Forex Trading for Beginners > Basics > Buying on Margin

Buying on Margin

How It Works

Buying on Margin Definition

Buying on margin refers to the purchase of securities using financial leverage (cash loaned by the broker).

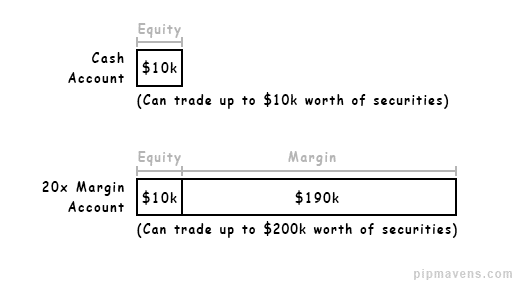

For example, a margin account with 20x leverage can trade securities up to 20 times the value of the equity in that account.

This means that with $10,000, a trader can buy up to ($10,000 x 20) $200,000 worth of financial securities.

A margin account differs from a regular cash account in that the latter only allows you to trade with the amount of equity in your account.

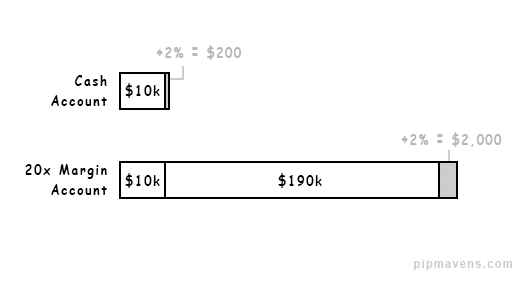

The benefit of trading on a margin account is that it allows you to potentially make more money than on a cash account.

For instance, if you gained +2% on a cash account, you'd make a profit of ($10,000 x 2%) $200.

But if you gained +2% on the full leveraged value of a 20x margin account, you'd make a profit of up to ($200,000 x 2%) $2,000. That's a 20% return on the $10,000 of deposit capital!

Now before you start buying on margin, BE WARNED...

Margin buying amplifies profits AND losses

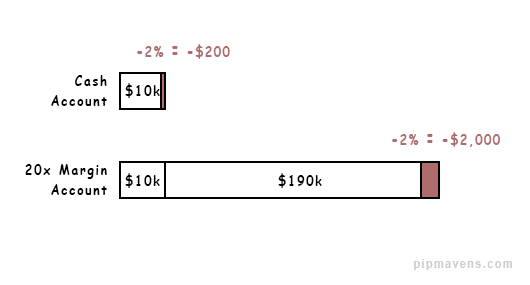

You see... what if the trader had lost -2% instead?

On a cash account, that's a straight-forward -2% loss.

But on the margin account, that's a -20% loss of the deposit capital!

In inexperienced hands, therefore, margin trading can be dangerous. This is why it tends to be heavily regulated by the financial authorities. You can lose a lot of money if you don't know what you're doing.

So if you want to be a successful trader, you need to understand exactly how margin trading works.

And the first step, is to learn about margin requirements.

Margin Requirements

The margin requirement refers to the minimum equity you need in your trading account to open a trade, and to keep it open.

It's usually expressed as a percentage of the total value of the securities being held in an open trade.

So if the margin requirement is 5% for example, you must maintain a minimum of 5% of the total value of the securities in your account equity. Otherwise, you'll get a margin call.

The margin requirement percentage is determined by one or more of the following:

- Financial regulations

- The trading exchange

- Your broker

- The type of financial security

Among all financial securities, the initial margin required to trade Forex and futures is the lowest, ranging from 10% to 1% or less. For stocks and commodities, a much higher margin requirement is usually required.

Used Margin

Commonly referred to as the maintenance margin, the used margin is the minimum amount of equity (in terms of deposit currency) you need in your account to keep your trades open.

You can calculate the used margin by multiplying the total value of the securities being traded with the margin requirement.

If your account equity falls below the used margin level, you'll get a margin call.

Available Margin

The available margin, also known as the free margin or usable margin, refers your account equity minus the used margin.

It's essentially the maximum amount of equity you are allowed to lose on all your open trades before you get a margin call.

Let's say you have a $10,000 account with some open trades that require a maintenance margin of $2,000.

In this case, your available margin is ($10,000 - $2,000) $8,000.

This is the maximum amount you are allowed to lose in equity before the broker starts automatically closing your trades.

What is a Margin Call?

A margin call refers to a situation when your available margin is wiped out and your account equity drops below the margin requirement.

The term originates from the early days of stock investing, when transactions between client and broker were made over the phone.

Whenever a client's account equity dropped below the margin requirement, the broker would literally call up the client to ask for a margin top up, in order to keep the equity level above the maintenance margin level.

If the client did not add more funds into his account (to increase his equity level), the broker would sell the stock holdings until the equity level was above the margin requirement level.

This was how it was done decades ago.

In modern times with most trades being done electronically over the internet, a margin call no longer involves the broker calling you up.

Now, when a margin call is triggered the broker will automatically close your trades (for a loss) until your equity level is above the margin requirement level. You won't get any advance warning.

This is why it's crucial that you understand how a margin call is triggered, and take precautionary steps to make sure it never happens to you.

Example of a Margin Call

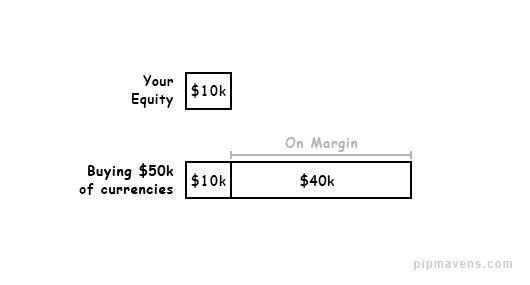

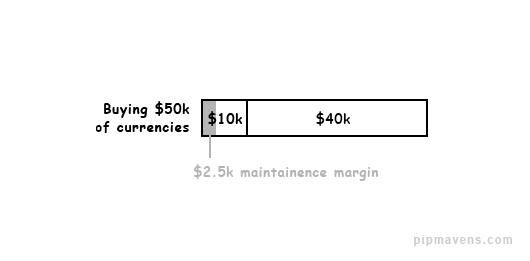

Let's say you have a $10,000 account and buy $50,000 worth of currencies.

If the margin requirement is 5%, you need to have at least ($50,000 x 5%) $2,500 of equity set aside in your account to keep the trade open.

If your equity (of $10,000) goes below $2,500 because of paper losses, your broker will automatically start closing your trades (and book the loss).

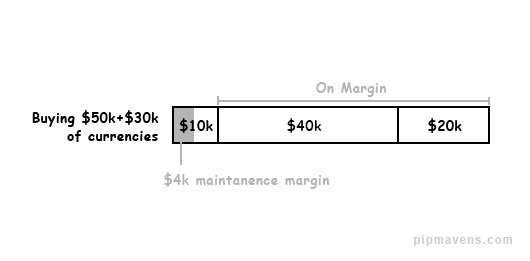

Now let's say you see another trade opportunity and go on to buy an additional $30,000 worth of currencies.

This means you now have to set aside another ($30,000 x 5%) $1,500 of equity on top of the $2,500 from the earlier trade, as the maintainence margin (used margin).

The maintanence margin for keeping both trades open is $4,000.

Now, if your account equity ($10,000) drops below the combined margin requirement ($4,000), the broker will automatically start closing your trades.

The Lesson

The lesson here is that the more you buy on margin, the less "room" there is in your account before a margin call is triggered.

So be careful not to open too many trades, and always keep an eye on your maintainence margin relative to your account equity.

Next, let's look at the different types of trade orders we can use for trading!