Forex Trading for Beginners > Analysis > Hawks and Doves

Hawks and Doves

Definition and Explanation

Historically, the terms hawk and dove were used in foreign policy to describe people who were pro-war and anti-war respectively.

The hawks were those who favoured aggression and physical force to achieve foreign policy objectives, while the doves were those who favoured more peaceful and diplomatic means.

Over time, these terms started being used in monetary policy to describe the preferences of central bank members regarding interest rates and inflation.

Hawkish Meaning

When it comes to monetary (economic) policy, a hawk is someone who prefers low inflation, which is typically achieved by keeping interest rates high.

Here's how the process goes.

When an economy is performing well, inflationary pressures go up, resulting in rising price pressures that - if left unchecked - eventually leads to a lower standard of living for the populace. If the price of food and other necessities goes up 20% (for example) everyone is worse off.

To prevent this from happening, the central bank adopts a hawkish stance, which means they are looking to raise interest rates to prevent inflation from rising too much.

With higher interest rates, the economy slows down, and the inflationary pressure eases.

In this way, a hawk is someone who favours the restricting of economy activity via contractionary monetary policies such as the raising of interest rates.

Easy to remember: A hawk flies high in the sky, so a hawkish person wants high interest rates.

Dovish Meaning

The opposite of a hawk, a dove is someone who prefers high inflation, which is typically achieved by keeping interest rates low.

Here's how the process works.

When an economy slows down, businesses start closing and increasing numbers of people become unemployed. If the situation is left unchecked and deteriorates, all sorts of social and economic problems will emerge.

To prevent such problems from popping up, the central bank will typically adopt a dovish stance, which means they are looking to cut interest rates so that it becomes cheaper for businesses to borrow capital to run their operations and keep workers employed.

In this way, a dove is someone who favours the boosting of economic activity via expansionary monetary policies such as lowering interest rates.

Easy to remember: A dove flies low in the sky, so a dovish person wants low interest rates.

How a Hawkish Central Bank affects the Forex market

One of the most important things a Forex trader must know is whether the central bank is hawkish or dovish.

If the central bank is hawkish, we can expect interest rates to go up in the foreseeable future, which usually causes the currency value to rise.

Conversely, if the central bank is dovish, we can expect interest rates to go down in the foresseable future, which causes the currency value to fall.

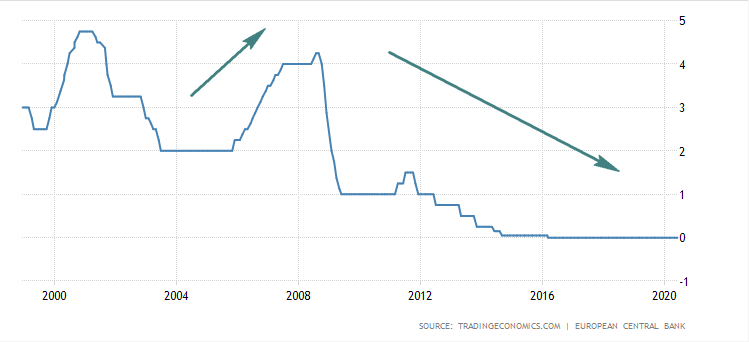

Here's an actual example of the hawish vs dovish stance of European Central bank from 2004 - 2019, compared to the EUR/USD exchange rate:

The European central bank raising interest rates from 2004-2008, then cutting interest rates from 2008-2019.

EUR/USD exchange rate rises from 2004-2008, then falls from 2008-2019.

To find out which central banks are hawkish and which are dovish, you can simply read their monetary policy statements from their respective websites:

- US Federal Reserve (USD)

- European Central Bank (EUR)

- Bank of Japan (JPY)

- Swiss National Bank (CHF)

- Bank of England (GBP)

- Reserve Bank of Australia (AUD)

- Reserve Bank of New Zealand (NZD)

- Bank of Canada (CAD)

To find out the current cenrtal bank interest rates, click here.

Summary of Hawks vs Doves

Depending on the state of the economy, central bank representatives will choose between being hawks and doves.

To be a good Forex trader, you must always be on top of which central banks are hawkish, and which are dovish.