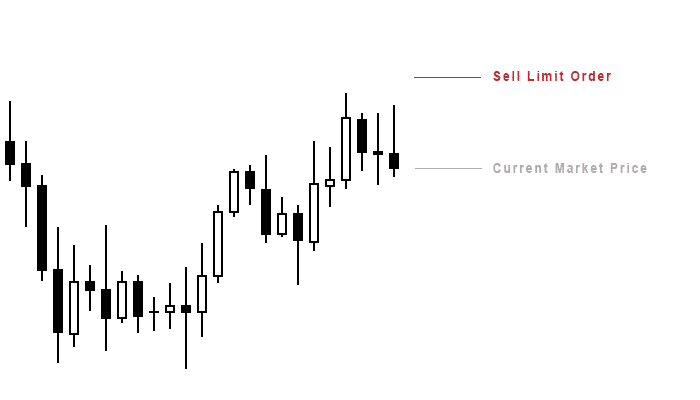

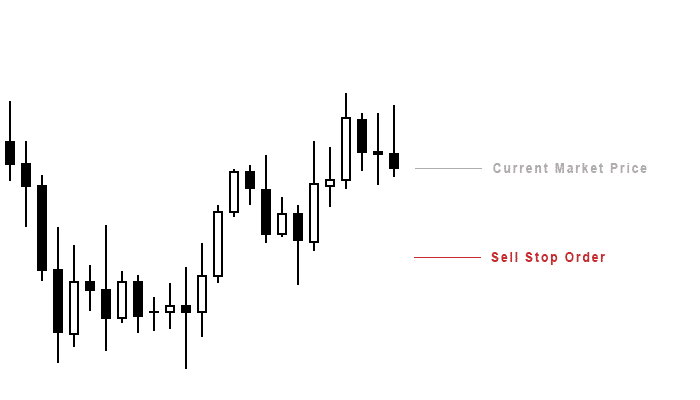

Sell Limit vs Sell Stop

A sell limit can only be set above the current market price, while a sell stop can only be set below the current market price:

One more thing you need to know: while a limit order guarantees your trade entry price, a stop order does not.

This is because when the specified price of a stop order is triggered, it turns into a market order.

Stop Loss Order

A stop loss order is a standing (pending) instruction to close a trade at a specified price level, for a loss.

It's used to restrict the amount of capital that can be lost on a trade.

The rule of thumb is to set the stop loss at a price level where you think the market price should not go.

Once the specified price level is hit, the trade will be immediately closed.

Note that a stop loss order will not be triggered if the market price gaps past the specified stop loss level.

Note: Do not confuse a stop loss order with a stop order.

A stop loss order is used to close a trade, while a stop order is used to open a trade.

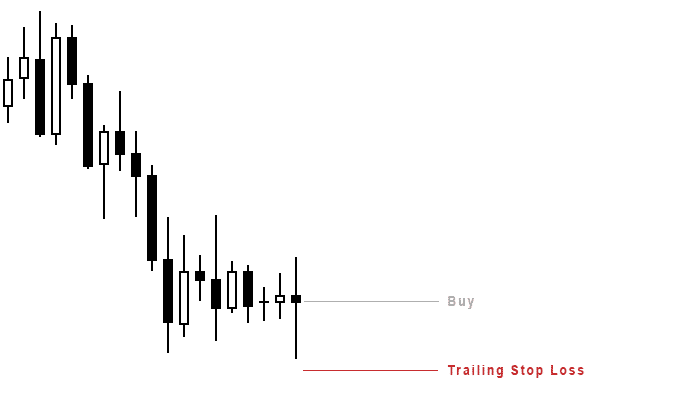

Trailing Stop Order

A trailing stop order is more commonly referred to as a trailing stop loss.

What is a trailing stop loss?

A trailing stop loss is a more advanced version of a stop loss.

In addition to serving as a basic stop loss, it also:

- Moves in your favor when the market price moves in favor the trade, and

- Stays in place when the market price moves against an open trade

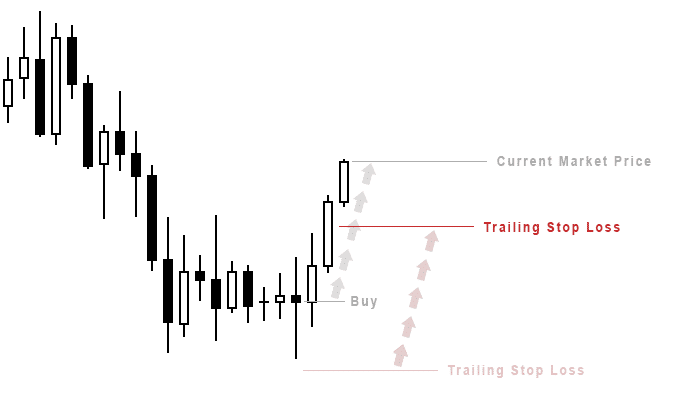

Here's an example of a trailing stop order in action.

First, let's say we enter a buy trade with a trailing stop loss below the recent low:

When the market price moves in favor of the trade, the trailing stop order does so as well:

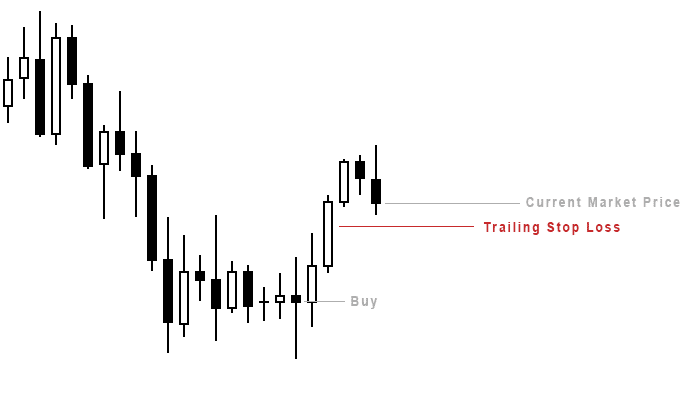

But when the market price moves against the trade, the trailing stop order stays in place:

In this way, a trailing stop loss is designed to "trail" the market price as it moves in your favor. This is best used in strong price trends.

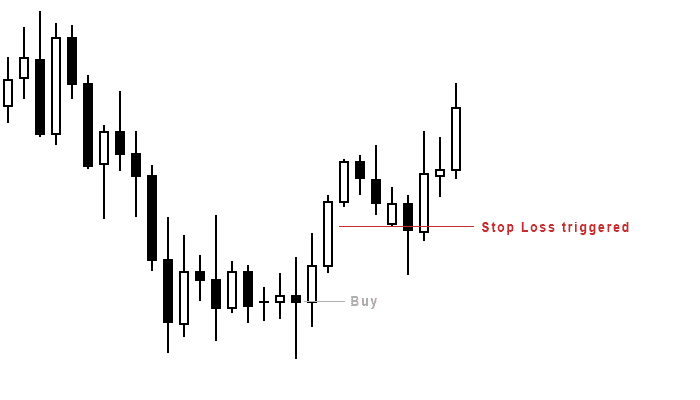

The downside of a trailing stop order is that it can prematurely knock you out of a trade as the trend continues on.

Using the same example, we see here that the trade was stopped out (albeit at a profit) just before the market price continued to move up:

If a normal stop loss was used instead of a trailing stop loss, the trade would not have been stopped out.

As a trader, it's your job to use the right type of stop loss order to suit each situation.

Stop Limit Order

A stop limit order - sometimes called a 'stop limit on quote' - is a combination of a stop order and a limit order.

It is often used in stock trading, and can be used to either open or close a trade.

To understand how stop limit orders work, we must first understand the limitation of regular stop orders.

Since stop orders turn into market orders when the specified price is triggered, the trade entry price is subject to slippage.

In low liquidity market conditions, this can be very risky. Imagine your buy stop order is triggered at $20 for a stock, but the trade gets filled at $24. That's an unexpected paper loss of -20%!

Now wouldn't it be great if there was a way to limit the impact of such slippage?

As it turns out, there is!

That's what a stop-limit order is for.

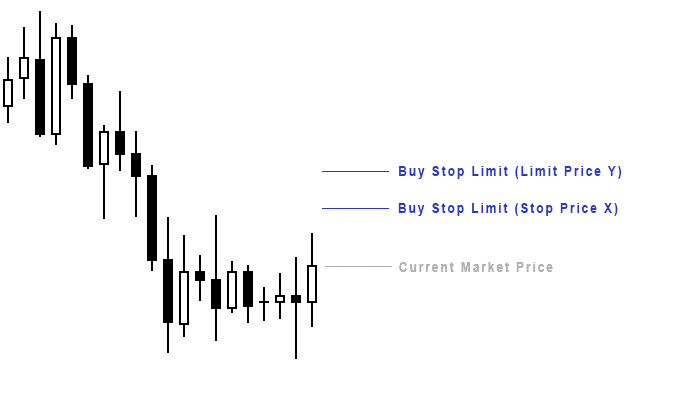

Here's how it works:

- You specify a stop price X

- You specify a limit price Y

- When the market price hits price X, your broker will seek to open a trade for you (as per usual)

- The difference here is, a trade will only be opened if its fill price is Y or better

With a regular stop order, you have zero control over the price at which your trade gets filled.

But with a stop-limit order, you can choose the worst price you are willing to accept for your trade to get filled. If the trade can only be filled at a price worse than Y, no trade will be opened.

Compared to a stop order, therefore, a stop limit order is more conservative.

But that doesn't necessarily mean that it's better!

The downside of this, is that you will miss out on explosive price moves when your trade it cannot be filled at price Y or better.

In such situations, a regular stop order might get filled at a worse price than Y, but it would at least have caught the explosive price move.

As a trader, your job is to use the most appropriate order type for each situation.

Limit vs Stop Limit Order

If you've been following along, you should now know that a limit order is totally different from a stop limit order.

While they are both pending orders, they have contrasting functions and are used for different purposes.

If you're still confused about the two, I recommending reviewing these sections again: limit vs stop limit.

Trailing Stop Limit Order

A trailing stop limit order is a more advanced version of a stop limit order.

The only difference is that this pending order:

- Trails the market price in the opposite direction of the intended trade, and

- Stays in place when the market price moves in the direction of the intended trade

The best way to understand this is with an illustration.

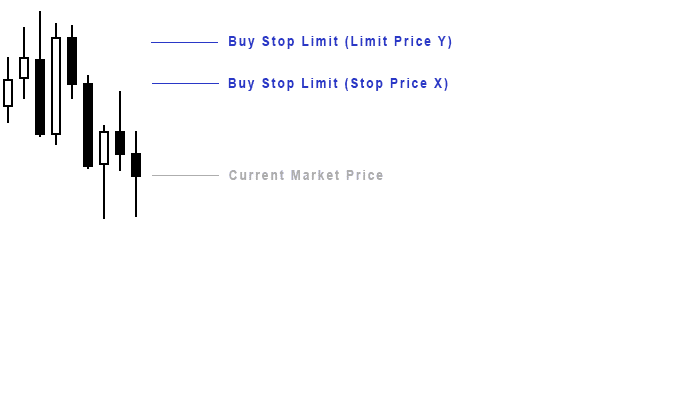

Let's say you set a buy stop limit order:

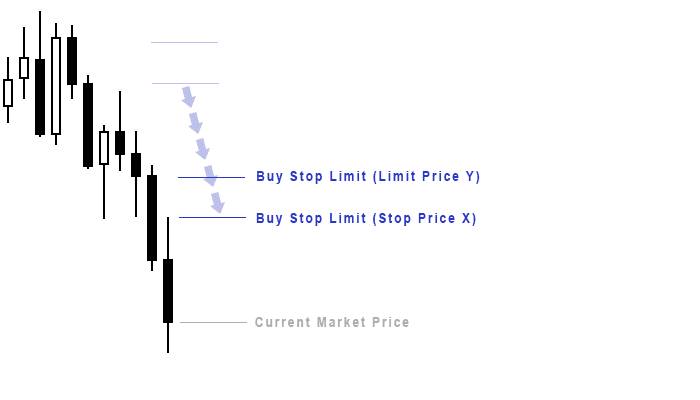

When the market price moves down (in the opposite direction of the intended trade), the buy stop limit order will "trail" the market price:

When the market moves up (in the direction of the intended trade), the buy stop limit order stays in place:

Summary

Each type of trade order serves a specific purpose.

To be an effective trader you'll need to understand their strengths and weakness, so you know which ones to use in different circumstances.

For instance, when trading in a choppy trend it might be a better idea to use a regular stop loss instead of a trailing stop loss.

The better you are able to customize these trade orders to suit each situation, the better your trading results will get!

Next: Coming soon >