Trading Strategies > Intraday Trading > Day Trading for Dummies

Day Trading for Dummies

The Beginner's Guide To Day Trading

(2020 edition)

Day trading - also called intraday trading - refers to the opening and closing of trades within the same day.

This style of trading is very popular among beginners, as it is often portrayed as a quick, easy, and exciting way to make money.

Practically however, day trading is the most challenging form of trading, and those who try it typically fail.

It also doesn't help that the vast majority of trading "educators" out there are not profitable traders, but savvy marketers pretending to be one.

So before you do anything else...

Check Your Learning Sources

Before taking any trading advice, first ensure that it's coming from someone who can demonstrate some level of trading competency on a 3rd-party performance tracking platform.

This applies to the book authors you follow, trading experts you listen to, and online forums you visit.

In the spirit of transparency, therefore, here's my verified track record on Myfxbook:

Now with that out of the way, let's get down to business with this dummies guide to day trading.

Here are the topics we'll cover:

How Do Day Traders Make Money?

Day traders identify short-term profit opportunities within the small price fluctuations of each day.

They typically do this with:

- News services,

- Technical indicators, and

- An understanding of order flow mechanics

1. News Services for Dummies

Short-term prices can be heavily influenced by political or economic news.

Here are some examples:

Oct 2019: GBP/USD reacts to reports of a Brexit deal on Tuesday and Thursday

Aug 2019: USD/JPY reacts to President Trump's trade war escalation against China on Friday

Aug 2019: NZD/USD reacts to a surprise interest rate cut on Wednesday morning

To avoid being caught off-guard by such news, and perhaps to even profit from them, a day trader follows news websites such as ForexLive and subscribe to news notification services such as Ransquawk.

The moment some market-moving news occurs, the trader is immediately informed. Then, he can quickly take steps to position his trades to benefit from the situation.

2. Technical Indicators for Dummies

Almost all traders use technical indicators to aid with trading decisions, and intraday traders are no exception.

The only difference is that they tend to prefer to technical indicators that are more sensitive (responsive) to the immediate price moves.

For example, instead of using the simple moving average (SMA) indicator, they tend to prefer using the exponential moving average (EMA) indicator as it is more sensitive to the most recent fluctuations of the price.

The EMA is more sensitive to price changes and reacts quicker than the SMA.

Intraday traders also tend to prefer using shorter period settings on their technical indicators.

For example, rather than using the standard RSI period setting of 21, they might use a period setting of 9.

A shorter period setting is more sensitive to price fluctuations

In the chart above, we see that the 9-period RSI is better able to identify overbought and oversold price levels, compared to the 21-period RSI.

In this way, a shorter period setting allows intraday traders look for profit opportunities within the daily price fluctuations.

3. Order Flow Mechanics for Dummies

A competent day trader understands the subtleties of short-term price action and the mechanics of how trade orders are filled.

This gives him a perspective that goes beyond what is ordinarily displayed on a price chart.

A layperson sees just a plain price chart

A competent trader also sees the important demand and supply areas

In observing the how the price moves according to order flow dynamics, the trader builds a picture in his mind of where the largest clusters of the orders are located on the price chart.

This gives him a good idea of where the best short-term trading opportunities are.

How Day Traders Make Money

To summarize, they first have a mental map of where the best profit opportunities are on a price chart, based on a deep understanding of price action and order flow dynamics.

Then, they think of ways to exploit those profit opportunities by taking as little risk as possible, and take action with the assistance of technical indicators.

Lastly, they subscribe to news notification services to be on the lookout for news developments that they can exploit for profit.

It's a multi-layered approach that evolves as prices fluctuate in real time.

Should You Consider Day Trading?

For the average person, the simple answer is no.

The fact of the matter is that over a typical 6 month period, more than 8 out of 10 intraday traders end up losing money.

So if you're thinking of being a day trader, you'd better have good reasons to believe you can perform much better than average.

This being said, how do you know if intraday trading is something you should consider?

You might want to consider it if you:

- Don't have large financial obligations/debts

- Have substantial savings

- Are able to comfortably pay your bills

- Are an introspective person inclined towards rational and logical thinking

- Are willing to spend years building the relevant mindset and skills

On the flip side, you should not be considering it if you:

- Are heavily in debt - (clear your debts first)

- Are low on savings - (build up your savings first)

- Need quick cash - (the pressure will work against you)

- Expect to transition into full-time trading within a year - (very unlikely)

Intraday trading CAN be very lucrative if you know what you're doing.

The thing is, it will probably take at least 2 years of dedicated effort before you begin to get the hang of it.

In the meantime, you'd be bleeding capital along the way.

Sounds difficult?

Good. That means you're starting to get it.

Can You Make Money Day Trading?

The reality is that the road to profitable day trading is full of adversity and struggle. The sooner you accept this, the better.

And if you're not willing to go through the harsh and prolonged journey of getting there, then it's better that you don't start at all.

Profitable intraday traders are like the Navy SEALS of the trading world - the elite of the elite.

If you want to count yourself among them, be prepared to persevere over the first few years of training.

So the bad news, is that most people fail at day trading.

But the good news, is that a minority of people do, and they are very successful at it.

The Best Market For Day Trading

Since day trading involves taking small profits within a relatively short period of time (under 24 hours), the quality of daily market conditions is especially important.

The first characteristic of a conducive environment for day trading is high liquidity.

Liquidity for Dummies

In trading, liquidity affects the ease at which your trade orders are executed at the desired price.

A market with high liquidity means that when you enter an order - even at large volumes - the order can be filled at (or close to) the price you see on the trading chart.

For example, if you see a stock is trading at $30.11 and you click 'Buy', your order should be filled at the price of $30.11, or at worst, $30.13.

If the order gets filled at $30.14 or more, this could add anywhere from 5% - 30% of additional cost to your trading bottom line - which is a HUGE difference.

Because of this, day traders are very particular about the liquidity conditions of the markets they operate in.

Price Volatility for Dummies

The next important characteristic to watch for is price volatility.

As intraday traders close their trades by the end of each day, they must choose to trade securities with sufficient price movement on most days.

Some stocks, for example, barely move a few cents on a typical day.

Intraday traders tend to stay away from such financial assets as there isn't sufficient price volatility to provide regular opportunities.

Trading Hours for Dummies

Many financial markets have restricted trading hours.

In US stock trading (and stock options trading), for example, the market is only open from 9:30am - 4:00pm Eastern Time, and is closed on public holidays.

Compare this to the currency (Forex) or Cryptocurrency markets, which are open 24 hours a day, even on public holidays.

While some people might be inclined towards the restricted stock trading hours, intraday traders tend to prefer the flexibility of the markets that don't close.

Barriers To Entry for Dummies

Each asset class has its own barriers to entry.

In the US for example, stock trading requires one to hold a minimum of $25,000 in the trading account at all times. This rule applies to everyone who fulfills the criteria of being a pattern day trader.

In futures and options trading, one would will need a minimum of $3,500 - $5,000 in capital to get going.

For Forex and Bitcoin, one can get started with as low as $200.

So What's The Best Market For Day Trading?

As you can tell by now, the Forex and Bitcoin markets have several advantages over the others.

Personally though, I prefer trading just one these markets.

Which one is it?

Let's see.

First of all, the Forex market is much larger than the Bitcoin market. At the time of this writing, the former is over 20 times larger than the latter.

Also, while all good Forex brokers are regulated by the financial authorities, many Cryptocurrency exchanges are not (yet) properly managed and regulated. This subjects Bitcoin traders to a much more counter-party risk.

On the whole, therefore, my view is that the best market for day trading is the Forex market.

Basic Day Trading Strategies

There are are two basic types of day trading strategies: "Momentum" and "Fade".

Momentum strategies focus on trading in the direction of strong price moves, while Fade strategies focus on trading off short-term support/resistance levels.

Momentum Strategy - Day Breakout

The first type of strategy is the Day Breakout.

The essence of this approach is to trade the breakout of the previous day's high/low price.

There are two variations to this strategy.

In the first variation, we place a buy stop order above the previous day's high price, and/or a sell stop order below the previous day's low price.

This is the more aggressive variation of the strategy that is best used during strong market-moving news events.

The idea is that if some big news pushes prices above the previous day's high price, we want to be buying. Conversely, if the news pushes the market price below the previous day's low price, we want to be selling.

In any case, a stop loss order should be set relatively close to the entry price, and the profit target should be placed at the next major resistance level with a minimum 1:2 risk-reward ratio.

The second variation of the strategy is the one that should be used in the absence of strong market-moving news.

In this variation, we first wait for a breakout to occur, and enter a trade upon a re-test of the breakout level.

Occasionally, prices will come back to re-test the breakout level, and this is where we want to set a limit order to trade towards the direction of the breakout.

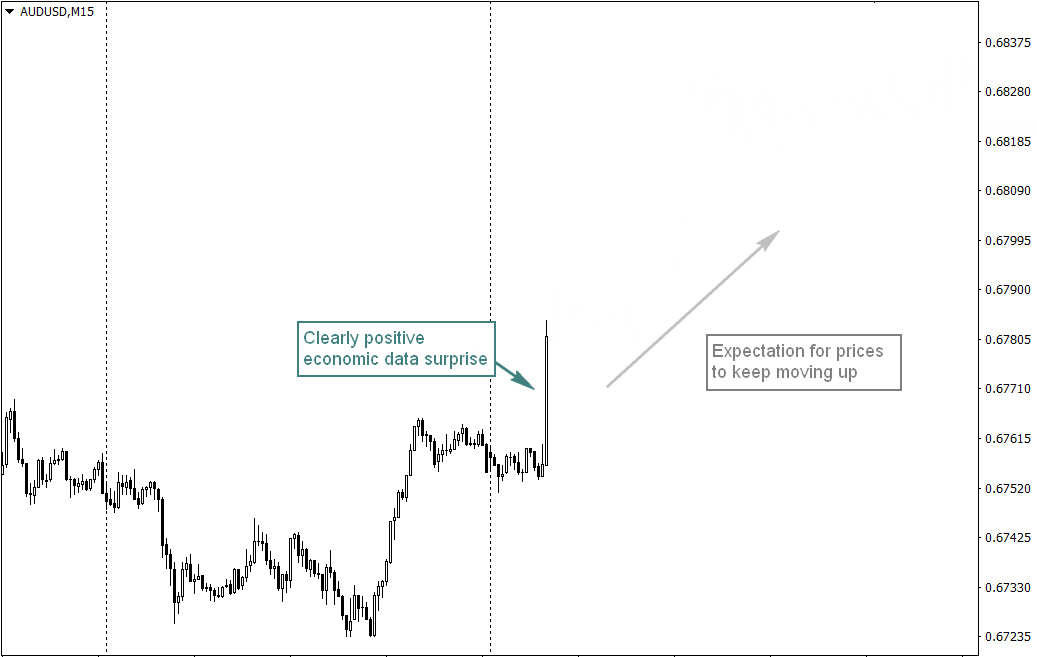

Momentum Strategy - News Surge

The next type of momentum strategy is the News Surge.

The idea behind it is simple: wait for a strong market-moving event to occur, and enter in the direction of the price surge.

For example, below we see a strong positive surprise of the employment data for the Australian economy:

Within the first 15 minutes of this surprise news release, the AUD/USD rallied strongly:

Upon seeing BOTH a data surprise and a strong price reaction, we will enter in the direction of the price surge. In this case, we want to be buying.

The trick to this strategy is to only trade upon events of with an unambiguous surprise (either positive or negative).

If it's not absolutely clear that the news is "good" or "bad", no trade should be taken.

With this strategy, there's a good chance of a profit.

The downside, however, is that unambiguous surprise events like these seldom occur.

If you can be patient to wait for the right setups, this is a good trading strategy to add to your trading toolkit.

Fade Strategy - Day Breakout Failure

This strategy is the flip side of the Day Breakout strategy (first variation).

When prices:

- Temporarily break the high/low price of the previous day, and

- Quickly move back past the pre-breakout level

...we will enter a trade in the opposite direction of the initial price breakout.

Example:

Upon seeing a failed breakout of the previous day's high/low price, we'll:

- Enter a trade in the opposite direction of the breakout,

- with a stop loss just beyond the failed breakout candle,

- and a profit target of at least twice the stop loss allowance.

Unlike the Day Breakout strategy, this strategy should be used only on days with no major news releases.

Day Trading For Beginners

These are the basic approaches that will get you started.

While there are other types of trading approaches - such as swing trading - the ones I've covered here are simpler to execute, so give them a try first.

Eventually, you will want to modify these strategies to suit your risk preferences... but don't change the trading rules too much, as they are based on time-tested supply and demand principles.

Now if you're ready to try to day trade, here's what to do next.

How To Try Day Trading

To try day trading, you first have to choose a market to specialize in.

As mentioned earlier, my view is that Forex day trading is the best approach, so that's what we'll go with here.

You'll need to learn:

- How margin trading works

- How currencies are traded in pairs

- What a lot size is, and the appropriate volume to be trading with

- How to calculate the value of one pip

- The different types of trade orders, and how to use them

- The 3 main trading sessions of each day

Next, register for a brokerage account that's fully regulated in the US, UK, Singapore or Australia. These countries have strict rules that protect you from unethical brokerage practices.

Do not register with brokers incorporated in Cyprus or the Caribbean islands.

Lastly, experiment with the various trading platforms offered by reputable brokers. Start with a demo account and practice with the basic strategies I outlined above.

Keep your risks small and practice trading for a minimum period of 6 months before deciding if day trading is something you should pour more effort into.

Read all the trading books you can get your hands on, and never stop learning.

Successful day traders spend many years honing their craft before they see positive results, so if you choose this path to trading you must be prepared to be in it for the long haul.

Day Trading For Dummies

Day trading is often portrayed as a sexy and exciting way to generate an income.

The reality of it, however, is that day trading is hard. Among all market participants, day traders have the lowest rate of success.

This is why I always recommend newcomers to first try being profitable on the longer timeframes (such as with swing trading), before considering to day trade.

If you absolutely must begin by day trading, take my advice: start small, follow these trading tips, be prepared to work hard, and keep learning from mistakes.

Next

How To Become A Day Trader

>