Trading is not for the naive.

I often get emails from people who are struggling with their trading, and don’t understand why they keep losing.

The thing is that for many retail traders, the reason for their struggle boils down to one simple point.

Ironically, it’s something so obvious that few people ever manage to figure out what it is.

Check Your Information Sources

First of all, think about everything you know about trading.

Where did you learn this from?

If you’re like most retail traders, most of what you know comes from articles, websites and forums that you’ve visited online. Typically, this is information that’s freely available to everyone.

After visiting many of these sites, you come to realize that they all teach the same things:

- Buy on a bounce off support

- Sell on a break below support

- Put your stop loss above/below the previous high/low

- etc

It’s the same ideas, regurgitated over and over again.

So you figured, “well, if everyone is teaching the same stuff, it must surely work!”

This, while comforting, is unfortunately just wishful thinking.

How To Lose Money And Frustrate Yourself

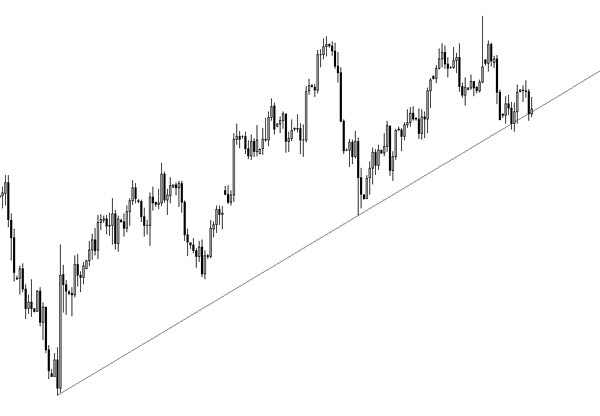

Just two weeks ago, we saw the EUR/USD test the daily support trend-line:

Shortly after, there was a clear break below the trend-line:

This is a textbook trend break, which indicates the end of the uptrend, and perhaps the start of a downtrend.

According to conventional trading theory, you should now SELL and set a stop loss above the previous high, like this:

At this point, everything looks fine and dandy.

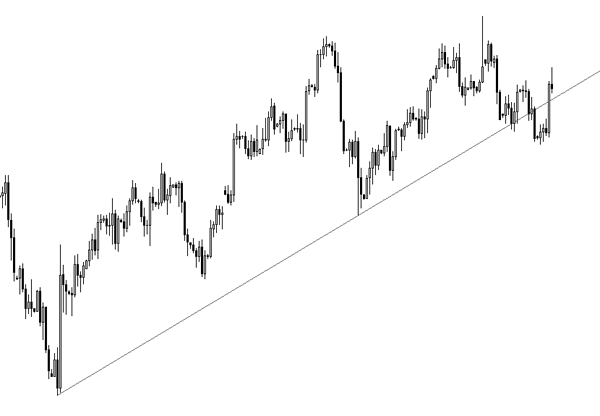

But just barely a week later, look what happens:

You should know that this isn’t a hypothetical example.

This actually just happened three days ago.

Scenarios like this happen over and over again in all currency pairs, and in all time-frames… and the reason people keep getting lured into trades like these is because they follow what everyone is doing.

They don’t understand how supply and demand relates to market expectations.

Let me explain.

How To Make Money Trading

Look at it this way: How does a trader make money?

- The trader enters a sell trade

- Other traders come into the market and push prices down

- The trader then exits his trade for a profit

Notice how, in order to make a profit, the trader has to take action before and after the other traders push the market price in his favor.

In other words, he has to take action when few other traders are taking action.

The problem is, if you’re trading based on information that’s freely available, you’d be taking action at the same time as most other traders.

In doing this, you become part of the majority of “other traders” who help to push the market price in favor of the minority of traders who took action earlier.

Who Are You Making Money Off Of?

The point is, if you’re trading in the same way that most traders have learned to trade, the odds are against you.

After all, if you’re doing the same thing as everyone else, who are you making money off of?

As Warren Buffett said, “when playing poker, if you don’t know who the sucker is… it’s probably you.”

Common Sense Is Rarely Common Practice

So think about how you’ve been trading.

You already know that in order to make a profit, someone else has to take a loss. That’s common sense.

The question is, what’s your trading method based on? The same technical indicators as everyone else? Or something that profits off the predictable actions of those traders?

But you have not provided a clue how to deal these situations

Hi Mudasir,

The clues are in all the posts of the blog. 😉

Interesting post Chris. But there is a lot more to it of course. Like where the big banks, the liquidity providers have placed their limit orders. Or major news announcements just after a setup has been triggered.

After all, when we try to be contrarion, and reverse the orders that our trading system tells us to take (eg trendline break, wait for retest, then take confirmed break), we often still fail. Same with reversing trades from badly performimg robots.

I look forward to your next post.

Hi Andrew,

Agreed. The trick is not to be a total contrarian.

Just because I’m not buying doesn’t mean that I must sell.

Hi Chris,

My trading system is based on moving averages.

I always follow the trend. If the 50-day MVA is above the 100-day MVA the trend is up and if the 50-day MVA is below the 100-day MVA the trend is down. For this currency pair the bias is up because the 50-day MVA is above the 100-day MVA. That means that only long entries are allowed.

Chris,

any plans of forming a team or teams of traders and pulling resources together to trade, following your strategy (if it really works)?

Thanks!

Hi Pierre,

I’m not sure what you mean by pulling resources together to trade.

Right now there is already a group of us trading with the same method, but it’s only open to Icarus traders.

Hi Chris,

Interesting post! If you see the Daily chart indicators are showing Bullish Divergence for Eur-USD pair. The pair hovered around the trendline. On Thursday the economic news from Europe came out positive. Economic news plus Bullish Divergence confirmed bullish bias.

I went long on Eur/NZD (& GBP/NZD) and Eur/AUD at the same time and kitted huge profit.

Chris, I think you have touched on something here of gigantic proportions! Fortunately, I was not one of the ones who got caught with that unusual move however, I have been caught in the past in similar moves! I have been doing some reasoning and soul searching in recent years concerning much of the methods and systems I was taught in the past. First of all, we all know the majority of retail traders are not winners, however many of these Forex losers are highly intelligent men and women. Many are like myself, college educated with degrees. We’re talking doctors, lawyers, engineers etc. etc. I began to ask myself, “What’s wrong with this picture?” I recall when I started trading Forex 8 or 9 years ago, I honestly could not buy a winning trade. Now I submit to you, I followed the teachings I had received to the letter of the law! You remember the advice – no matter what – trust your system! I even got my psyche tuned up as was suggested by my guru teachers so I’d be sure and not get psyched out when I finally pulled the trigger. You know what, none of it mattered! I still got my rear handed to me on a silver platter. I got beat up and lost trade after trade. Now where did most of my training come from – it came from brokers and their training courses and if the truth be known, much in the “for sale” courses I paid for were nothing more than souped up copies of the brokers’ courses consequently after paying high dollars for these courses, I still got the stuffing knocked out of me! I kept on trying to “mine” my “Forex Gold” with all of these “shovels” the brokers kept producing. It was just like the “shovel sellers” who sold shovels during the U.S. Gold Rush days. Not many prospectors found gold but there sure were lots of “shovel sellers” who made money! (Thank you Jeff Glenellis for teaching me this!) Now I’ll be the first to admit, there are a few retail traders who have learned how to make money in these markets but much of the money that is made by “gurus” (who claim to be successful retail traders in retail Forex) is not made in the markets themselves but is made by those who have become modern day “shovel sellers” selling their trading wares (courses, webinars, indicators etc.) to retail traders. What’s interesting, most of this information is pure, rehashed garbage! Why is it garbage? Because very simply, it doesn’t work! It’s worthless! Please allow me to defend my position further. As a retail trader, where do we place our trades? Through a broker, right? And how do you think the Forex market has so much instant liquidity? It’s provided by brokers and market makers who take the opposite side of retail traders trades! I ask you, what’s wrong with this picture? If you are trading with this worn out, trite information of the past 50 years, go no further, you have found why you can’t be successful in the Forex Markets. We retail traders are like sheep being led to the slaughter. Do some thinking and deep heart searching and perhaps you will come to the same or similar conclusions I have, we have been convinced our trading methods and tools are the only ones available to us that will work! If the brokers teach the methods but the same broker takes the opposite side of our trades, do you not see something suspicious here? What I am saying is, if you’re going to cease getting beat up by these markets, you had better change your ways (or methods)! Doing the same old thing over and over will never bring you success. Chris, that example you pointed out is a prime example of how market makers will move the market to induce traders to go one way and then pull the market away from them in the opposite direction leaving retail traders stunned with a losing position and wondering what went wrong. Worse than that, there were probably many who lost their whole investment in that one move! Haven’t you ever wondered why your stop loss was hit by only a pip or two and then retreated back into your direction after taking you out? This used to happen to me – so often I really don’t want to talk about it but somewhere along the way, I began to look for clues that would steer me away from such tragedy. Little by little, I began to see a side of the market I had never seen before in spite of my broker’s retail trading knowledge and wisdom he had so readily and willingly shared with me. If you think the big banks and large institutional traders trade with these garbage systems and methods they’ve handed you, you need to think again! If it won’t work for you, it won’t work for them either. They know that and they’re not about to use it to trade with so, why should you? The truth is, they are using what they have taught you – to trade against you – and take your money! You’ve got to start looking at the market from the brokers and the big boys viewpoint if you’re going to beat these guys at their own game! I saw that EURUSD move coming and believe it or not, I got on the correct side of the trade because of the clues or footprints left for me to read by these guys! So here’s my advice, start thinking like the guy on the other side of your trade. It’s not retail traders – Jim Jones or Tom Sawyer your being paired up with in Los Angeles or London or Tokyo, it’s the brokers and the market makers (the big banks and institutions) that are taking the opposite side of your trades! Check out their balance sheets and see what kind of money they are making in the Forex markets. It’s not in the millions, it’s in the billions! That’s the kind of system I want and need to follow. If your going to be successful in these markets, start thinking and behaving like a broker or a large bank or institution who truly are the BIG winners in this market. No, I realize we don’t have the financial wherewithal to move the markets like they do but we retail traders must find a way to trade with them as it’s the only way we will ever make money. Chris, I don’t know if you still sell your Candlesticks books anymore or not, but it was those books that helped me begin to see the markets in a whole new way! I had bought both books and they had lay in a file in my computer unread. One day I discovered them and began to read. Boy oh boy, the wealth of knowledge contained therein was incredible. I’m not saying I am killing the markets everyday, but I am saying because I’ve gotten rid of the “shovel sellers” methods and am now trading what I see on the charts (true reversal points indicated many times by the candlesticks and price action as well as other chart patterns that are not being taught by these guys), I am doing a whole lot better than I’ve ever done before and getting better at reading between the lines on the charts everyday! I’m not so easily fooled anymore! And it’s all because, like Chris, I have found 90% of what I learned is not usable and does hurt my trading – badly! Incidentally, don’t throw out the 10% that does work! It’s in that 10% you will begin to find success! Here’s one more tip: In your losing trades, look for clues on the charts and in the candles for those things that happened that caused you to lose your trade! It’s in your losses you will begin to understand how to make them tomorrow’s winners! You will begin to see hidden things these people are using to defeat you! Keep working, searching and never, ever, no not ever, quit! If you will pursue, you will be a respectable, honest to goodness winning, retail trader someday! And thanks Chris for all of your great blogs! All that I have ever gotten from you has been of significant value! Keep up the good work! Your approaches to the markets are indeed not the general run of the mill! They are fresh, innovative, and filled with wisdom! I think if I were having to start all over again, that’s exactly what I would be looking for. Good luck to all of you! (Better yet, make your own luck!) Your bank account will thank you!

Hi Robert,

Thank you for sharing your experience — I’m very happy to see the level of reflection you’ve put into trading. In my opinion, that’s what it takes to develop a (trading) philosophy.

Kudos for not giving up when the going got tough.

Excellent post. I was checking constantly this blog and I’m impressed!

Extremely helpful info particularly the last part 🙂 I care

for such info a lot. I was looking for this particular information for a long time.

Thank you and best of luck.

Hi Chris / all

Based on the charts above

I recon the best thing to be learn’t from the above chart examples is you don’t know untill you know (like so many things in life)

So be prepared to cop a loss if you have got it wrong using a fairly aggressive early entry and get back in and follow the trend again that should have been treating you well so far in the examples above

Is it Wrong to have a go at the early break entry (No) if it’s “how you” trade and it’s “profitable for you”.BUT (yes)..if it is against how “you personally trade” and it causes you to stop trading profitably

We have to know what works for us the individual trader

What works for you may not work for me and vice versa as small things can often make a huge difference

Trade profitably

Kevin

“We have to know what works for us the individual trader” <-- Yes!

some good points but…the reasons retail traders fail is in the design of the system. The system of Brokers & Market Markers who have superior infomation (they know exactly your account size, open trades and most importantly the location of your stops). The network of Brokers and market makers have a nice relationship of payments to each other for the provision of new “dummy” retail clients and share in the proceeds of losing retail traders account balances. The best part is the “illusion” of trading. Retail traders are not trading in a real market, they are trading against their brokers computer program, which is designed to take their money. The computer program will always win.

Have you ever had the experience of being wrong by only 6-10 pips then the market turns in your favour, time and time again. Just think how clever you are, by just getting in wrong by only 6-10 pips!!!!! The statistical probability of being this accurately “wrong” should make you question the “game” you’re in.

This is not an isolated situation just for Forex, it is in the Futures market too. If you are still not convinced that I’m on the right track, read the “conflicts of interest” declaration of any futures broker…ANY.

You will notice a common thread.

a) Define a market as a willing seller against a willing buyer.

This is fundermentally not the same as a participant on a fair platform

of exchange where trades are anonymous.

b) Your broker may be taking the counterparty position. (95% of time)

c) Your trade may be executed only with your broker (ALT Alternate Trading System in US or MTF Multi-Functional Trading Facility in UK) In other words if your broker chooses not to provide liquidity to you to exit a winning trade, then thats the “market” just suck it up.

d) Certain Future brokers in the UK, explicitly exclude the 1979 Misrepresentation Act, to prevent clients suing them for misrepresentation

as they know its a shame.

e) Market data is proprietary (meaning the prices are theirs alone).

f) Clients are unable to offset through a different broker, meaning the whole point of “fungible” is completely lost, particularly when trading the “ES”.

This whole industry needs a re-work to make it fair!!!

The CME needs to properly regulated by an agency with teeth, not “self regulated”.

If you want to make money then sell a strategy or become a broker.

My best advise is “don’t trade” until the market is re-worked.

Hi Adam,

Thanks for the input.

While I agree that it’s not “fair” that retail traders don’t get to trade in the actual (interbank) Forex market, there are actually a number of advantages when trading with a broker.

The trick is to understand that your broker does not trade specifically against you, but against the aggregate of their customers. 😉

Neither the FCA or SEC provide any mechanism to validate BBBO on a per trade basis for retail forex. BBBO=Best Bid Best Offer. To say the retail forex industry is regulated is like saying a drug dealer has his or her clients best interests at heart!

Your broker may be providing you with “market” data based on your long net position, but at the same time provide completely different data to customers who are net short. The market data moves in response to your brokers net liabilities, aggregated counter party position, with a direct aim to hit your stops. If you are lucky, the computer program will miss your position, this time …….but in the long run, you will lose! Try not using a hard stop but a mental stop, and you will find the market behaves differently.

Where are the traders who are making consistent money….there are none. A trader may make money for a year, but will get targeted by the broker software and lose.

Hi Adam,

The way the Forex market is technically structured, plus the potential conflict of interest with brokers makes it unlikely for the average trader to make money over the long run. I’m certainly in agreement with you on this.

However, viewed from another perspective, this makes it very lucrative for the minority of traders who understand how the system works and know how to avoid the pitfalls.

I think most wantabe traders get into futures (currencies) because of the leverage you can put in a couple thousand and trade with a couple of hundred thousand which in their mind is enough to make a decent living, then they find out that it is the leverage that is their undoing,,, not the trades or brokers per se, a couple of stop outs and their account is gone, macro trends the banks and big institutions are interested in are weeks and months in the making, so you need a 200 or 300 pip stop to stay in,,it is very easy to have a day in the middle of it where it retraces 200 or 300 pips so the leverage crowd gets knocked out for sure everytime. My advice (yes I have made 2 million from a 4 million account),all my trades lasted weeks and months, so leverage with any hard stop impossible,,go back to etf’s and mutual funds, forget the leverage it is worth it if you actually want to have any of your money left in a year. I only used fundamental macro , the weekly charts and stochastics, no ema’s fibs, and all that bs,,look for a big drop and then look to see where the money went, and buy that,it will be down big time,,that is how the big boys do it.

Hi Des,

Absolutely. Fundamentals are crucial to my decision making process, and the money is found where the big trends are.

The professional traders, market makers are not going to enter short at the bottom of a channel like the current charts you posted. The break of support could be a change in trend, but after the line break you have to wait,, wait,, wait for at least a retest of that line. Retail traders have to be in always,,, and jump in to soon. When they get stopped out they blame eveyone but themselves for jumping in. Nobody hunted your stop here,, you made a bad entry and got hammared with a stop. You get paid to wait in this business. If you can’t WAIT,,, don’t trade.

Pros never buy at the top and they never sell at the bottom. If they want to sell,, they’ll run the price up first and then sell. If they want to buy,, they’ll run the price down and then buy. Wait to see what they’re doing before you jump in, get stopped, and blame the broker.

New traders, pay attention here! ^^

New traders, pay attention to this. ^^

Hi Chris, spot on article, after years of so called learning from expensive gurus I discovered most trading courses are run by salesmen who cannot make money trading I even attended an expensive trading course where the instructor turned up in an old van!!that said it all… as for myself I regard trading in that I am a manager of foreign currency not a trader, I mean that to make money in this game you have to understand how you manage profitable trades and trades that fail to take off, and how to avoid losing the hard earned profits you have made, for this knowledge only experience learned over a period of time will suffice, knowing how to read a chart is secondary …regards Pete