Are You Ready To Set Aside Your Fancy Indicators

And Focus On The Real Facts That Create

Consistent Trading Profits?

I have to start with this question because not everyone out there is comfortable listening to the truth, even when it’s backed by cold, hard facts.

Some people prefer excuses to real achievement, and others prefer fantasy to reality.

This manifesto will not tell you what you want to hear – it will tell you what you need to hear.

If you’re not ready to have your assumptions about retail Forex trading sorely tested (and probably turned on its head), close this page right now.

If, however, you’re ready to explore the counter-intuitive truths behind why you’re struggling with trading, proceed with an open mind.

We All Want To Believe

These days, everything you could ever want to know about trading can be found with a simple Google query. Brokers are everywhere, and anyone can learn to trade online in less than a week.

This really seems like a time where even the ‘little guy’ can get rich, doesn’t it?

Here’s the dream we all want to believe: “Anyone with a laptop and internet connection can start trading and make money. After some practice and experience, I’ll be able to quit my job and make even more money trading full-time from home.”

Ahh. If only it were that simple, we’d have a world full of homemade millionaires.

You see, this is only half the story.

It all really comes down to a matter of capital and strategy.

Allow me to explain.

The Secret Ingredient to Financial Success

I started trading back in 2005 when the retail Forex industry was relatively new (it still is, by the way). Indeed, I was able to attain a significant level of success trading a few hours a day by myself, even though I was stuck in a day job back then.

The most important advantage that retail Forex trading gave me was the availability of leverage. Of course, there are many other advantages, but this is by far the most important for someone with less than $100,000 to start making serious money.

If you’ve studied how people attained great wealth within 5 – 10 years, you’ll find the common denominator to be their ability to use some form of leverage. This is perhaps best demonstrated by the financial success of Mark Zuckerberg (of Facebook) and Jeff Bezos (of Amazon.com) who leveraged the internet to reach more than a billion people online.

A small hedge fund can trade millions of dollars in assets, which puts it way out of reach for more than 99.9% of the world’s population. With the leverage provided by the retail Forex industry however, just $20,000 will do it. Never before in the history of the world has such an opportunity been made available to regular people.

The fact of the matter is that the world of trading has changed. Previously, only wealthy individuals were allowed to speculate in financial markets. These days, a college student can deposit $500 into an account and start trading in 2 weeks.

Traditionally, any gains made from a $500 account wouldn’t be worth half the effort (for both the trader and broker), but with leverage, the student can now find himself with a significant increase in pocket money, with no additional effort.

And what about the young working professional or retiree with a $20,000 account? There is suddenly the very real potential for a trading income that can replace that of a full-time job. This is what usually causes people to pick up trading – the promise of a new income steam. Not necessarily to get rich (not yet, anyway), but an extra $300 – $700 per month now wouldn’t hurt, right?

But Here’s The Rub

Pit an average retail trader against a multi-million dollar hedge fund – with all their specialized knowledge, resources, experience and manpower – who do you think will win in the end?

Clearly, all things being equal, the hedge fund will easily beat up the retail trader and take his lunch money.

But notice I said “all things being equal”.

The Silver Lining

Military history tells us that although strength is a key to winning wars, weaker forces have indeed defeated stronger ones, many times before.

Can this also happen in an online trading environment?

Coming from Singapore, where we have a conscript army (all able-bodied men must serve in the military for two and a half years), I’ve learned a few things about winning and losing on the battlefield.

If you’ve taken a look at the world’s military history, guerrilla warfare was the prime cause for many of the major upsets in war. History has consistently shown that small groups of men, applying the proper strategies and tactics, can cause great damage and stand up to armies of far greater size.

Firepower is not all that counts. If the general of a large army fights the guerrilla on the same terms as he would another large army, he is in for a rude awakening. The guerrilla has no regard for the rules followed by the great army.

An expert is not afraid of another expert. He is afraid of the fool, because he has no idea what to expect.

This is the same reason why the world is having such a hard time fighting terrorists – they don’t operate on the same terms. The enemy is no longer wearing a uniform we can easily recognize and shoot down. How do you fight an enemy that you can’t identify?

It soon became clear to me that as a retail trader, I cannot expect to survive long in the markets if I traded on the same terms as the professionals. I had to trade like a guerrilla. So that’s what I did.

The outcome being that I was able to quit my job, trade from home (and often overseas while on vacation), and never having to worry about writing a resume or gaining employment.

Can one really make a comfortable income trading Forex at the retail level?

The answer is yes.

Will most people who attempt to do so, ever achieve this?

The answer is no.

This has little to do with the inherent difficulties of trading, but rather that it is the nature of trading for the majority to always lose. The fact is that for me to buy at a low price, I need the effort of others to keep buying to push prices higher for me to sell at a profit.

If this makes sense to you, keep reading. You’ll probably pick up something here that will completely change the way you look at your trading.

The purpose of this manifesto is not to tell you something about trading that can be easily found online (or indeed, anywhere offline).

This will not be about the history of Forex trading, or market entry/exit techniques that everyone seems to be so crazy over.

If you’ve spent considerable time, effort and money learning new trading tactics but still struggle to make a decent trading income, this manifesto will reveal what you (and countless others) are doing wrong… and how to fix it once and for all.

I will explain a few facts that will give you a completely different perspective of Forex trading at the retail level, and how you can “up” your trading game to a level far surpassing that of your peers.

The 249% Profit Track Record Behind This Manifesto

Just so you know, I didn’t dream up the material in this manifesto overnight.

I’ve been trading for over 9 years and have a track record of showing my trades LIVE in front of a public audience, attaining a 249.03% profit over a period of 5 years. That’s an average 49.81% gain per year.

We’ll talk more about this at the end of this manifesto, so keep reading.

Who Is Chris Lee?

You might know me from the Candlesticks e-book I published in 2008.

In an industry filled with quick-fix tactics and trading robots that lost a lot of money for a lot of people, this e-book was an honest breath of fresh air for many traders.

After publishing this e-book, letters and email testimonials came in faster than I had time to read them (although I eventually did).

It didn’t occur to me at the time, but the e-book had provided a channel of constant communication between me and thousands of frustrated traders who kept losing money.

It gave me a unique insight to the real problems plaguing retail traders, and I’ve since spent considerable time and effort figuring out how to solve them.

Then about five years ago, I disappeared from the limelight and began working on a “trade along with me” program where I taught my trading method to members by taking LIVE trades in the market.

Unless you’ve invested in the e-book, chances are that you’ve never heard of me. That’s OK, because the trading principles I teach won’t be easily accepted by the masses, and will probably never be popular.

This is perfectly normal, because only a small portion of retail traders will ever see success in the markets – the game of trading is such that whatever is popular is unlikely to work.

Why I Changed My Mind About Sharing This Material

I have never given away information as important as this, for free. But I’m doing it now for 3 reasons:

- First, I am ever more disgusted with the magic pills and silver bullets being peddled online. I despise seeing people led down dead-ends with trading methods that can never work in the long run.

- Second, it is getting increasingly hard for regular people to make a decent living. Jobs are getting cut and retirement funds are in danger of being wiped out. If there ever was a time to be serious about picking up the knowledge and skills to be financially independent, it is now.

- Third, there isn’t much time left. The retail Forex trading industry is changing in ways that do not benefit small-time traders. The faster you can build your account to $25,000 – $50,000 or more, the safer you are from the changes that are coming. More on this later.

I started my publicizing my trades LIVE in April 2009, right in the middle of the global financial meltdown.

This was the time when the investment giants Bear Sterns and Lehman Brothers collapsed practically overnight, Citigroup dropped below $1 per share, and the world continued on to suffer the longest list of bank failures in history. Talk about being at the wrong place at the wrong time.

Despite all this however, our small group of traders enjoyed a 79.38% win rate and an average return of 102% per year during that period.

What I’ll be revealing here are some of the concepts and principles that got us these results.

I’ll Take You Beyond The Usual Short-Term Tricks

As you read this manifesto, I promise to take you beyond just another trade entry/exit technique that might make you some money temporarily.

The stuff I’ll be revealing to you is as true as gravity, regardless of the tools and indicators you might already be using.

If trading can be likened to building a house, indicators are the tools we use to build it; and what I’ll be sharing with you here is about the architectural design.

Regardless of the quality of building materials or workmanship, a poorly-designed house will collapse – it’s only a matter of time.

The key is to have your house designed with the right foundations to begin with.

If you’ve been trading for more than 6 months but are still struggling to make consistent profits, it’s likely that your problem is not about finding more tools, but rather finding the right design (plan) to properly use the tools you already possess.

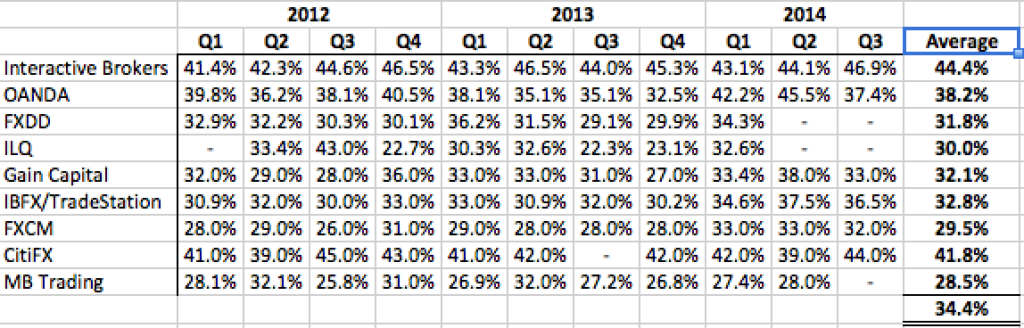

FACT: More than 65% of retail Forex traders lose money after 3 months.

Here’s a list detailing some of the major retail Forex brokers, and the percentage of profitable trading accounts every quarter:

This means that the average retail trader has an approximate 1.4% chance of being profitable every quarter of the year.

So don’t be too upset if you find that you’re having trouble making money – an overwhelming majority of people don’t. And in this manifesto, I’ll explain why.

I’ll show you how to tell if a trading strategy is likely to work in the long run.

You don’t want to waste time and effort on a strategy that makes

money temporarily, but loses effectiveness after a few months.

For some, a small modification to their trading method is all that’s needed. For others, a complete strategic overhaul will be required.

Whatever trading strategy you’re applying right now, regardless of the technical indicators you’re using, this information can raise your trading to a level you may never have thought possible.

I Also Promise You The Trading Principles

That Will Never Go Out Of Style

You can walk into a magic shop, buy off-the-shelf tricks and use them to entertain your friends for a few days… but you can only perform those tricks a couple of times before their effect wears off.

The secrets I’ll be sharing with you is not about getting new tricks… it’s about understanding the foundational principles of how to continuously mystify people.

Once you understand these principles, you’ll immediately see not only why so many retail traders lose, but also why they will never be profitable in the long run.

You’ll discover what you’ll need to do to change your

experience of trading from “frustrating” to “enjoyable”

You do NOT need any special background, education or skills to use this knowledge. The only thing you’ll need is will to make the changes you know you’ll need to be making.

I can tell you exactly what you need to do and even give you a map on how to do it – but you need to be the one to take action.

After going through this manifesto, most traders will realize they can’t keep trading in the same way… and this will be met with internal resistance because it is human nature to resist change.

In the end, your willingness to make the changes you KNOW you’ll need to make, will spell the difference between long term success, and short-lived profits.

It’s your choice.

A Lesson in Recent History

Until recently, I purposely avoided the spotlight and all online publicity… despite being constantly sought after by numerous internet marketers and robot-selling vendors who asked for my participation in the promotion of their products.

If you’ve been surfing online for trading strategies in the past 3-6 months, you‘d have seen a couple of them. And if you’ve been my subscriber all this time, you’d know that I don’t promote these $97 “automated teller machines”.

In fact, I avoided them like the plague, and for good reasons.

Just by looking at how those robots took trades, I knew there was no way they could be profitable in the long run. It was only a matter of time before these machines blew up… which they eventually did, in just a matter of months.

The only people making money from this were the sellers of these “magic boxes” and a few traders who got lucky.

Whenever one of these robots blew up, the sellers simply disappeared and re-emerged later with a new website, selling a new robot, under a new name.

The retail Forex industry became an ugly place.

Every other day, I would hear about people blowing up their accounts with robots, and yet they would continue searching for the next “sure-win” automated trading solution.

This sickened me.

Don’t get me wrong – it wasn’t that I felt sorry for those robot users.

On the contrary, I think they got what they deserved. They were looking to make money without learning or practice. They were looking for a free lunch: pay $97 once for a robot that makes $500 per month.

Yeah, right.

These people didn’t want to put in the effort to learn to trade for themselves… they wanted a chuck of computer code to think and make decisions for them, for a low one-time payment of $97 (“Quick, where’s my credit card!!”)

The truth is that automated robots are simply tools. And just like any other tool, their effectiveness depends entirely on when and how they are used. Sadly, most robot users don’t even know how they work.

It’s one thing to understand exactly what the robot is programmed to do, and under what circumstances it should, and should not be used.

It’s another thing to run the robot on an account without knowing anything about its operative parameters.

Unsurprisingly, many people got burnt for their laziness and greed.

I’ve had the enlightening experience of receiving more than a few emails from people who were truly sincere about making money trading, but didn’t want to actually learn how to do it.

To this day I still can’t believe how naïve some people are. This is like wanting to be a Formula 1 driver without ever having to step inside a car.

It’s utterly ridiculous.

OK, I get your point Chris.

But You’re Kind Of… Rude?

Why, thank you. In the years that I’ve been teaching people how to trade Forex, I found that being “nice” doesn’t help.

An army recruit may resent his sergeant for being strict on discipline, but in war, it could very well save his life.

Trading is war, people.

If you want the financial rewards and freedom that comes with this, you’d better be ready to hear some hard truths. I’m not here to make merry.

I’m here to smack you on your helmet, tell you to hold on to your rifle, stay low and don’t get shot. Try to be a hero and the market makes an example out of you.

If you can do this, you stand to possibly change your life in ways you probably can’t even imagine right now.

I wrote this Manifesto to get people to WAKE UP and get their heads out of the clouds.

Trading is serious business, and unless you have some operative knowledge about how the game is played, you’ll always be the guy with the short end of the stick, wondering why your account keeps dwindling.

Get Ready

Trading at the retail level is inherently difficult because the principles that bring success often run counter to what we’re used to in our daily lives.

In other words, for most people, winning at trading is not something that will come naturally – it’s something that has to be learned and trained.

The concepts and principles I’m about to share with you were learned the hard way – through painful experience and careful reflection.

After dedicating almost every waking hour to figuring out the game of retail Forex trading, I now present a portion of what I’ve learned here for anyone who might have an interest in attaining financial independence with Forex.

Use this knowledge to better your trading and your life.

Let’s begin.

The Real Reason Why Retail Traders Struggle

Let’s start with uncovering the reason why you may be struggling with your trading.

Depending on your experience, you’re likely to fall into one of these categories.

Sound familiar?

Here’s the good news: there is a common cause to these problems.

And you’re about to find out exactly what that is.

An Open Advantage

I have a confession to make – I sometimes to go to trader gatherings acting as a new trader. I do this to experience first-hand, the real frustrations of people who are struggling with trading.

Why do I do this? Because I get more realistic feedback as “one of the strugglers” rather than as a winning trader. People tend to be less straightforward with me when I’m perceived to be “better” or “different”. I want to know what’s really going on in their minds, not what they want me to think.

So what did I discover?

Almost every time, I’m struck by how everybody is approaching trading the wrong way.

You see, although retail traders understand the technicalities of trading (like, what the pip spread is), few actually use this knowledge to their advantage.

This is the prime cause for so much struggling and time wasting. It’s the reason why the overwhelming majority of new traders will fail in achieving their dreams even if they buy lots of “how to” products, study them religiously and work extremely hard at it.

This is going to be important, so read the following carefully.

Your Trading Business

Before we proceed, I need to make sure we’re communicating off the same level of understanding. This way, we’ll avoid any confusion and unnecessary guesswork along the way.

To kick things off, we need to step back and take a look at the business of running a trading operation.

All traders run a trading operation – some just do it better than others. Most are not even aware that they’re running one.

Losing traders treat their trades like lottery tickets: each one having no connection to the others. Trades are taken in isolation, each one serving as a lottery ticket that – hopefully – makes some money. If not, they just keep trying until they get lucky, or wipe out.

Winners, on the other hand, have a plan. As retail traders, they know that certain trading styles put them at a natural disadvantage, and so they cleverly avoid those. Each taken trade plays a role in an elaborate strategy that skews the probabilities in their favor.

Winning traders do not know which specific trades will be winners or losers, but they know they are likely to walk away richer than when they started.

Planning To Win

The first reason wealth eludes so many traders is poor preparation. The path to success begins with the words ‘I need a plan’.

But an effective plan is more than simply a series of steps to follow. How do you know your plan is likely to work?

Even among the minority of retail traders that have a plan, most have absolutely no idea how effective it will be. Here’s an example.

Would you bet money on yourself in winning a street fight against Bruce Lee?

Probably not.

You know the moment you step within his reach you’re going to get your ass handed to you. It’s not a matter of IF you’re going to lose; it’s a matter of HOW QUICKLY you’re going to lose.

In the same way, retail traders pit themselves against the trading equivalent of Bruce Lee every day – they click the buy button thinking they might win in the end, when they never stood a hair of a chance to begin with.

Most retail traders have no idea how heavily the odds are stacked against them.

Here’s why:

1. Retail traders don’t know who they’re trading against; and

2. Their plan for success (if they even have one) don’t take into account their natural strengths and weaknesses as retail traders.

Now imagine on the other hand, that you’re a skillful chess player and you challenge Bruce Lee to a round of chess. Wouldn’t you stand a much better chance at winning?

This isn’t rocket science, folks.

In short, here’s what you need to do:

1. Learn about the technical aspects of trading (I’m not talking about technical analysis here)

2. Figure out your strengths and weaknesses as a retail trader (compared to professional traders)

3. Devise (or learn) a trading strategy that maximizes exposure your strengths while minimizing exposure to your weaknesses

4. Devise (or learn) trade entry/exit techniques that compliment your strategy

Most retail traders skip steps 1 – 3 and jump straight to step 4. They focus on the ‘hows’ of trading, but ignore the ‘whys’.

Take this example. In applying a moving average cross-over to identify trade entries, one should ask, “Why would a moving average cross-over work as a trade entry signal?” What are the reasons? Does this method maximize my strengths as a retail trader?

In my candlesticks e-book, I detailed not just candlestick patterns. More importantly, I revealed to my readers why those candlestick patterns work.

Once you understand how to read candlesticks, no memorizing of candle patterns is necessary. With this knowledge, you can effectively interpret any combination of candlesticks, in any market!

The difference between surface knowledge and true understanding

…is knowing the answer to the “why” question.

If a stranger walks up to you and tells you he can turn a $100 bill into a $500/month income stream, but won’t explain why his method works, would you hand him your money?

I hope not.

But this is exactly what people are doing online every day, even right now.

The world’s richest investor said it best:

Obstacles of the Mind

Before I expose why some trading strategies work (while others don’t), the first thing we need to look at is your thinking.

It’s ineffective to talk about trading methods without addressing the most important component of trading – your perspective.

In an industry filled with exaggerated (and largely unrealistic) claims, our first area of business is to correct any psychological obstacles that will hinder your progress.

By eliminating these obstructions, you’ll be able to grow your capital faster and easier than you might think is possible. These are the overriding concepts that successful retail traders operate on.

See if you can identify with the following symptom:

There are two opposing ways of thinking when it comes to trading at the retail level. There’s opportunistic thinking and strategic thinking.

Opportunity seekers are always looking for their big chance to make lots of money. Their only criteria is, “Can I make money from this?”

So today it’s automated robots, tomorrow it’s binary options, and yesterday it was some other concept already forgotten.

Opportunity-seekers pick up lots of trading techniques, use a few, and abandon everything the moment there are a few losses or the next “easy” way to trade comes by. The only question they ask is, “What’s the easiest way for me to make money right now?”

A strategic trader, on the other hand, is a completely different animal. He is clear about how much money he wants to make and how to get to that goal.

He knows the strengths and weaknesses of retail traders compared to their professional counterparts. He understands what drives market prices and devises (or learns) different methods for taking profits based on this.

After reviewing the pros and cons of each method he picks the one most likely to achieve the results he wants.

The strategic trader knows that the biggest opportunity lies with how his trading operation is run, not the hot new product that is promoted this week.

Here’s the thing: The overwhelming majority of retail traders are nothing more than opportunity seekers. They have no strategy for choosing the trading products they buy.

They hop from one method to another, and while they may have some arbitrary income goal they have no idea how to achieve it.

And since they don’t have a clear strategy they cannot follow any sort of plan to reach that goal… so they end up buying anything and everything that comes with the promise of easy money with the hope that this is going to be it – this is their chance to make it big.

They especially love (and fall victim to) “automated money” products promising huge rewards with little or no effort.

Forex trading is incredibly lucrative and one can make a lot of money in an embarrassingly short period of time.

However, the capital and skills required to do this consistently takes time and effort to build.

All right, assuming you now have the right expectations and understand the need to get serious with building a trading operation around an effective strategy (that you fully understand), let’s talk about what else stands in your way…

The semi-experienced trader buys books, videos and attends seminars to learn about various trading “strategies”. Most of these methods include some combination of technical indicators that serve as trade entry/exit signals.

Now before we continue, I want to state for the record that all of these methods work. All of them.

I say this because you need to understand the subtle truth behind this statement.

There’s a BIG difference between a method that works, and a method that works consistently.

And therein lies the key to understanding why so many trading strategies fail.

Would you rather make $500 on 2 trades, only to lose $450 on the next 2 trades? Or make a consistent $30 on each of 4 consecutive trades?

A winning strategy should not be based on how much money is made on each trade, but how consistent the wins are.

Consistency trumps short term gains.

A Winning Strategy is not determined by how much money

is made on each trade, but the consistency of the wins.

So it’s not a question of whether the strategy makes money (even a monkey can make money trading), but whether it can make money consistently.

And how can we find out if a trading method is likely to make money consistently?

First, you’ll need to…

Understand Your Business

In case you haven’t realized by now, we are in the business of retail trading.

And just like how a savvy entrepreneur studies the industry environment before coming up with a business plan, so to must we take a good look at the retail trading industry and select the path of least resistance to making money.

You don’t want to get involved in a business that tries to sell ice to Eskimos. You want to run an easy business, not a tough one. Swim with the current, not against it.

The bottom line is that we don’t want to end up with a strategy that works against our natural strengths and weakness as retail traders.

Many people can’t make consistent profits simply because their trading method exposes their weaknesses while avoiding their strengths.

From here on, I’ll be sharing with you what you need to be doing, and more importantly, why you need to be doing it. Be sure to take notes.

Let’s go.

Principle #1: Trade on the Longer Time Frames

Why is it preferable for retail traders to trade on the longer time frames?

To understand this point, we’ll need to once again step back and look at our trading from a business perspective.

In business terms, our trading profits are the income of our trading operation, while our losses are the expenses. Nothing groundbreaking here.

There is, however, one type of expense that’s often ignored by retail traders… the bid-ask spread.

It’s the cost we pay our broker for their services, and it typically ranges from 2 – 4 pips on the major currency pairs.

So how does the pip-spread affect the way we run our trading operation?

Imagine you run a bakery that makes and sells (incredibly delicious) bread.

Each loaf costs you $0.50 to bake (an expense).

You now have to decide how much to sell each loaf of bread.

Should you set the sale price at $1 or $2? (Ignoring all other factors)

Which would you choose? The answer is pretty obvious…

Most people would choose $2, since that leads to more income and profits.

From an operational perspective however, there’s another reason why $2 is a better choice…

Allow me explain by posing a slightly different question:

In the same bread example, how many loaves of bread would you need to sell, to make a profit of $300?

If your sale price was $1, you’d have to sell 600 loaves to make a $300 profit.

If your sale price was $2, you’d have to sell 200 loaves to make a $300 profit.

Take a close look at the numbers…

By simply doubling your income, you reach your profit goal three times faster (not just twice).

This little-understood concept has immense implications when it comes to trading.

If you have an income goal of $80,000 per year, would you rather reach that level in 60 small trades or 20 medium-sized trades? Which is easier to achieve – being right 60 times or 20 times?

This is the first reason why short-term traders find it difficult to reach their income goals – they have to be right a lot more times than a medium-term trader (like me), who only has to be right a fraction of the time.

And there’s another reason why it’s difficult for short-term retail traders to consistently make money – their account gets quickly eaten up by the bid-ask spread.

Huh?

Allow me to explain further.

You see, a trader who pays a 2-pip spread on 1 trade (to make a profit of say, 200 pips), pays a smaller portion in fees compared to another trader who pays a 2-pip spread each on 11 smaller trades to make the same profit.

Here’s what I mean:

Trader A is a short-term trader looking for trades of 20 pips profit.

Trader B is a medium-term trader looking for trades of 200 pips profit.

|

Trader |

No. of trades |

Profit per trade |

Gross Profit |

Spread per trade |

Total Spread |

Net Profit |

|

A |

11 |

20 pips |

220 pips |

2 pips |

22 pips |

198 pips |

|

B |

1 |

200 pips |

200 pips |

2 pips |

2 pips |

198 pips |

Trader A pays a 2-pip spread for each of his 11 trades for a total expense of 22 pips.

Trader B pays a 2-pip spread for his 1 trade for a total expense of 2 pips.

So in total, Trader A had to make a gross profit of 220 pips and pay the spread (-22 pips) to arrive at a net profit of 198 pips… while Trader B only had to make a gross profit of 200 pips and pay the spread (-2 pips) to arrive at the same net profit.

Trader A had to make 20 pips MORE than Trader B, just to get the same net profit.

If both traders were competing to see who made the most net profits, Trader A would have to perform 10% better than Trader B, just to get even.

By simply trading on a larger timeframe, Trader B gets a natural advantage over Trader A!

To summarize, Trader B enjoys:

- Fewer trades (less effort)…

- More profit per trade…

- Paying less brokerage fees…

- Less pressure to perform…

…all while getting the same net profit as Trader A.

I hope something just clicked in your head.

This is what I mean by choosing an easier path to achieving the results you want.

Add to all of this the fact that professional traders trade with a much lower spread than retail traders, and you know that competing against them on the same level (i.e. short-term trading) puts us at a significant disadvantage.

When Trading Short Term, You Are Fighting

Against The Professionals For Scraps

As large as the currency market is, there’s a limited amount of profits to be made each day – a quick look at any of the major currency pairs will show that few will move more than 150 pips per day.

Intraday retail traders who try to open and close trades within the same day for a profit are thus effectively trying to get a portion of a limited number of pips.

When trading in the short term, you pit yourself against the professional traders for the limited scraps of “meat” in the market. And more often than not, it’s the retail traders who end up as part of the scraps.

Compare this to the medium-term trader who trades over a period of days or weeks – suddenly, there’s a lot more meat to go around.

With the right trading approach, and with no extra effort, you can set yourself outside the professional’s crosshairs, and stand to make more pips in the process.

The secret is to trade on different terms than the professionals. Don’t compete against them at their own game. Smart retail traders choose a hunting ground where they have the advantage.

Short Term Trading is particularly susceptible to re-quotes and slippage

And if you’ve ever tried entering/exiting a trade as the market price was moving quickly (as is typically done in short-term trading), chances are that your order either did not get executed by your broker, or you suffered some slippage.

Both are factors you cannot control… so think about this: If these are factors you cannot control, is it a good idea to have your trading business be especially vulerable to them?

With a short-term profit target of 20 pips, a slippage of 2 pips is an additional 10% cost (expense) to your bottom line. With a medium-term target of 200 pips, a slippage of 2 pips is a mere 1% cost.

Repeat this over hundreds (or even thousands) of trades… and this seemingly small expense really begins to add up.

Again, think about which approach makes it easier for you to be richer after a year of trading.

|

Short Term Trading |

Medium Term Trading |

|

|

Effort required |

More |

Less |

|

Profit per trade |

Less |

More |

|

Brokerage (spread) fees paid |

More |

Less |

|

Risk of un-executed trades |

High |

Low |

|

Risk of slippage |

High |

Low |

|

Impact of slippage |

High |

Low |

|

Competes against professional traders |

Yes |

No |

Which looks like a better arena to trade in?

The answer is glaringly obvious. Yet so many new traders come into the market looking for the thrill of fast money that they don’t stop and think about whether short-term trading plays to their advantage.

The only “downside” of medium-term trading is that it does not give the adrenaline rush that short-term trading does.

So ask yourself: are you trading for a thrill? Or to make money?

Your Broker Says “Thanks”

So why is short-term trading so popular among retail traders?

The first reason is that they don’t understand the concepts you’ve just learned.

The second (and more insidious) reason is that brokers typically promote Forex trading as a means of making a fast buck… simply because it’s such a lucrative business for them.

Think: would a broker prefer a retail trader like me, who makes a 200-pip profit while paying only 2 pips on the spread, or someone else who makes the same profit trading short-term, after paying 10 times more than I did in spread fees?

It’s business, not personal. If I were a broker, I’d do the same thing and promote the hell out of the “benefits” of short-term trading.

Only educated and savvy retail traders like you will see past their marketing gimmicks and choose to play the game that avoids your natural weaknesses. You want to play the game where you have an advantage to win.

The longer term you trade, the less you are affected

by the negative impact of the bid-ask spread.

At first glance, a 2-pip spread may not seem significant… but across a large number of trades, it’s like bleeding to death from a thousand paper cuts.

It’s the quiet poison that sabotages your trading success without you being aware of it.

So what’s considered to be the medium-term timeframe? For most purposes, this refers to the 4-hour chart and daily chart.

Trade on the smaller time frames (such as the 15-min or 5-min charts), and you’re setting yourself up to swim against the current.

If you’re going to be trading for a long time, you need to decide if you want to keep struggling, or to let the wind carry you.

Remember, it’s all about choosing the path of least resistance to making your profits.

What Do You Think Of Principle #1?

Let Me Know In The Comments Below!

Next: Principle #2

Click here to read Principle #2

Your Comments (446 comments so far)

-

Ram

-

graham

this is really clearly presented! makes alot of sense

thanks -

Al Squair

I will be ready to start tradig by March !st.

Please do not email me before then.Thanks

-

damon

sounds like you got a very interst point

-

leon

Starting to see the light!

-

shawn

I started trading forex in 2008 and with in the year found that I had no success on the smaller time frames (5m, 15m, 30m) but I could with some degree of consistency make profits on the higher time frames (1h, 4h and daily). My favorite chart is the 4h hands down; I enjoy the daily but like trades more frequently. The higher time frames have sooo much less market noise and are easier to trade.

-

STEVE

MAKES GOOD TRADING SENSE..

-

Greg

Look forward to reading more

-

Goldfever777

Excellent article which makes a lot of sense.

-

Nice article.

-

Steve

Just a quick note to let you know I found your insight to be very sound and look forward to reading and absorbing more of what is ahead…:)

Peace Out!

-

Xes

Great article. Thanks for sharing.

-

Gerald

Good article for the mindset. A start up guide for every trader but professional and rookie.

As for me I will read through it before ever taking any trade.

-

Reviewer

I’m gonna watch out for brussels. I will appreciate if you continue this in future. A lot of other folks will be benefited from your writing. Cheers!

-

MaryAnn

Thanks for the great reading – definitely will be part of my plan. The candles are starting to talk to me!

-

david kong

Thanks I has gained a lot in narrowing down the gap in understanding forex, and hopefully more comments will be published.

-

ben

Like your article on why retail traders are meat for the big boys. Great insight, Chris and thanks

for sharing -

andy

Just opened a live account short-term trading. makes more sense to adjust to longer time frames. many thanks

-

Alex

The article was great

-

Colin Morgan

Hi Chris,

Tried to download the PDF but getting the following:

Mailing List Not Active

This mailing list is not currently active.Please push the “Back” button and notify the website owner.

Thought you would like to know.

Keep up the great work! People like you are a breath of fresh air!

Best,

Colin Morgan-

Chris

Hey Colin,

Thanks for the heads up… there was a small technical error with it but it’s now been fixed.

So please try again!

-

-

My Homepage

I genuinely enjoy searching at on this site , it has great content material .

-

Some truly wonderful content on this web site, regards for contribution.

-

vir

I really appreciate how you approach the different trading situations.

-

David

Definitely makes great sense and thus reliable. Anxious to study the rest. What a sincere, experienced and wonderful person you are! Thanks.

-

ian

this is great stuff just when i was thinking that i was alone on this

-

William Dangler

Aw, this was a really nice post. In thought I would like to put in writing like this moreover – taking time and actual effort to make a very good article… however what can I say… I procrastinate alot and certainly not seem to get something done.

-

Andreas

All of this is true when I had my trading course my teacher told me the same.

-

derrick

hi.

just after reading the first principle,i can see that i on the right track.thanks. -

tom

like what i am reading.will download the next 4 principlesfor sure.

-

Ade

thank. I do appriciate your knowledge sharing and it’s so educative. U did impacted more power and strienght into me.

-

James

I agree with what you have said so far. The only problem not mentioned was the BIGGER stop loss required trading the higher time frames. And unfortunately I do NOT have 20k to put into a forex account. Last year I netted 35k in take-home pay. So to save up the 20k would take me years. Yet, I would still prefer to swim with the current than against it. Maybe those in my shoes could trade the larger time frames with a micro account. Thanks for your efforts in helping us small fries.

-

Chris

Hi James,

You’ve brought up a good point about the stop loss.

The thing is… there’s a way around this “limitation”. We’ll be examining more on this later…

-

-

frank

I read the first 4 principles and they are great. I have been waiting for the 5th but never got it. Please be so kind as to forward it to me. Thanks

-

Bobby Balcom

Very efficiently written story. It will be helpful to everyone who usess it, including yours truly :). Keep doing what you are doing – i will definitely read more posts.

-

Gregory K.

Great info. Really resonates as the truth … Makes total, logical sense. I love your philosophy (battle is won before it’s fought), clarity and simple way of explaining complicated topics. I very much would love to get involved with your Icarus Project, especially after taking a beating in the school of hard knocks. Will work hard (or easy) for pips, but love the idea of stress free (as much as possible), go with the flow, end of day or 4H trading … living well (not chained to the computer)and consistently moving toward goals. Thanks for sharing your knowledge and know how.

-

Terrence Meltz

it is all true chris the only time i seen clarity is when all the junk is moved off my charts but i do feel a sense of forlorn without them like there is no direction but i know its something i need to work with sometimes it seems random but thanks you are opening my eyes and confirming my thoughts i hope i can find a clear direction

-

Ben

Chris,

All the pitfalls you mentioned I fell into and have not been able to climb out or walk away from!!

Thank you for putting your time and effort into writing the article.

Ben

-

David

Nice article….makes sense!

-

Tony

Hi Chris,

I can see now how my speed trading attempts have serious flaws that even a modest win rate won’t overcome.

Best,

Tony -

ganiyu

good

-

Christopher Lee

Very well presented and direct information regarding the pitfalls traders (especially new traders) face.The distinction between opportunistic vs strategic summed it up best.

-

atsel

Is Forex not meant for small account-size retail traders? I hope that is not what your write-up is preaching. Anyway i will not jump into conclusion till after reading the other parts.

-

kevin

This is good info and does point out some problems that I am having, I look forward to more info.

-

RENNY MARTINEZ

Thank you very much for your Open Information!

-

Stanislaw

very intelligent, helpful article,-everything is logical and is easy to understand, thanks

-

grumpy

Good stuff – waiting for the next installment with interest

-

Chinyere

Very nice and thought provoking. I have absorbed this first part like a sponge. I intent to implementt the principles to the latter. I’m looking foward to reading the whole arrticle. Thank you.it is an eye opener.

-

Carmi Peles

Very very cleaver and interesting !!!

I agree 100% with all the above points here explained…

Thanks for sharing.

Waiting for # 2- # 5 asap… -

bill

thank you bill

-

I definitely agree with your teachings and love to put them into practice. But my concern is which Broker is honest indeed? Am asking as a new Trader.Thanks for sharing your precious ideas.

-

Chris

Hi Alex,

Most reputable brokers are honest, although that doesn’t (necessarily) mean that they are working toward your best interest.

In this game, your best protection is knowledge. No one will be more interested in taking care of your well-being, than yourself.

My suggestion is to stick with the popular brokers that are regulated by big city financial authorities, and to avoid those that are located in the Mediterranean islands like Cyprus.

-

-

dugsey

Brilliant and sound advice took me 2 years to get this far on my own, cam’t wait to see whats next.

Many thanks -

Fernando

Great information and advice!

I’ll be waiting for the following articles.Thank you

-

Joe Italiano

I have been tradig for 10 years and I have trained many retail traders and we are on the same wave length as far as having a solid busuness plan for trading. Good insights in your presentation. I look forward to seeing #2- #5

-

SCHWEITZER

Interesting document will read it I expect the rest of the EBook

-

P Lombard

Yes makes sense . Looking forward to rest of principles

-

Neville

Makes good sense, what I have been finding out over 2 years.

-

johann

Thanks xo much – really very necessary information in easy to understand language. A breath of fresh air in the land of BS…. Thanks again.

-

johann

another great principle – can’t wait for the next one…thanks again

-

JNANENDRA KISHORE

It is extremely informative. I prefer using 4H, Daily and Weekly Charts. However, using longer TFs has a drawback of using huge Stops, but it pays to me a lot. I manage my trades mechanically…when I find the price has moved 100 pips in my direction, I trail my stops to 50 pips.

-

Kevin

Cant wait

-

Robert Dawson

Your perspective so far seems to be in the category of the ‘light bulb moment’. So obvious (dah!!), but so hidden by all the hype, systems etc etc etc.

I am new to forex trading and see myself in both types of traders you have so far described.

Very much looking forward to further principles. In the meantime I will look up your Candle book.

Rob -

gerardo

…is important to have people like you. Professionals teaching the right way forward.

Sincere thanks for this work.Gerardo R.

-

MICHEL PLAFTER

I will change my trading switching from short term to medium or long term using the hour 4 and daily frame.

Very informative and interesting.thelonetrader

-

james

i like straight talking people like your self thanks for being so honest

really enjoyed it kind regards james knight -

George

Thanks Chris for this highly enlightening manifesto; I look forward for more.

God bless. -

Domenico

I am particularly interested when you say that the forex industry is about to change and that we nedd to grow our accounts to 25000-50000 as fast as possible,the faster they grow the safer we are.

-

Thanks for the service Chris. I look forward to reading all the manifests

-

Patrick Chambers

This information is excellent and it is helping me a lot.

-

Teboho Jeffrey Sekamane

Thank you so much for being an eye opener, cause now I know exactly what I should change in my trading strategy, you being so helpful.

RegardsTeboho Sekamane

-

Mike

You are too much I want more and keep the good work

-

Domenico

Why we need to grow our accounts to 25000-50000 as fast as possible,the faster they grow the safer we are.

-

Domenico

What is about to change in the forex industry

-

colin ooi

Hi Chris,

I am interested to learn about forex and I think that looking at the long term charts will help me as I am not making any money with the shorter term charts

-

glenn

Very Helpful! Thanks Mate!

-

Bendz

Hi,

It’s really interesting. Now, I understand the reasons for my failures 😉

-

Abdul

Hi Good MAN.

The lesson here folks is sure..ism is better than optimi..ism

Thanks alot…God speed.

Abdul. -

dawid

i do understand the principles , and thanks for that. it is more difficult to trade on a lower budget, to be honest. so it is easier to loose . what is the best and safest amount of money to start of with when available funds is not always there? thank you

-

Chris

Hi Dawid,

Assuming you’re already familiar with demo trading, I would suggest to start with at least $2,000.

-

-

Mike B

Great information. I have been struggling to be a successful forex trader.

Like many (as you mentioned), I was trading the wrong time frames which were much more stressful and harder to trade.

I have seen the light and have made the change and my trading is steadily improving. -

Ian

Very well written article. The advantages of trading the higher time frames are finally clear to me. Thanks.

-

Tony Hawley

Hi Chris – it is amazing that I did not appreciate the basic reasons why medium is so much better than short term trading.

Many thanks for enlightening me!

-

Yanto

That’s greatest!

-

Ganiyu

Sir i enjoy your write-up its a complete true i learn a lesson from my mistake Thank you God bless you.

-

Doc Gailey

refreshing, different from run of the mill net info. Thanks for your discipline in writing it.

-

guido

Hello Christof Lee,

Excellent article Which makes a lot of sense & a lot of great experience exceptional.

thank you very much

Regards – esteem……..

Guido – Italy

-

Frank Lobach

Hi Chris, you are so right on all of this.I have been looking, trying,buying,collecting,getting totally confused as to how to put all this “stuff” together to make a good,simple to follow plan.It has cost me so much in time ,frustration and money,it has not allowed me to actually start to trade for myself,but has gotten me to use “pro” signal providers to trade my accounts for me,and I am still waiting to get back up to my original start up account balance.They trade huge amounts of small trades with huge stop losses,so much spread in/out costs,small profits for a while ,then large losses every so often ,wiping out all my gains overnight.I understand many methods of trading, but have not been game to actually set up my own method in case it fails,and I end up seeing all my time and money being wasted.I guess subconsciously, I was “collecting” to avoid the inevitable crunch time .I also think the longer time frames are the way to go ,as the “end of day” type of trading allows a much more relaxed style ,without having to rush anything,giving a quality of life back to me.I just have to be prepared to decide on one of the many methods I have collected,actually start and finish one of the many good training courses I have at my disposal,and just focus and do it.It is so easy to allow myself to be distracted/diverted by so many other things every day though,because of my own uncertainty in my ability to get down to business and stick to a set path.

Thank you for your “in my face” approach,it is refreshing and I hope I can make it work for me to make me work.Frank Lobach-

Chris

Hi Frank, your comment pretty much sums up what most retail traders go through when being misled by online marketers who are not actually traders themselves.

I’m glad you’ve picked up something from this manifesto, and encourage you to keep on looking for the trading approach that suits you.

-

-

Danny Chou

Your article explained the common sense in Trading. Plan a strategy depending on own strength

and weakness. -

daniel

amazing and good one lee!

-

matt

Thanks Chris.

Your stuff is full of good commonsense and based on sound principles.

Matt

-

suastana

it look new for me…and what you said is true..I want to now the other seri ..seri 2 until 5 usefull

-

Jose

Very good

-

anthony vitale

Like a big brother with experience that wants only to be of assistance to a newbe .

you do not see that every day ! understanding what you are actualy doing will be helpful to yourself .!

far better that stubbing your toe over and over without understanding what you are actualy doing

Thanks – very much. -

Mark

Makes a lot of snese- and explains a lot why I haven’t got anywhere before! 🙂

-

John

Hi Chris

I am new to trading, still paper till I know the rules, I have subscribed to many articles and a couple webinars which are a joke as all they want is not to teach but to sell, I am so impressed with your principle 1, it is amazing can’t wait to read more -

Roberto Maurer

Congratulations! This is a well thought ideas, thank you for sharing with me! I am looking forward to the other principles.

-

Fred Zablocki

From what i have read so far this is the most common sense piece of advice that i have come across so far and a view and direction that i am currently in pursuit of due to my previous experiences, failings and knowledge gained the hard way, loved the info provided and have taken it all on board, thanks for the advice, much appreciated.

Keep up the good work

Fred -

Bhagirathpuri Goswami

really you have opened my eyes how to trade real forex business. we should take it as our own business and not gambling. Thanks. Awaiting your 2 to 5 principals.

-

moeketsi

Most trades I win are on 4h time frames. I tried daily time frame on Thursday and by Friday 14h GMT I had 600pips from three trades.. Greate staff Chris!

-

Naresh

Good article ! Thanks for sharing.. =)

-

Chris

Thank you everyone for your kind words! I hope you enjoy the next Principles as well.

-

-

antonio

I am amazed for the logic of your explanation and how well you presented it. I want to read the next and i would like if is still possible to have the book you wrote in 2008 concerning the candles sticks.

Thank you very much.

-

Chris

Hi Antonio,

Thanks!

You can get the ebook here: Candlesticks Made Easy. This is the updated version.

-

-

WLR

Many thanks for the ‘eye opener’, I’ve been trading as a scalper for many years while fully aware that longer time scales should be more beneficial, but reluctant to change.

Your treatise has finally convinced me to take a more sane view of what I want out of trading ,and as of next week I will fully commit to your philosophy.

My regards ,and long may you continue.-

Chris

Hey WLR,

I’m glad I was able to contribute to your trading!

-

-

Vios

Lot’s of information.. Thanks

-

Chris

Bro, you typed so much it hurts my eye..

-

Paul Jones

makes sense to me I traded short term & was doing OK but seemed to get some dicey tips.as soon as I was making profit I would get a negative tip.seems strange to me.

how do I find a reliable site where I know I will be able to withdraw any profit,most only tell you how to deposit & how quick you can make money.-

Chris

Hi Paul,

I’m sure you know that in trading we don’t always get winning trades.

This said, I do agree that it’s not easy to find a reliable site that teaches you how to be an independent trader. There are a lot of marketers out there who aren’t traders themselves, so you’ll have to be careful about the advice you get.

Personally, I don’t take the advice of people when I don’t understand their trading approach.

-

-

Naseema

Thank you very much for sharing your expertise – much appreciated !!!

Love your no nonsense approach!

As a new trader i realise the importance of what you’ve shared and will incorporate these lessons into my trading.

I really like what i’ve learnt thus far and look forward to learning more.

Thanks again and unlimited blessings,

-

Naran

Hi Chris, I am really enjoying your manifesto, I have read Principle #1 Trade on the larger time frame and #2 Minimal monitoring. It really opened up my eyes!! As you may be able to tell, I am a short-term trader! Now you made me thinking, as you are exactly right; I keep staring at my screen all the time to get the right trade set-up, and it hurts! Please let me know your remaining principles, I really want to learn what you are saying! Regards.

-

Tom

Thank you for sharing Chris! I am new to forex and have been practice on demo account. Before reading your article I thought it would be best for me to trade short term. Yes I would have to work harder and pay more spreads but with a small capital, I don’t think I can survive the market’s swings if i trade long term. Am I wrong?

Thanks again!

Tom-

admin

-

-

moustafa

smart and honest contribution i have read it slowly to concentrate and i think i got the idea of being conservetive and not taking the matter hastely and lightly to make consistent winings

-

John

Makes a lot of sense, thank you.

Forgive my scepticism, however I am still waiting for the ‘big sell’! -

gary

great never thought about it like that thanks

-

Helmut Thoma

Hi John,i read you very good explained trading,and i am aggree with you and this are so important to know before you hit the trigger with a live account,this are so importent to know,and no marketers tell you this,also the point you must know which broker is the right one for you and more.I have not downloaded but i read this,and i will read also the following lessons.I go now to the tenniscourt.

Regards,

Helmut -

larry c

I have been trading for about 2 yrs I have won some but lost more due to the believing the fast track to riches in the forex market pipe dream. Yes i believe that you must have a plan and stick by the rules. I have a tendency to look at the chart and it seems like a good entry, only for it to turn around and go the other way. That pisses me off. but waiting until a conformation candle would have saved

me a lot of money and frustrations. I truly need a plan I can count on. But I must deal with my own emotions and obey the rules. thanks for your insight l do see a lot of me in your report.

Larry Copeland -

Chuck

Well, this is interesting. You are the first to make sense about trading forex, I like it.

-

jean

Great article but what next ???

-

admin

Hi Jean,

Look out for the coming Principles!

-

-

moustafa

i have gone through 1 and 2 will u send me the next principle please… i found them very useful

-

admin

Hi Moustafa,

Yes you’ll get the rest soon!

-

-

b

Really makes a lot of sence.

-

Gino

I understand and agree with your strategy but…..the markets are so up and down,I think you need much more time to get the same results as a short term trader or do I still think wrong?

greetings

Gino-

Chris

Hi Gino,

The time you spend trading (regardless of medium term or short term) depends almost entirely on the trading method. In terms of profit per unit of time spent however, I would certainly prefer medium term trading.

-

-

jerome schiff

You tell the truth. the longer trends are easier to determine . the problem is to keep the risk down etc. when you are right very large profits are available and you dont have to be glued to the screen.

-

tad

Like what I’ve read so far.

-

Samuel

nice

-

ARAFIENA .PIUS

I really enjoyed this. It”s like teaching a child how walk before learning to run. Good work Chris. Cant wait to see the #3–#5.

-

Sake

Couldn’t agree more.Felt like you are talking about me. Very much appreciated.Thank you.

-

bob

tradeing only a short time , this comfirms what i have come to suspect .thank u bob .

-

interesting

-

Fxtrader

Excellen article

-

phil

Sounds interesting – thank you

-

charles

This article make’s a lot of sense.your Strategies towards the Forex market on a longer time frame,you can see your self paying off some of my Montly Bills. Thanks For the Heads up!!

-

paul kirschke

have to see the info and test the results..

-

Andrew

Fascinating insights. I look forward to further examining your strategic principles. As a beginner, I also appreciate the level of communication that you employ.

Best wishes,

Andrew -

Charlie

Keep it up!!!

-

Jerry

You have my attention. I’m intrigued..

-

Ron

Makes sense so far. I want to keep reading.

-

Jeremy

Makes a lot of sense.I’m looking forward to the remaining sections.

-

Dale Senkovich

Good

-

HERPATOCA

Que informacion tan interesante, Muchas gracias, Esta es la respuesta de muchas preguntas. Aplicare estos consejos.

-

Ian

Hi Chris

Great stuff… I m looking for principles 3,4 and 5!

-

Chris

Hi Ian,

If you’ve signed up for the rest of the principles, they’ll be sent to your inbox over the next few days. 🙂

-

-

Albert

good so far..

-

john shubin

so far so good.

-

Johann

Hallo and thank you,

I think a lot of people fall into the trap to want to find a system that works for them and we are gulable and believe what we are told on face value. Invest your money into a system but whatever you try it does not work.

Thank you for the first artical it makes a lot of sense.

Looking forward at the other articals.

Johann -

RobertE. Russell

High Chris,

I am a former semi-resident of Singapore, having left there in 1990 due to a lack of oil field activities that could sponser my being there, and a very poor experience with Merrill/Lynch through whom I tried trading, but not Forex.- I would have been fleeced anyway mostly because of my ineptitudes intrading – as in the old saying “You need a broker to trade for you, but only until you are broke”. ha – much water under that old bridge.I’ve enjoyed your sharing your experience and expertise (I am preetty much a rank beginner in this forex business and in dire need of some real expertise in methodolgy). I am currently engaged in this process via “The Apiary Fund.com” , and hoping to become funded by this company to tradeforthem – a much longer process than I had ever imagined and wth the failures I’ve so far experienced with a paper account, about three months old, I may not achieve that goal – so like you have mentioned about beginners, I am scouting for avenues of more rapid and consistent progress and my desk top icons testify to those efforts, including another from Singapore, called “Magic Forex” – if I remember rightly.

You seem to have the edge I am hoping to mimick, and I cannot offer any criticisms, except in a positive vien. So congratulations !!. I hav downloaded the remaining parts of the booklet, abut haven’t been able to simply purchase the candlestick book until I can open a Paypal account.

So, until then, thank you again for posting your website to my address.

Regards

Robert E. Russell-

Chris

Hi Robert,

Good to hear that you’re not giving up despite the setbacks – everyone experiences setbacks but it’s how we respond to them that matters! 🙂

-

-

ola amos

dear trader,iam so glad u sharing dis info.so so happy n tanx sir

-

Duncan

Excellent, well presented information Chris.

I’ve been down all the roads you mention in the article and keep dipping my toes in and out of live & demo accounts desperately trying to find a strategy that works for me. Unfortunately I’m guilty of trading every time frame that exists and only recently came to the conclusion that longer charts produce safer and consistent returns, although I also have concerns with stop loss size.

Looking forward to the remaining installments.

PS:- Just purchased ‘candlesticks made easy’ and finding it a very interesting read.

Thanks once again. -

Zakir

what is your strategy. I wish to learn more from you.

-

Lennard

after 2 years 4H and day chart are the best fit….set up must be there..wait losses focus and we really to be sharp….the more we linger more chance of interfering with the strategy…my best results when I leave it alone ..that is to say…set and forget..come back move stop manage..go away…good discipline is facilitated by minimal involvement….thank you..I look forward to more instruction ..len

-

ng

alot of good points here,thanks chris

-

Nigel Harvey

That is very professional advice for the retail trader and I take to heart.

-

MG Lewis

I appreciate your commentary,your wisdom and your guidance. Thank you

-

Howard Taylor

Thanks Chris. Great read, for me more like a slap upside the head! My inner voice screams things like this to me but probably like a lot of traders I am conditioned to pay more attention to all the noise and the hype. Getting into the mindset of the market- the psychology of the market- and WHY the market reacts the way it does instead of WHAT it is doing will make a difference over the long term. I am trading forex binary options with some success, but not as much as I would like. I know you say long term trades, and I completely understand why and agree with you. I am anxious to see if I can use the same concepts to improving binary trade success rates, until I can focus more on true forex trading. THANK YOU!

-

Me parecen muy serios y acertados los comentarios expresados por Usted en su Forex manifiesto.

Mucho me gustaria recibir los complementos de este escrito, lo mas pronto posible.

Por favor, informar si tienen un servicio de señales de alerta, pagados mensualmente.

Gracias -

Richard

Hi Chris,

Can not wait to read the Principles 2-5 as think you are making sense so far

Thanks in advance

Richard (South Africa) -

jayprakash

dear sir,

i really appreciated to see this lessons this is very fruitful help

for the newcomer in forex trading.

please continue to give thi valuable guidelines by e mail

i wish you happy healthy and long life

thanking you with regaeds.

jayprakash -

Gert

Hi Chris,

#1 is so obvious, practical and true, jet so hard to do.

Thank you -

jalebi

its wow

-

rob

More than interesting

-

bo

finally somebody makes sense about retail traders

-

Hi Chris,

Thanks for this, so sensible and yet so very easily overlooked.

Trading the longer time frames is so obvious …when it’s so eloquently pointed out.Thing is, the very large stops required for say, daily frames, are so large that the risk equates to a margin that excludes all but the wealthy trader.

Unless of course you use binaries… where stops aren’t a consideration, but of course the returns are potentially much lower too. Even so, it gives you the chance to use longer time frames and at least know your total risk or loss from the outset.

Thanks again for your excellent piece here. I look forward to further reading.

Cheers,

Geoff.

-

David Chow

It make since looking for the rest.

-

Cesar Ruiz

Excellent principles. You wrote step by step what I did during 2 years as a short term trader. Today I went back to Demos to develop my strategy.

-

I like to know ALL you have to teach . Do you use which indicators? Please let me know !! Thank you!!

-

Frank Lobach

This is great Chris.I have seen it before,but could not get my head around a lot of it then,so stored it for future reading ,but never really have done much with it yet,as with a huge amount of other very good ,sage advice like yours,very basic advice,all ignored when I came across sections I could not fully understand or remember.I have taken notes from many educators,with various levels of good content, a lot similar to yours too, but when I need to remember any of it “on the ground”,it escapes me and with so much info stored, I usually cannot find the stuff I need when I need it either.Very much a case of lack of faith in my capabilities,so the memory lets me down I believe.

I do need a system that I can follow in steps, 1,2,3 etc,and understand completely,so I can get the confidence in my ability to trade with consistent results leading to a slow,steady upward equity curve in the bank balance.I do realize it is a long term thing and patience is required, and I have always felt much more comfortable with systems that recommended medium term time frames ,as I do not want to sit in front of my PC most of the day.”End of Day” trading has always sounded like the way to go for me. Will stick with it,as your principles and approach to trading does fit in with my own feelings about trading,as well as the fact I know losses have to be expected.Do hope I get to see some kind of steady (net) profit soon,as it would be such a nice change from all those negative balances so far in other trading experiences? Thanks again Chris, keep up the good work,Frank -

rauul balkar singh

you are great

-

Nigel Harvey

good lesson but it takes effort to do what you say

regards

Nigel -

hatinder

good sensible smart thinking

-

Bill

Hope this gets more meaningful, but thanks for your input.

-

Paul Mullen

I’m here to learn how the small trader will succeed, so any knowledge you can spare, bring it on

-

buck

ok so far but did i just jump through hoop #1

-

michael

Awesome Article. thank you chris.

-

Derek

Just what I need to know,as I am realizing that short time frames whip me about .

-

Dan

this sounds very sincere,but most new traders still get emotional until they learn the hard way.

this article is ‘ a word enough for the wise’ -

Norman

Excellent, gIad I took the time to read this

-

Diva

Your article is awesome which can help to kill the inner hesitation while trading.

-

Geoffrey Lowes

So far to me, Chris this has been an eye opener, I have been there and done ALL those things that have seen my accounts severely depleted.I did not have a “plan, just entered because it “looked” good, or my bombastic,macadamia and emaculate line said it was time to go short.

-

Kim

Longer term trades makes very good sense – been on and off trading for the last few years and somehow have gotten comfortable trying to predict the next 8 to 15 pips, not more, mainly because I can put closer stop losses and limit drawdowns. A longer term strategy has larger profit potential – but I believe the trade has to have room to breathe otherwise one gets often stopped out. Hence I have to get comfortable with a wider stop loss setting – and I haven’t been able to. Am keen to read your next principles and see how one can deal with that. Nevertheless very insightful document and good advice.

-

admin

Hi Kim,

I’ve written a post here that answers your question. 🙂

-

-

Gus

excellent infomation. many people favor scalping , including myself . this is eye opening info that i’ll putto use right now. thank you gus valdez .

-

David Lockey

Hello Chris. What can I say that has’nt already been said? Have just finished the first part and it left me thinking I want to kick myself! Your knowledge (wisdom) really does cut to the bone.

Many thanks,

David -

stan

you seem honest and not a scam artist…how refreshing

-

Dennis

looks good

-

Amador

So informative; Wished I’ve known this earlier.

-

DEUDON Guy

Hello

Thanks to open our eyes, I really enjoyed the step-by-step demonstration, I so included trader long term, my question is: if I useful level 1 day, I have to set my stop loss correctly so I take a higher risk by increasing this value stop multiplied by 8 or 10 that over a period of 30 minutes. and if I’m wrong direction it hurts, there are precautions has take before opening a trade and ensure that direction.

Thank you for your help, I believe in you.

Guy (France)-

admin

Hi Guy,

That’s a common misconception – you do not necessarily take a higher risk by trading on the longer time frame with a larger stop loss. I’ve written about this in the blog here.

-

-

Gerald Wernick

You seem to have the Forex business down. I’m looking forward to see what else you have to say.

-

john beuth

Couldn’t agree more. I gave up intra-day trading a year ago. With good money management (critical) my returns have improved substantially. looking forward to reading your principals 2 to 5.

-

Bjorn

Just the difference between short term and long term trades caused a big AHA in me. One of the best descriptions of trading forex I have read! Looking forward to the next principles!

-

S.R.Chavan

Most complicated and trapping the new comers into forex trading by the brokers is excellently explained.Most complex things are made very simple to understand by commom man.Your article is an Oasis for people who have lost money in the forex market but want to continue to recover the lost money.May your tribe increase.I recommend all new comers to go through your article before entering the Forex market.

S.R. Chavan

-

Douglas Lang

I have been trading for 8 years and have finally come to the end of the road.I have another 6 weeks to prove to myself i can make a living doing this or I’m to have to go work for someone else after 25 years of being self employed. Talk about a lot of pressure but it is what it is. I have $20,000 to work with . After 8 years of trying every system known to man I have come full circle to feeling my best shot is trading a system I wrote myself over the past two years. Its the best system i have seen and the only one I trust . I wish I had started using it 2 years ago. I never traded it consistently because it requires that you trade the London open which I didn’t want to do. Now I have no choice and starting tonight I will be up trading at 2:30 EST. there is very little drawdown with the system but only if you take trades at both London open and New York session.

-

Chris

Hi Douglas,

Thank you for sharing your experience! Good luck with your trading and if you don’t mind, I’d like to hear about your progress from time to time! 🙂

-

-

katwal

This is the most interesting and revealing piece of information I have ever come across

-

DR. SAM. LAYEFA

Fantastic lecture, may i add, i really enjoyed your teaching on CANDLESTICKS.

-

sridhar rao

very interesting and convincing…nice of you to share your experience and knowledge with so many..you changed the way i have been thinking…hope readers see better tomorrow..God Bless

-